Are you a Canadian individual who is looking to buy a new home within the next year? Well, there’s some good news for you! With the launch of First Home Savings Account (FHSA) next year, you can buy that property & save money – at the same time!

Table of Contents

In this blog post, we cover all your basic FHSA information needs. We hope that by the end of it, you are able to identify whether you’re a potential beneficiary of this new legislation, how to take advantage of it as an FHSA holder and its impact on you as a taxpayer.

First Home Savings Account (FHSA) Status & Eligibility in Canada

What Is The First Home Savings Account (FHSA) in Canada?

A First Home Savings Account (FHSA Canada) is a type of savings account that is specifically designed to help qualifying first-time home buyers in Canada save for the costs associated with purchasing a housing unit.

FHSA accounts typically offer income tax advantages, such as tax-free interest earnings and free withdrawal from FHSA savings for any qualifying home purchase or home buying expense.

Who Is Eligible For A FHSA in Canada?

- Must be a resident of Canada.

- Must be at least 18 years of age. There is no FHSA age limit.

- Must not have owned a home and lived in it as your primary residence in the 4 years prior to the FHSA account being opened. This also includes your surviving spouse or common-law partner’s primary residence, assuming you are still together at the time of opening it.

FHSA Canada Expected Timeline

While the Tax-Free First Home Saving Account (FHSA) is not currently available in Canada, the Canadian Federal Government proposed this new legislation as part of Bill C-32 (Fall Economic Statement Implementation Act, 2022) and assuming that it is passed, the FHSA Canada timeline is currently set for mid-2023.

Is The FHSA Avalaible In Canada?

Yes, as of 1st April 2023, Canadian residents above the age of 18 who aren’t homeowners can now open an FHSA in Canada. There are a number of financial institutions that can help you open an FHSA in Canada. You can get detailed information about the terms and conditions of each lender by typing in the “company name + FHSA” in Google. For example: “FHSA Scotiabank”, “FHSA account RBC”, “FHSA account TD” or “FHSA account CIBC”. Most lenders have a dedicated landing page with all the information that you need to open an FHSA.

How Can I Open A FHSA In Canada?

Check if you’re eligible to open an FHSA in Canada.

Study all the FHSA issuers in the market. FHSA issuers include banks, credit unions, and insurance companies. Use Google search, talk to friends and family for their recommendations, or book a call with your real estate agent or financial advisor to find the best option for you.

Once you’ve identified the issuer, the next step is to contact them.

To open an FHSA for you, your issuer will need the following information: your social insurance number (SIN) and your date of birth. Your issuer may also request additional documentation that proves that you’re eligible to open an FHSA. Make sure to provide your issuer with all accurate information.

Once approved, you then need to pick the type of FHSA you want to open. Your issuer will be able to guide you through this process.

Can I Open An FHSA If I Already Own A Home?

No, existing homeowners cannot open an FHSA in Canada. One criterion to be eligible for an FHSA in Canada is that you or your common-law partner/spouse must not have owned and lived in a home in the 4 years preceding the launch of the first-home savings account. The FHSA is meant to help first-time homebuyers save on costs associated with purchasing a home.

When To Close An FHSA?

Close your FHSA before your maximum participation period ends to avoid any unexpected tax complications. Your maximum participation period begins the day you open your FHSA and ends on the 31st of December of the year in which one of these events takes place – the earliest of which is counted:

15th anniversary of opening your first FHSA

you turn 71 years old

the year following your first qualifying withdrawal from FHSA

First Home Savings Account (FHSA) Contribution Limits

What Is The Maximum FHSA Contribution?

The FHSA limit proposed for first-time home buyers in Canada is a lifetime contribution limit of $40,000 tax-free. This is similar to tax-free savings accounts (TFSA) or registered retirement savings plans (RRSP).

The First Home Saving Account has an annual contribution limit of $8,000 per year, including 2023. FHSA contributions must be made in the calendar year.

What is valuable to note however is that if you didn’t hit the annual contribution limit of $8,000 in the previous year you can roll this additional contribution room into the following year without affecting its contribution limits. For example, you were only able to contribute $2,000 in 2023. This would allow you to roll over $6,000 into 2024 giving you a maximum FHSA contribution of $14,000 in 2024. Important to note though, you must have already opened your FHSA account to be eligible for the rollover.

Who Can Contribute To Your FHSA Account Canada?

While only the FHSA account owner may deduct contributions, parents can contribute to their child’s First Home Savings Account by ‘gifting’ their child the funds and having them make a qualifying contribution.

Can I Open More Than One FHSA?

Yes, you can open more than one FHSA at a time but you need to be completely on top of your contributions else risk unintended tax consequences. The total amount of your contributions to all your FHSAs cannot exceed the maximum amount that you can contribute to your FHSA for the given year.

First Home Saving Account (FHSA) Qualifying Withdrawals

What Is The Maximum FHSA Withdrawal?

There is no maximum qualifying withdrawal, however, your FHSA withdrawal must meet certain conditions in order to be tax-free. Note that when you are withdrawing funds, your contribution limits do not reset.

- You must be a first-time home buyer when you make the qualifying withdrawal or intend on moving into your first home within 30 days of the withdrawal from your first home savings account.

- The home or condo must be located in Canada.

- There must be a written agreement for the purchase of your first home. This also includes the construction of your first home which is also eligible. Both must be in writing with a move or build date before October 1st of the following year.

What happens to leftover funds? Your additional funds can be transferred to an RRSP or RRIF as long as it’s done before December 31st of the following year. At this time your FHSA will no longer be an FHSA.

