When you’re beginning to build your investment portfolio, the type of investments you pursue depend on your means at the time. Ask yourself the right questions, understand your goals, and figure out what you can do within your own means. Everyone’s financial starting point is going to be different. It’s not a one size fits all strategy – it’s what works for you.

When starting out, you should build your investment portfolio at a pace that is conducive to your own means. Not everyone will be able to purchase one or more $500,000 properties right off the bat, however, the goal remains the same: setting up a channel that will help you build equity and amass wealth. Even if buying a modest studio condo for $350,000 is what your budget will allow, that’s a great way to get your money to start working for you and will set you on the path to being able to afford larger investments in the future.

Investing in real estate is one of the few things that you can buy without having to pay the full purchase price. Typically, purchasing a property requires 20% down, meaning when you have $100,000 to spend you can purchase a property worth $500,000. The equity growth is based on the full value of the asset. Which means if the asset grew 10%, you’re looking at a $50,000 increase in equity compared to $10,000 if you had invested that money in, say, stocks. For more information on this topic, check out our full blog on investing in real estate versus stocks.

Investing in pre-construction condo developments are a great way to make a high return and start to build your investment portfolio. The beauty of pre-construction condos is that they require less up front and have an attractive deposit structure. A typical pre-construction condo will require 15% down over the first year with another 5% due three to four years later when the building is ready for occupancy. That’s 20% over three or four years, compared to a house which requires 20% upfront.

During the three to four year build time, not only do you have time to properly save money but the property’s value is increasing along with the market. If the market grows an average 4% per year, a $500,000 property could earn an additional $80,000 in equity by the time you move in. So, even though you’ve only paid $100,000 into the property, by occupancy it is already worth at least $580,000. Ultimately, with this type of investment you are benefiting from the ability to leverage a smaller amount of funds.

The other benefit to investing in pre-construction condos is that you’re purchasing properties for below-market value. I always guide my clients towards investment opportunities that are primed for profit. A perfect example that demonstrates this was a recent investment opportunity we had at Platform Condos. The week after Platform launched a listing with a nearly identical floor plan, terrace, and exposure was listed at 2055 Woodbine Avenue for $949,900. The price for the suite at Platform Condos was $779,900 and it was in a far superior location. Our client that purchased this earned $170,000 in equity on signing!

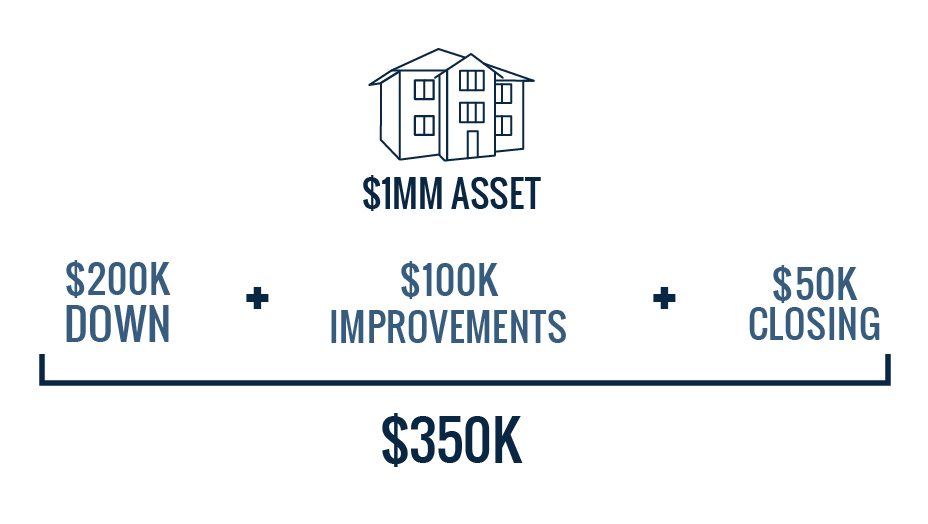

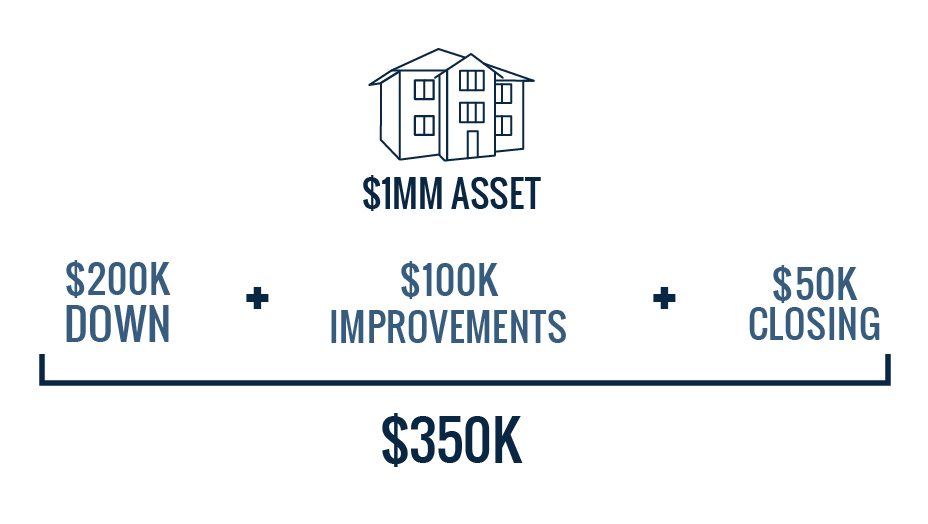

While it is true that houses historically have increased in value more quickly than condos, it can also be said that they require a much greater investment upfront and often require additional investment after purchase. Let’s say you want to buy a house in Toronto and it has a price tag of $1MM. First off, you’ll need 20% down ($200K). We know the Toronto real estate market is hot and we’ve all seen Property Brothers so chances are even a million dollar house is going to need some improvements. You’ll want to budget for those improvements and they could cost you upwards of $100K. Then, when the sale is final, you’ll need another $50K in closing fees.

The same money required to purchase a single $1MM house could be used more effectively to purchase several pre-construction condos and generate a higher return. Even if you have the $350K that you would likely need to purchase a single home in Toronto, if your goal is maximizing your return, why not consider using that money on multiple pre-construction condos? With $350K you could invest in at least three pre-construction condos, building equity three times faster than a single home.

If your goal is to start building a portfolio, investing in a house is not the best way to get your money to start working for you. The question you need to ask yourself is what can we do today to expedite your growth for the future? If you’ve made smart investment decisions and have used our leveraging strategy, you will eventually have the means to add a house to your investment portfolio.

Want to learn more about leveraging? Check out our blog post on How to Use Your Equity to Build a Comfy Retirement.

Get the hottest pre-construction investment opportunities right to your inbox.