Finding a good investment for all your hard-earned income is tough. You’re looking for safety and profitability – a duo that only seems to show itself to accredited investors. Depending on how much income you’ve managed to save – you’re probably deliberating between investing in the real estate market or the stock market.

Table of Contents

If, as an investor, you were to ask me what’s more popular, I’d say the stock market. But if you were to ask me what’s going to make you some serious wealth – it’s definitely the real estate market – especially in Canada.

Consider this for a second: Do you own a home or condo? If you do, I encourage you to compare the equity you’ve earned on your property versus what you’ve earned in the stock market over the last 10 or 15 years. More often than not, the equity that you’d have earned on your property is going to be in multiples of your stock market income – unless you know a secret or two like Buffet!

People, in general, and my clients, in particular, are starting to wake up and realize that investing in the stock market is earning you pennies in comparison to the dollars pouring in from your real estate investments. And if you’re still just an investor – here’s my take on why I think you’d be much better off as a real estate investor instead!

Real Estate Vs Stocks: Why I Am On Team Real Estate

What’s The Biggest Risk Of Investing In The Stock Market?

Kenny Rogers was right about gambling and don’t be fooled, investing in the stock market is definitely a gamble. We all know the saying: the bigger the risk, the bigger the reward, but with this type of investment, you forgo any control you have over your money.

When you purchase stocks, you’re buying a very small portion of a publicly traded company and in return, you’re allowing the success or, worse yet, the failure of that company to determine what happens to the money you’ve invested. To be successful, you need to do a lot of research on companies and market trends staying on top of them (or ensuring that your financial advisor is) to ensure your money is safe and continues to grow.

While there are lots of ways to try and make smart choices in the stock market, the truth is: you just never know when something could take a turn for the worse.

But…What if one of the companies you’ve invested in gets a new CEO and that news causes their stock to plummet? What if the shares of, let’s say, an airline you’ve invested in for years suddenly takes a dramatic dive due to an unforeseen controversy in the news? The fact is, these events are things you have zero control over.

Due to all the market volatility in the stock market – more often than not – you end up taking a higher risk than what your investment is actually worth.

Real Estate Vs Stock Market: What’s The Safer Investment In Canada?

When it comes to investing for the long term – a real estate investment is usually the safer choice compared to the stock market. Real estate is part of a tangible asset class over which you have ultimate control.

You can see it, drive by it, heck, you can even live in it. And guess what? You don’t have to worry about your house appearing on social media making a fool of itself and causing the property value to plummet.

Historically, Toronto’s housing market – in fact, the real estate market as a whole – has been outperforming the stock market offering continuous and stable growth for investors. While economic and political factors can and do influence the real estate market, it’s very rare to see property value drop significantly for the same reasons.

Don’t get me wrong – I am not saying that real estate investment is completely immune to all economic and political changes (Q4 of 2022 is a prime example). But investing in real estate is a long-term proposition and from that point of view, even if the market takes a dip, given time, it always corrects itself.

Who Should Be Investing In Canada’s Real Estate Market?

Anybody can start investing in Canada’s real estate market provided that they have the necessary funds available. The most popular cohorts of real estate investors in Canada are – first-time home buyers, local investors, foreign investors, retirees, and families looking to upsize/downsize from their existing units.

Yes, you absolutely need to have some liquid cash available to invest in real estate. Investing in real estate generally requires more capital than investing in the stock market. You can start with lesser money but that limits your investment option.

In addition to the financial requirements, you may have to set aside some time to manage your investments. If you’re busy or are just feeling intimidated by the real estate market, you can get a real estate agent to manage your real estate investment portfolio while you can just sit back and watch your investments grow!

Bottom line: Real estate leverages your money in a way that the stock market just can’t compete with. If you have the means, your dollar will go further when invested in real estate. You can check out my clients’ returns and book a call if you like what you see! I’d be happy to help you build long-lasting wealth through your real estate investments.

How Much Money Do You Need To Start Investing In Canadian Real Estate?