What Investments Can You Hold In A FHSA?

You can use your FHSA to hold the same types of investments as you do in your RRSP & TFSA. A few examples of qualified investments that you can hold in your FHSA include – stocks, bonds, mutual funds, savings accounts, government & corporate bonds, and guaranteed investment certificates. You cannot use your FHSA to hold private securities or other private investments.

How Does An FHSA Compare To RRSP & TFSA

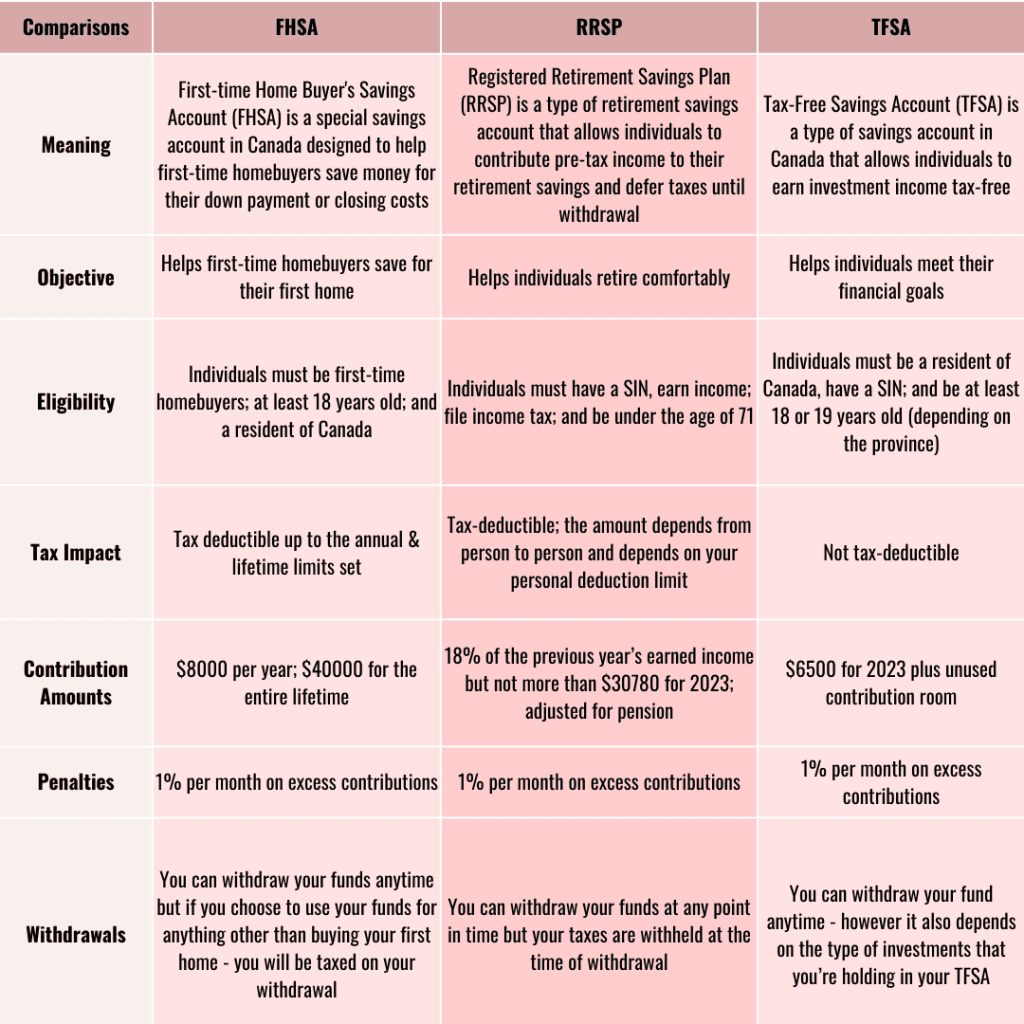

Whether you choose to save for your first home, retirement or both is really a question for you and your goals. If your intention is to buy a home, the FHSA is a saving tool that makes a lot of sense for tax purposes – especially since you can transfer funds over to your RRSP and those transfers do not reduce or limit your available RRSP contribution room.

FHSA vs RRSP Vs TFSA: What’s The Better Option For Canadians?

Can You Use FHSA & RRSP At The Same Time?

Yes, you can transfer property from your FHSA to your RRSP and vice-versa provided that it’s a direct transfer. If you’re moving property from your RRSP to your FHSA – you also need to make sure that you do not exceed your unused FHSA participation room.

What Other Saving Tools Can Help First-Time Home Buyers?

First-time home buyers may be eligible for various other savings & investment programs, such as tax credits, rebates, and down payment assistance. It’s a good idea to research your options and speak with a financial advisor or lender to determine the best course of action for you as an individual. Some common savings options for first-time home buyers include:

Tax credits: Some government programs offer tax credits to help first-time buyers offset the cost of purchasing a home. These credits can be applied to your income taxes -reducing your payments as a taxpayer. In Ontario, you can apply for the first-time home buyer tax credit and the first-time home buyer land transfer tax rebate.

Down payment assistance: Many individuals – young Canadians in particular – struggle to come up with the large down payment required to purchase a home. Down payment assistance programs can provide grants or low-interest loans to help cover this cost.

It’s important to carefully consider your options and weigh the pros and cons of each before making a decision. A financial advisor or lender can help you understand your options and choose the best course of action for your situation. The last thing you want is unsuspecting tax consequences.

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.