Investing for children’s education by buying an investment property for your child. Achieve financial freedom for your child. Real estate investment for kids, it’s not about investing in RESPs OR a condo, it’s about finding a way to do both.

Today we discuss investment for kids that goes beyond RESPs, we show you how investing for your child won’t break the bank but will set them up for a financially independent future.

It’s no secret that the financial challenges our kids face today are far worse than what we were up against. With tuition rates at an all-time high, the majority of students today graduate with a degree in one hand and significant debt in the other. Even if they do beat the odds and manage to get into the workforce right out of school, getting into Toronto’s housing market on their own won’t be an easy feat.

But what if I said the holy grail really does exist? What if investing for your child through real estate could help pay for your child’s tuition while simultaneously putting a roof over their head? This long-term investment for child future may allow you to spend a little less time worrying and a bit more time soaking in those last few years before they up and leave the nest. Here’s what we’re covering today:

Why RESPs aren’t enough

How investing in real estate works

The best way to invest for your child’s future

Why investing in real estate works

Paying your child’s debt

Tax-free profits

Why investing in real estate is low risk, high return

The Pierre Carapetian approach to pre-construction investing

It’s only natural for today’s families to ask how future generations will handle rising housing costs while meeting their own real estate objectives. Maybe our kids will make it on TikTok or become doctors, but if they don’t, it’s reasonable to say they might need some assistance getting into the Toronto Real Estate market.

HOW DO WE HELP OUR KID SAVE FOR A DOWNPAYMENT ON A HOUSE IN TEN YEARS THAT WE CAN BARELY AFFORD NOW?

Buying real estate in Toronto, Ontario has become so out of reach that parents increasingly have to assist their children in purchasing a home. According to a recent Abacus Data survey for the Ontario Real Estate Association (OREA), four out of ten parents of young homebuyers aged 18 to 38 assisted their children with the purchase with money.

The top reasons identified by respondents were high housing prices (88%) and difficulties saving for a downpayment (49%). They also pointed to a less stable employment market, greater college prices, and fewer new houses being created.

If you have the means to do so, investing in real estate for kids may be both profitable for you and beneficial to them. Real estate investing for kids in pre-construction condos is one of the safest methods to leverage your investment and guarantee your children a roof over their heads in the future.

BUYING AN INVESTMENT PROPERTY FOR YOUR CHILD

Buying an investment property for your child and investing in a pre-construction condo, while your child is in high school, is a great way to generate significant savings while simultaneously getting them into the Toronto housing market.

The Toronto condo market, notably the pre-construction market, might solve these RESP vs cost-of-living difficulties. Buying a condo for your child, specifically, buying a pre-construction condo for your kid offers numerous major advantages since it needs less money upfront. Still, the equity you develop will be based on the entire worth of the property.

And trust me, investing for kids is not as difficult as it sounds. If you own your home it really is possible to get your home equity to start working for you. We show you exactly how in this article, “How to Use Your Equity to Build A Comfy Retirement” — a must read. Or, watch the video below.

This is the best long-term investment for child method and it may help your children weather the stormy waters of the Toronto housing market while providing a steady stream of passive income. Are you ready to invest in your child’s future?

Let’s break it all down, including why this could be the greatest choice you make today for your kids.

INVESTING FOR KIDS: RESPs AREN’T ENOUGH

We all do our best to provide for our kids and when it comes to their education it can really add up. Hence, investing for child education becomes imperative. But, an RESP investment account for kids isn’t going to cut it. The cost of tuition in Ontario currently averages out at about $7,500 a year — and that price can triple depending on the degree, not to mention all of the added expenses like housing, textbooks, and meals.

Parents today have to start saving for their child’s education the minute they leave the delivery room, often opting for the traditional Registered Education Savings Plan (RESP). But, is RESP the best way to save for child education? What is the best savings investment for child education?

Furthermore, although investment for kids education via RESPs is fine, the returns are modest at best. If you’re looking at your RESPs and saying to yourself, “This isn’t going to be enough” or, “Great, I’m saving as much as possible, but it’s barely earning any interest” then the Toronto condo market, specifically the pre-construction market, might just be the answer.

So, how can you, as a parent, invest in your child’s future?

