Generally, when you think about selling a home – you focus on the money that’s coming in from the home sale and not what’s going out. I did so too – conveniently forgetting all the costs involved in selling my home in the first place.

Table of Contents

Since then, I have come a long way. In the past 17+ years as a real estate agent, I have learned a lot about the industry in Canada facilitating real estate transactions worth over half a billion dollars. So if you don’t want to get into the hassle of listing your home yourself and are looking for a listing agent to take over your woes – book a call with me or somebody from my team and we’d be happy to make the process seamless and even dare I say it, enjoyable!

My goal today is to make things transparent, breaking down the total cost of selling a house in Ontario – from preparation and staging right down to closing. I have also highlighted some miscellaneous expenses that many people overlook when it comes to selling their homes in Ontario!

Understanding ALL The Costs That Go Into Selling Your Home In Ontario

The costs affiliated with selling a house or condo will depend on how you want to approach listing your property. Your goal – and this is what I tell my clients – should be to represent the best version of your property to any potential buyer. And sometimes, this costs. My general rule of thumb when it comes to preparing a house to sell is to be cautious and only spend on something if it increases the purchase price of the property.

Related: Selling Your Home Yourself: Why You Should Or Shouldn’t Do It!

How Much Does It Cost To Sell A House [Or Condo] In Ontario?