Depending on where in Canada – and what type of property you choose to invest in – you will need between $10,000 – $100,000 to pay as a down payment for the property that you choose to buy. That’s how much you will need if you are keen on buying and taking over ownership of a property. Once you own a property, in addition to the equity that your investment gains over the years – you will also have the opportunity to earn additional rental income.

The more affordable and indirect route to investing in the real estate market would be through real estate investment trusts (REIT). In simple words, REITs work exactly like stocks – specifically real estate stocks. You can start investing in them with as little as $500. They pay dividends and are extremely liquid allowing you to cash out whenever you feel you’ve earned enough.

Average Return of Real Estate Vs Stocks In Canada

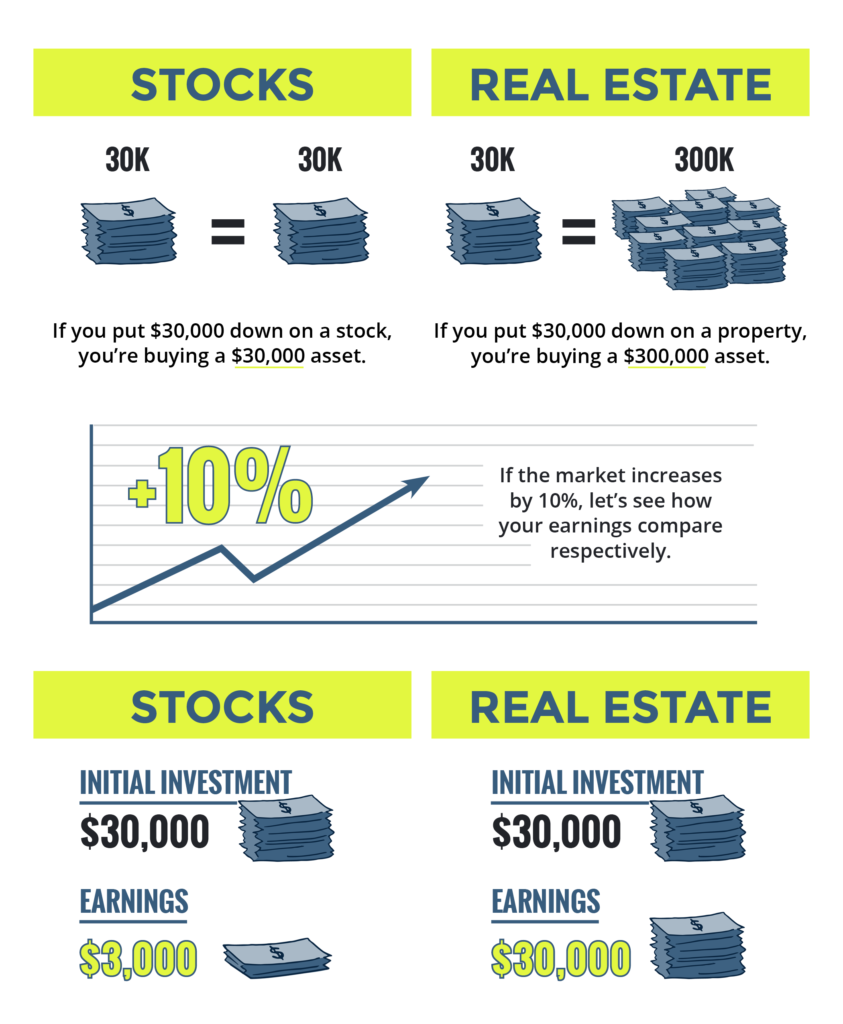

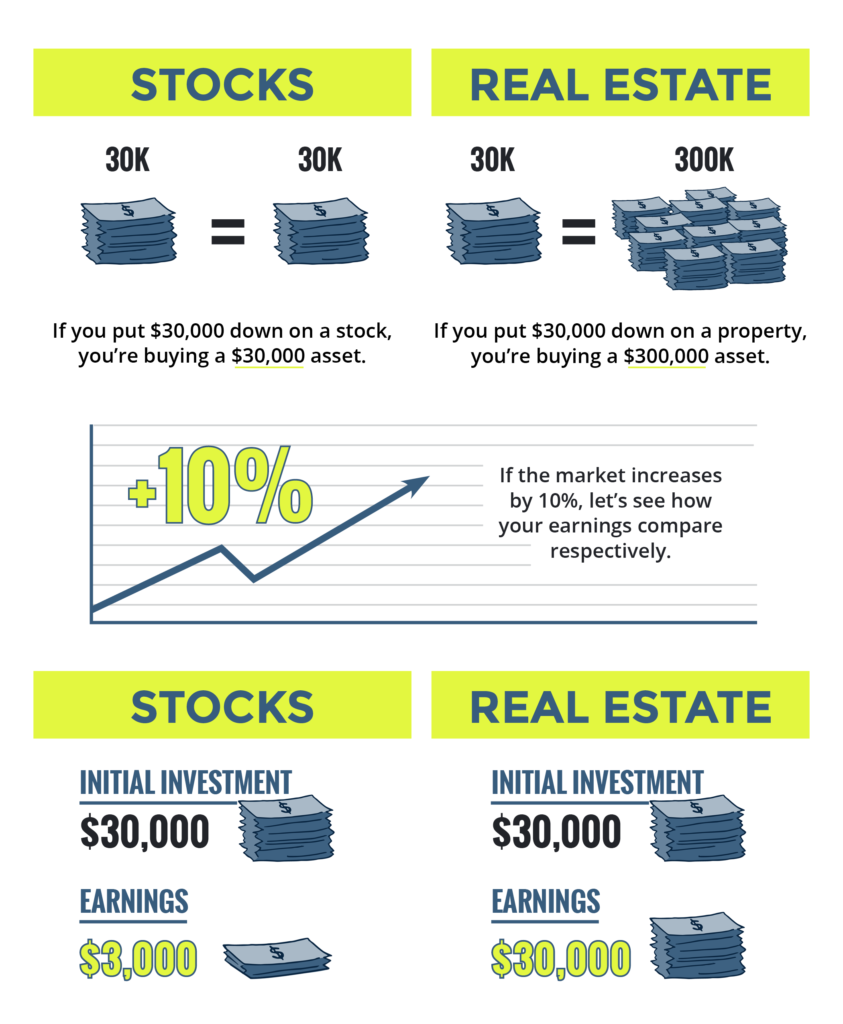

Imagine you have a war chest of $60,000 to spend on your investment portfolio. You choose to split that into half – investing $30,000 in stocks and $30,000 in real estate.

The $30,000 that you spend on stocks gives you ownership of over $30,000 worth of stock. However, the $30,000 that you invest in real estate acts merely as a down payment for a $300,000 asset. Real estate has the ability to earn you ten times the amount that the stock market can because you are investing in a much larger asset class – all thanks to the power of leveraging home equity.

Keep in mind: all real estate assets don’t appreciate unilaterally; you need to make an educated investment choice before investing in any real estate property. In case this is something that’s not up your alley, lean into the expertise of a local, experienced real estate agent to help you make smart decisions and maximize the profits of your investment.

I have been in the industry for nearly 20 years – investing for over 15. Before becoming an agent, I taught myself everything I needed to know to turn a $6,000 tax return into 6 properties. I immersed myself in all the complexities of the real estate market to gain some invaluable experience.

Today, I use my experience and expertise to guide clients and help them become real estate investors in Canada. If you’d like to learn more about the market or have a property that you’d like to discuss, book a call with me or somebody from my team and we’d be happy to help!