PRE-CONSTRUCTION INVESTING FOR YOUR KID

When we think about investment for kids, I always think long-term. The key benefit investing money for your child with this type of pre-construction investment is it requires less money upfront and even less when you use your Home Equity Line Of Credit but the equity you build will build on the full value of the property even though you only had to invest 20%.

Pre-construction is purchased prior to build and typically developers offer extended deposit structures allowing you to invest gradually over a few years. We discuss additional benefits later.

INVESTING FOR YOUR CHILD: HOW IT WORKS

To understand how it works you first need to understand how the Toronto real estate market has been performing. Historically, the real estate market grows on average 5% per year — however, the Toronto condo market in the last several years has been exceeding this historical average closer to 8%.

So compared to RESPs, the initial contribution (i.e the down payment) you make towards a condo will generate far greater returns because the equity earned each year is based on the full value of the asset, not the small down payment you’ve put into it.

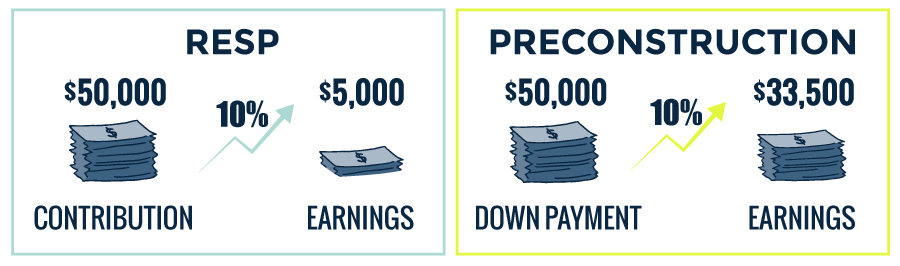

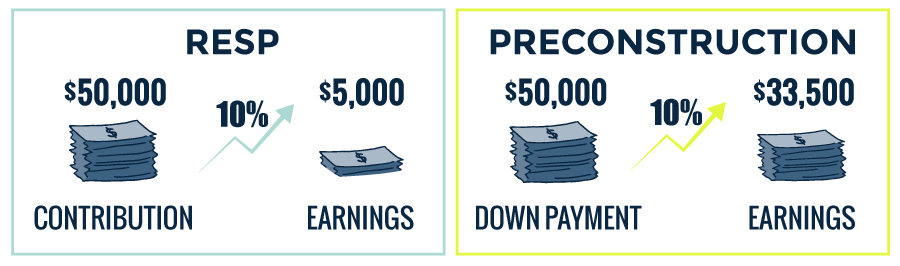

The example below is a comparison to show you how you can use leverage to achieve financial freedom for your child. When we talk of real estate investing for kids, it’s not about investing in RESPs OR a condo, it’s about finding a way to do both.

For example:

Say you put $50,000 into your kid’s RESP — which, by the way, is the maximum you can contribute annually. If the stock market goes up 10%, you’ve made $5,000 from your contribution.

Comparatively, if you were to put the same $50,000 down on a pre-construction property valued at $335,000 — if the market goes up 10%, you’ve actually made $33,500. Why? Because the equity earned is based on the full value of the asset, not just what you’ve put into it.

THE BEST WAY TO INVEST FOR CHILD FUTURE

Now that we’ve demonstrated how easy it is to generate high returns and why this is the best investment plan for child future, let’s implement this investment for your kids. Now, if you’re wondering can kids invest in real estate? The answer is obviously no.

In order to take full advantage you’ll want to invest in a property that will take occupancy when your son or daughter turns 18. The reasoning is two-fold:

1- They must be 18 years of age to own property and as a first-time home buyer they are eligible for significant First-Time Buyer Rebates.

2- Presuming they’ll be attending university when they’re 18 and will need housing.

Note: If you should choose to invest earlier, say, when they are in grade-school, you would purchase the property yourself, sell it and then re-invest those funds into one or two new properties: one for your child’s future and one for your own retirement.

The typical build time in pre-construction is three to four years, so you’ll want to be prepared to put a deposit down on a Toronto pre-construction condo when they’re between the ages of 14 and 15. It’s important to note here that beyond your initial down payment, you aren’t making any mortgage payments while the property is being built.