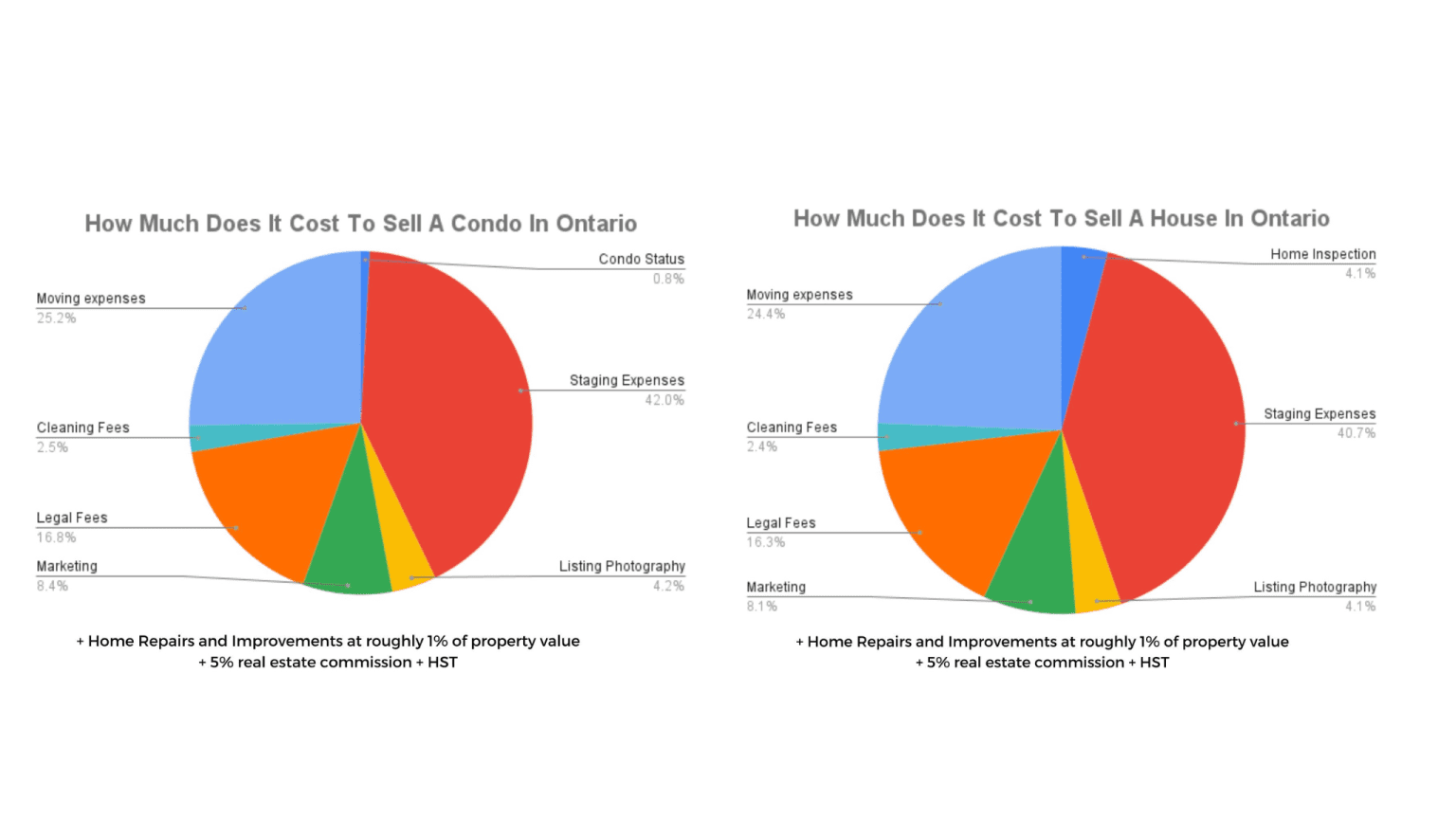

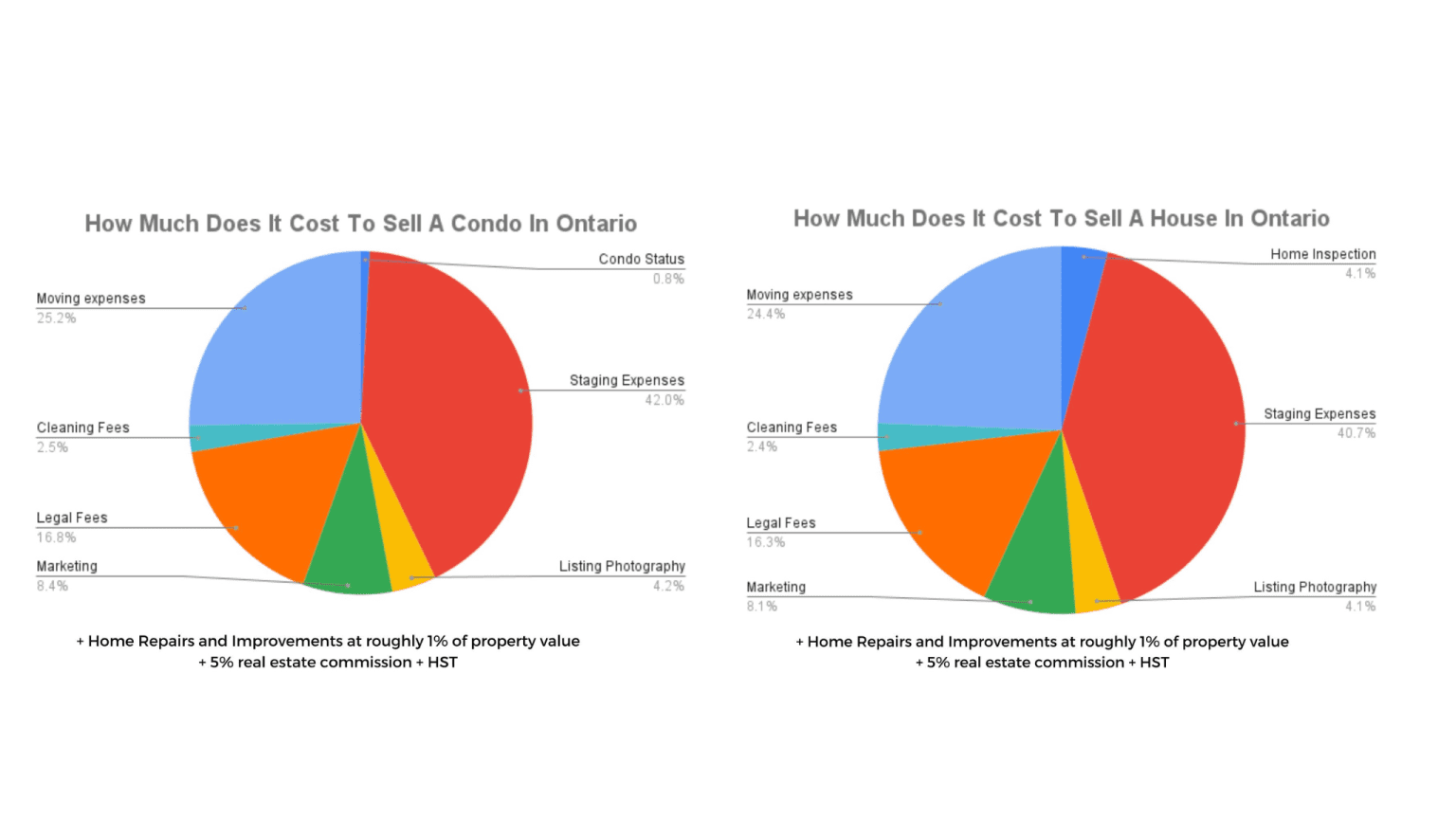

On the lower end, the cost of selling a house in Ontario is approximately $4850 plus the 5% real estate agent commission on the selling price. On the upper end, it could cost you anywhere between $10,000 – $12,000 + 5% realtor commission to sell your house or condo in Ontario.

Home repairs and improvements (variable cost – approximately 1$ of your property value)

Home inspection ($300-$500) or condo status certificate ($100)

Real estate agent commissions typically amount to 5% of the sale price and may include fees paid by the seller, such as land transfer tax.

Staging expenses ($2,000-$5,000)

Listing photography ($500)

Marketing ($100-$1,000)

Legal fees ($1,500-$2,000)

Cleaning ($150-$300)

Moving Expenses ($300-$3,000)

If you’re not sure where to begin, the best place to start is to get a home valuation on your property to see how much your home is worth in the current market. You can do this online but I personally wouldn’t trust an algorithm, as helpful as they are, you truly need to speak to a professional who knows your market.