The Nuances Of Investing In Canadian Real Estate

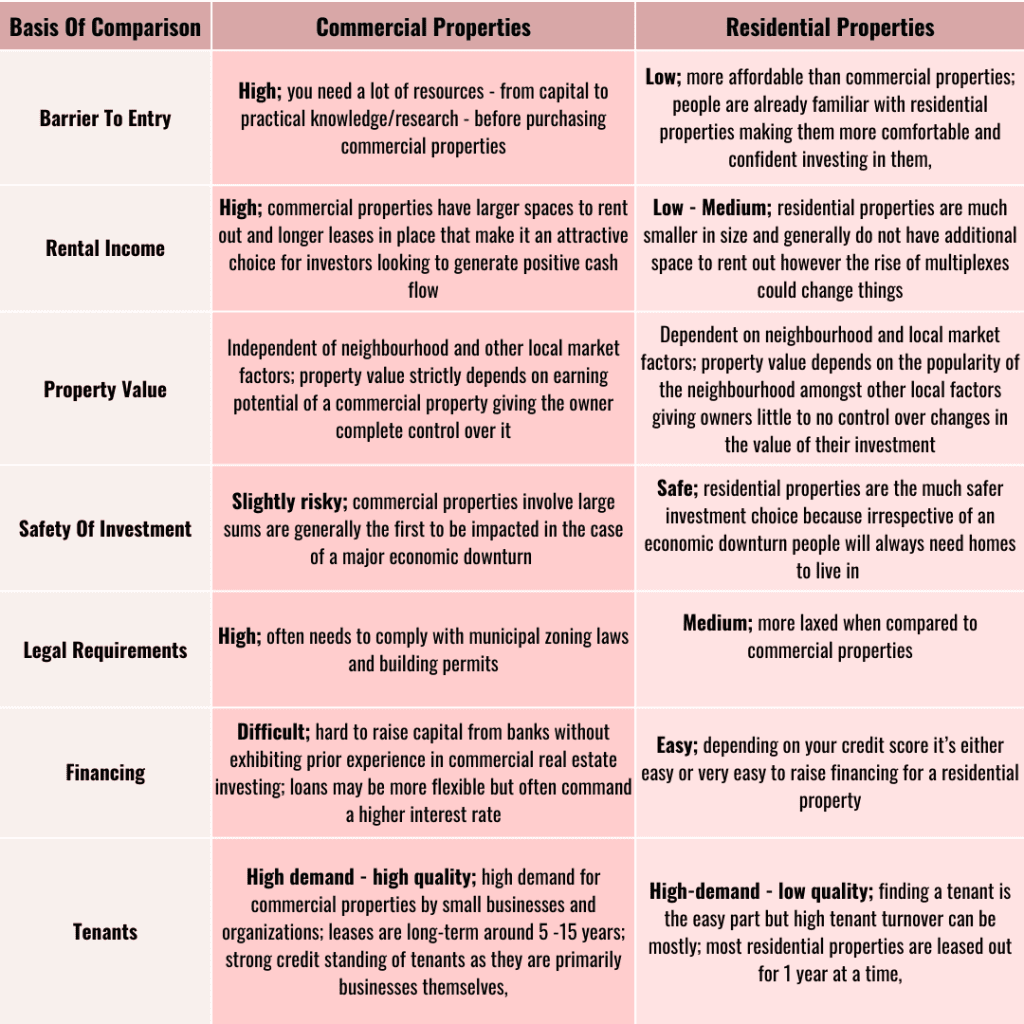

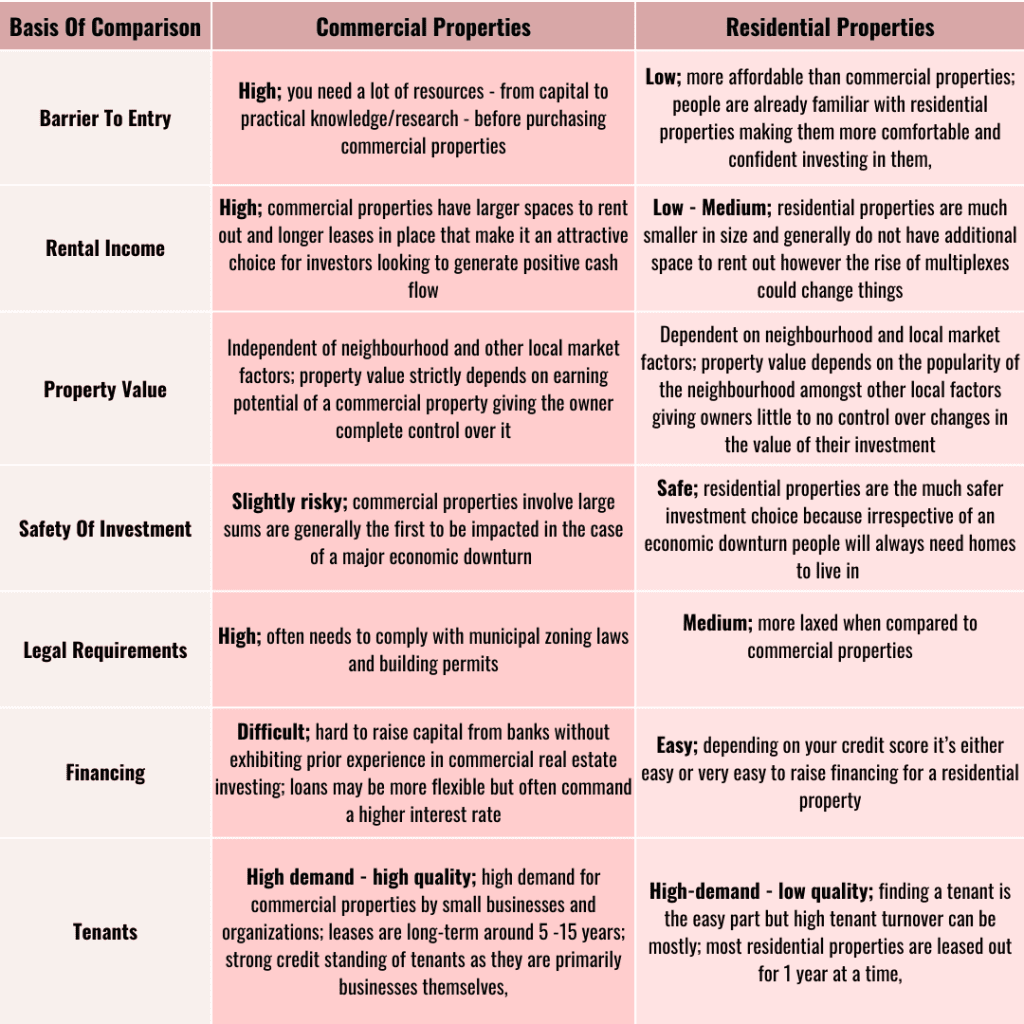

Investing In Commercial Properties Vs Residential Properties: Pros & Cons [Investment]

4 Tips To Help You Make Profitable Real Estate Investments In Canada

Work with an experienced real estate broker

Your smartest move out of the gate will always be to work with an experienced real estate broker. Savvy real estate investors don’t make emotional decisions. Working with an experienced, trustworthy real estate agent has a lot of advantages. Do you know how to find a positive cash flow residential property in Canada? Are housing prices truly falling or is that just click-bait? What neighbourhoods are on the rise and what asset class promises the highest returns in real estate?

Depending on how familiar you are with Canadian real estate, it could take you days to answer just these 3 simple questions – without any form of validation. Save some time, leverage expertise when available, and work with a real estate agent to build wealth smartly!

Ensure you’re fully funded

Don’t over-leverage yourself. A surefire way to make sure you don’t lose money in real estate is to ensure you’re fully funded. If you buy any type of investment property and don’t have the resources to hold on to it, you’re exposing yourself to an element of risk. Make sure you have all the money to hold on to the property – without any immediate pressure to sell.