When the building takes occupancy three to four years later it is registered with the city and it’s at this time that you will want to change the registered name with the building from yours to theirs, assuming they are now 18 years of age. Now on title, they are seen as a first-time buyer and become eligible for a full or partial refund on the Land Transfer Tax, which is applied at closing when the building registers with the city. This rebate alone can amount to $8,475 in savings.

This is also when the mortgage for the property kicks in. Obviously, an 18-year-old won’t qualify for a mortgage so you’ll be required to co-sign with them. In order to ensure that the Land Transfer Tax (LTT) refund and capital gains accrue to them and not you, have your lawyers set up the joint purchase by assigning 1% ownership to you and 99% to them. While the LTT refund will be based on the 99% ownership, you, as parents, can sign a trust declaration that you are only holding the 1% in trust for the child so that the capital gains would all go to them.

TWO KIDS? START EARLY AND DOUBLE DOWN

While your kid will profit from receiving a virtually paid-off or entirely paid-off apartment; financially astute parents could refinance this condo into additional condominiums and investments. If you have numerous children, start now and refinance as you buy additional condominiums. This strategy is similar to the game of Monopoly; it utilizes the homes to trade up for hotels and create a prosperous financial future.

WHY REAL ESTATE INVESTING FOR YOUR CHILD WORKS

If you’re working with an agent who has Platinum Access to projects like we do, they’re able to source properties that have Platinum Pricing or are priced below market value and have great profit potential. You can see some of Pierre’s client returns here.

The longer you hold a property — think long-term investment for child — the better your return will be. Ideally, you want to hold a property for at least six years to make the most from your investment. In the example we’ve used with the $335,000 property: if they hold the property for eight years (4 year build time + 4 years in university) and the market grew the average 5% per year, the property will be worth at least $469,000. So now they’ve made $134,000 in just eight years. But remember, the Toronto condo market has been far out-performing this historical average.

INVESTING FOR YOUR CHILD’S EDUCATION: KEEPING THEM FREE OF STUDENT DEBT

While most students are going into debt by paying tuition and housing costs, your child is paying into a mortgage while the property they live in is generating profits to pay for their school. With you to thank for getting them started, not only will they graduate with a degree but they’ll have a foot in the door of Toronto’s housing market. I believe they call that killing two birds with one stone.

TAX-FREE PROFITS

When your son or daughter decides they’re ready to sell the property, because it’s their personal residence all profits earned are completely tax exempt. It is the number one means of getting ahead without giving most of your income away in taxes. They’re not paying rent, they’re paying themselves and the gains are 100% tax-free.

LOW RISK, HIGH RETURN

Even if your child decides to go to university overseas, using Toronto pre-construction condos as a means of investing for your child’s education is a low risk, high reward investment plan. Your dollar will go much further when put towards real estate than towards an RESP.

Toronto’s rental market has also been commanding record-high rents, which means that even if they aren’t planning to live in the property it can be rented out. If you choose to rent out your investment you are entitled to an HST rebate on that property. Now you have a property generating equity and a tenant helping to pay your mortgage. The savings you can accrue from this approach will still provide you with money you can use towards your child’s education.

If you choose to invest while your son or daughter are still at a young age, the property must be put in your name and you won’t benefit from those first-time buyer tax breaks. You can however, still use the equity you earn from the investment property to be used as a Gifted Down Payment towards their first property when they are ready to purchase (at this time they will receive the first-time buyer tax break). You are able to gift a down payment of as much or as little as you want and there are no tax implications. This is a great way to help your kid get into the real estate market and start building wealth for themselves.

THE PIERRE CARAPETIAN APPROACH TO PRE-CONSTRUCTION INVESTING

Pierre has built strategic alliances and partnerships with the most prominent builders and sales teams across the city. Through these partnerships, he is given preferential access, a choice of the best layouts and suites, and the best terms. He’s been able to track the success of these pre-construction buildings watching them come into fruition from what were once parking lots. His experience selling these properties allows him to recognize which suites are the best, which will make the most money, which ones make the least money and which ones have the highest returns.

Pierre has a handful of investment properties himself and he lives by the model if he wouldn’t personally invest in the property, he won’t recommend it to his clients. You can download our Free Guide to Investing in Pre-Construction here to learn how to properly invest in Pre-Construction real estate. With over 500 investment properties, Pierre’s clients have made millions by making smart real estate decisions. Now, it’s your turn. Download the guide.