Related: How To Stage Your Condo To Sell 2x Faster

How Much Tax Do You Need To Pay On The Property Sold?

If the home you’re selling is your principal residence, you don’t pay any tax on the profits earned from the sale. However, if you’re selling an investment property you will pay 50% Capital Gains Tax on the net profits.

Related: FIRST TIME HOME BUYER TAX CREDIT AND REBATES FOR TORONTO BUYERS

How Much Do Home Staging & Home Preparation Expenses Amount To?

Well, this really depends on the amount of work that needs to be done to set up your property for success. On average, the cost of home staging in Toronto is between $2000 – $10,000.

Some real estate brokerages – like us – provide their clients with complementary home staging services. Working with a full-service real estate brokerage comes with the advantage of having everything managed by one team, under one roof – all working together to help you sell your home!

Coming now to home preparation. You can break down home preparation projects into two: small projects that can be done quickly at minor costs and large projects that require time and capital.

Some of the minor costs would be to hire a handyman to make minor home improvements like recaulking the bathroom, fixing screen doors, swapping out hardware, and giving your walls a fresh coat of paint.

Then there are the larger investments you can make that will help improve your home’s appeal on the market and hopefully boost its resale value. These costs include things like upgrading any old our out outdated appliances or, in the warmer months, hiring a landscaper to boost your home’s curb appeal.

Your goal in this phase is to give your ‘old home’ a ‘new home’ look that appeals to the prospective buyer!

Related: Five Simple Renovations to Increase Home Value Before Selling

How Much Does It Cost To Prepare Your Property To List In Toronto?

If you’re selling a house, you may consider paying for a home inspection to try and avoid any conditional offers, especially if your real estate agent wants to do an offer date for your listing. The cost of a home inspection will depend on the size of the property but they range between $300 to $500.

The condo equivalent to a home inspection is getting a condo status certificate. These cost $100 and provide interested buyers with a look at the overall standing of a condo building. It’s like looking at a person’s health records, credit score, and values all rolled into one.

You will also want to have your home cleaned ahead of listing and showings. This will vary depending on the size of your home or condo and is sometimes included in your realtor’s commission.

What Is The Average Realtor Fees When Selling Your Home In Ontario?

When selling your home, especially in a market like Toronto, you’ll want to use real estate professionals to make sure your home sells for a competitive price. The average realtor fee in Toronto is 5% of the sale price plus HST. This means if you sell your home for $800,000, you are paying your realtor $45,200.

The best real estate agents will spend much of their commission on successfully marketing your property in order to sell it for top dollar. Each realtor will have different services included in their commission so it’s important to ask your realtor what they offer. These things can include things like home staging ($2000 – $5,000), listing photography ($500), and marketing your listing ($100 – $1,000), which can really add up.

“In real estate, every agent demands 5% but not all offer 5% service. Pierre and his team are worth all 5% backed by the 5-star service they provide.” -Sherrard Ward, Seller. Read the full testimonial >>

Closing Costs In Ontario When Selling A Property

Do Sellers Pay Closing Costs?

The answer is yes and no. Most closing costs in Ontario – such as the home inspection fee/condo status certificate, land transfer tax, appraisal fee, etc. – are borne by the home buyer. Home sellers on the other hand need to account for just three types of closing costs: real estate agent commission, legal fees, and any mortgage payout changes.

What Are The Different Closing Costs That Sellers Need To Account For?

Beyond real estate commissions – which costs approximately 5% of the real estate transaction – the only other official closing expenses you will need to budget for are the real estate lawyer fees, which typically cost between $1,500 and $2,000.

However, when it comes to buying a property you will have a few additional closing expenses, you can learn more about closing expenses here.

Hidden Costs Associated With Selling A House In Ontario

Moving Expenses

One expense that shouldn’t be overlooked is the cost of moving. Whether you’re hiring movers or doing it yourself, you’ll need to budget accordingly. The cost for movers will depend on the size of your current place and the distance you’re traveling. If you’re doing it yourself, you’ll need to budget for boxes, packing supplies, and likely a rental van, plus gas and mileage.

Bridge Financing

One thing to be mindful of if your new property closes before your current home sells, you may need to get a bridge loan. This type of loan exists to help those who need access to the equity in their home for the down payment on their new property.

Banks, lenders, and some real estate brokerages offer their clients a bridge financing option, providing loans up to $200,000 for around 120 days to bridge the gap between closing dates. Although the interest rate is higher, typically between +2% and 3%, it’s important to remember this is a short-term solution!

Be aware that lenders may apply an administrative fee, ranging from $200 to $500. Prioritize checking if your mortgage lender allows bridge financing and adjust your budget accordingly to accommodate the additional expense.

Final Words

Yup, selling a house in Ontario has quite a few costs involved. Hopefully, now you know what you didn’t know before and can go ahead with planning the sale of your home or condo. If you still need any help selling your property – book a call with me or my team and we’d be happy to represent your listing and give it the attention that it truly deserves!

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.