Set aside your savings in an ‘Oh Sh*T Fund’

In addition to your monthly real estate payments (mortgage, property tax, and maintenance fees) it’s important to create a safety net. Financially speaking, even a house should be treated like a condo. With a home, it’s a good idea to have a “condo-fee savings plan” or as we like to call it, an “Oh Sh*t Fund”! It would help if you put away the equivalent of 5% of your monthly mortgage as a safety net toward eventual repairs or unexpected events. With the average age of a home in Toronto resting at about 80+ years, you’re gonna need it.

Don’t be in a rush to sell, hold on to your property

Imagine if you were sitting on a residential property you purchased 20 years ago—can you even imagine its value today? Holding on to your investment for 20 or 30-plus years will give you the opportunity to earn huge returns with little risk.

Analyzing The Flipside Of The Coin: Stock Investment

Does Stock Market Volatility Impact The Real Estate Market?

It depends on the nature and extent of the stock market crash. In some cases, a stock market crash could prompt investors to diversify their portfolio priming them for investment in the real estate market. On the other hand, if the stock market crash is a result of other, bigger issues plaguing the economy – it could very well dissuade investment into all asset classes: be it real estate or stocks!

What Are The Cons Of Investing In Canadian Real Estate?

You Need Capital: Investing in Canadian real estate is a ‘pay-to-play’ game. You will need at least $25,000 to start investing – assuming you’re paying 5% downpayment for a $500K property (highly unlikely as the average of homes & condos in Toronto is above $700k). In addition to the funds needed to secure the property, you will need to save some money for land transfer tax, closing fees and property management. All-in-all: it’s an expensive affair for investors short on ready cash.

Housing Market Volatility: Everybody, literally everybody, is aware of Canada’s housing crisis. In 2021, the market was at its peak. Fast forward 2 years, with the pandemic in the background and recession on the horizon, the market plunged as investors and homebuyers braced themselves for the worst. As of March 2023 – things are starting to look positive again and the market seems to be rebounding. While there may be some market volatility in the short term – for the long term, real estate investments are generally the safer option!

New Rules & Regulations: The government is aware of the housing crisis. To remedy it, new laws and regulations are being continuously introduced to dissuade investors from driving up the fair market value of real estate. For example: over the last 6 months, the government introduced a ban on foreigners investing in Canadian real estate (that’s not really a ‘ban’) while effectively trying to put an end to blind bidding in real estate bidding wars (not completely eradicated).

Pros Of Investing In The Stock Market In Canada

Low Barrier To Entry: Anybody can invest in the stock market. Stocks don’t cost hundreds of thousands of dollars – at least most don’t -and that makes them a lot easier to invest in. Whether you wish to start with $10 or $10,000 – all you need is a trading platform that’s accessible through your bank or one of the many other online platforms.

Liquid Asset Class: Stocks are very liquid assets – behind just cash and bank accounts. Liquid assets offer investors great flexibility and prove to be especially valuable during times of emergency when investments may need to be broken or restructured!

Enables You To Build A Diversified Portfolio: Unlike the real estate market, the stock market is exposed to multiple different industries – not just real estate. Top companies from each industry list themselves with the objective of raising finance and improving public perception. Investing in the stock market, therefore, allows investors to build a more diversified portfolio with risk spread across many different industries.

Potential To Earn Dividends: Companies pay its shareholders a certain amount of their profits as dividends. Investing to earn dividend can help you earn income but it won’t help you generate long-term wealth.

Final Words

Regardless of your investment approach, you are going to have to put some work toward growing your wealth. After all, if getting rich were easy, everyone would be doing it. Some might argue that investing in real estate comes with more responsibilities than throwing down money for stocks and bonds. But here’s how I look at it – whether you’re investing in real estate or the stock market, there will always be more value to investing strategically than just putting down money, pulling up a lounge chair, and sitting down to watch it grow.

Personally, I am a strong believer in strategic investing – and my clients’ returns validate that! If you’re looking for some guidance but don’t know where to begin, book a call and I’d be happy to chaperone you through your first real estate investment adventures!

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.