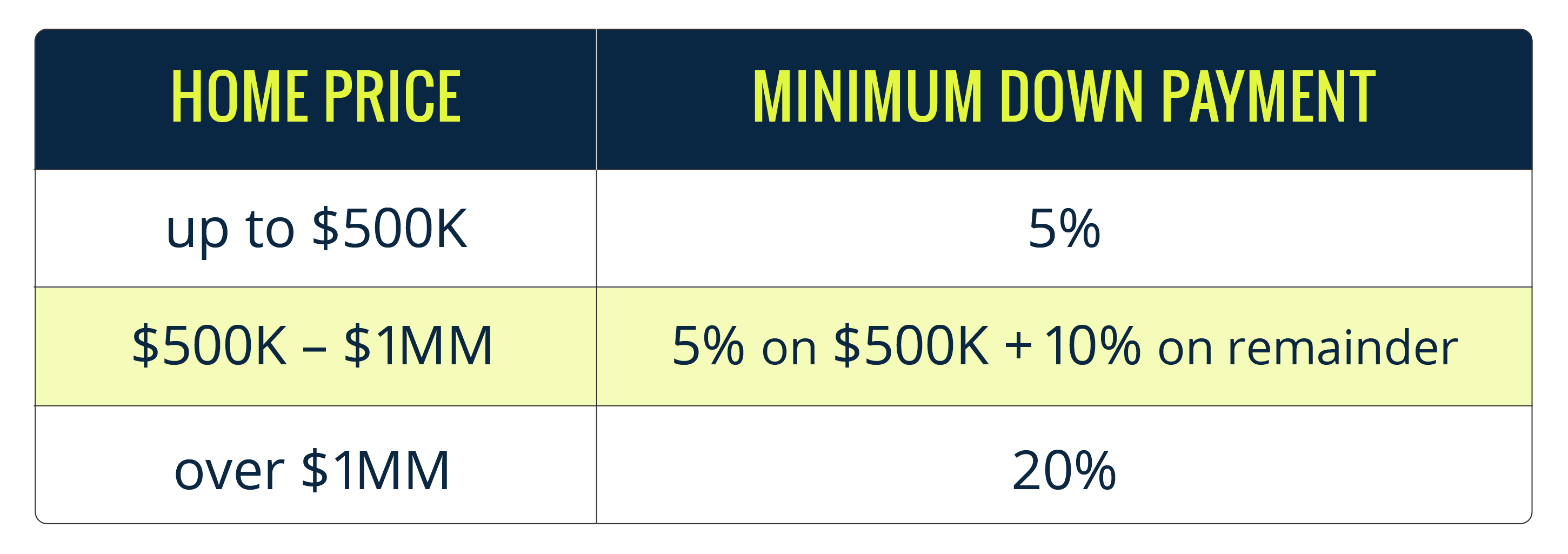

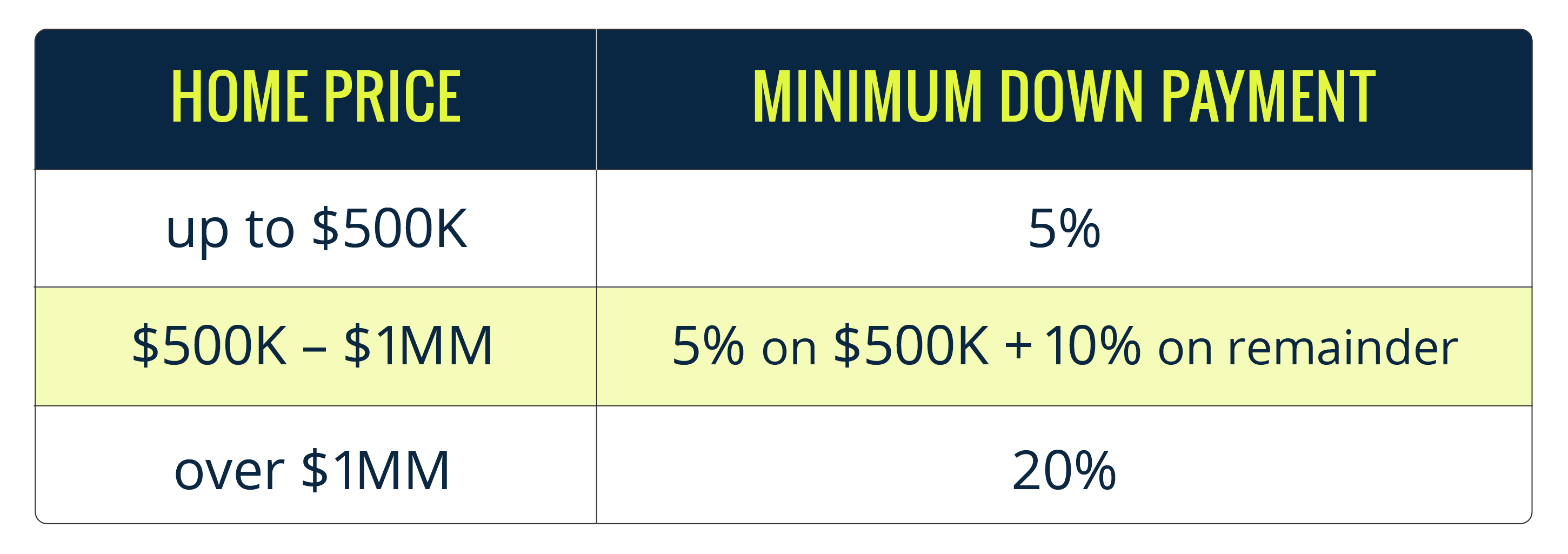

The minimum down payment required for any particular property depends on its purchase price. A 20% down payment is required on properties over $1,000,000 and therefore do not require mortgage insurance.

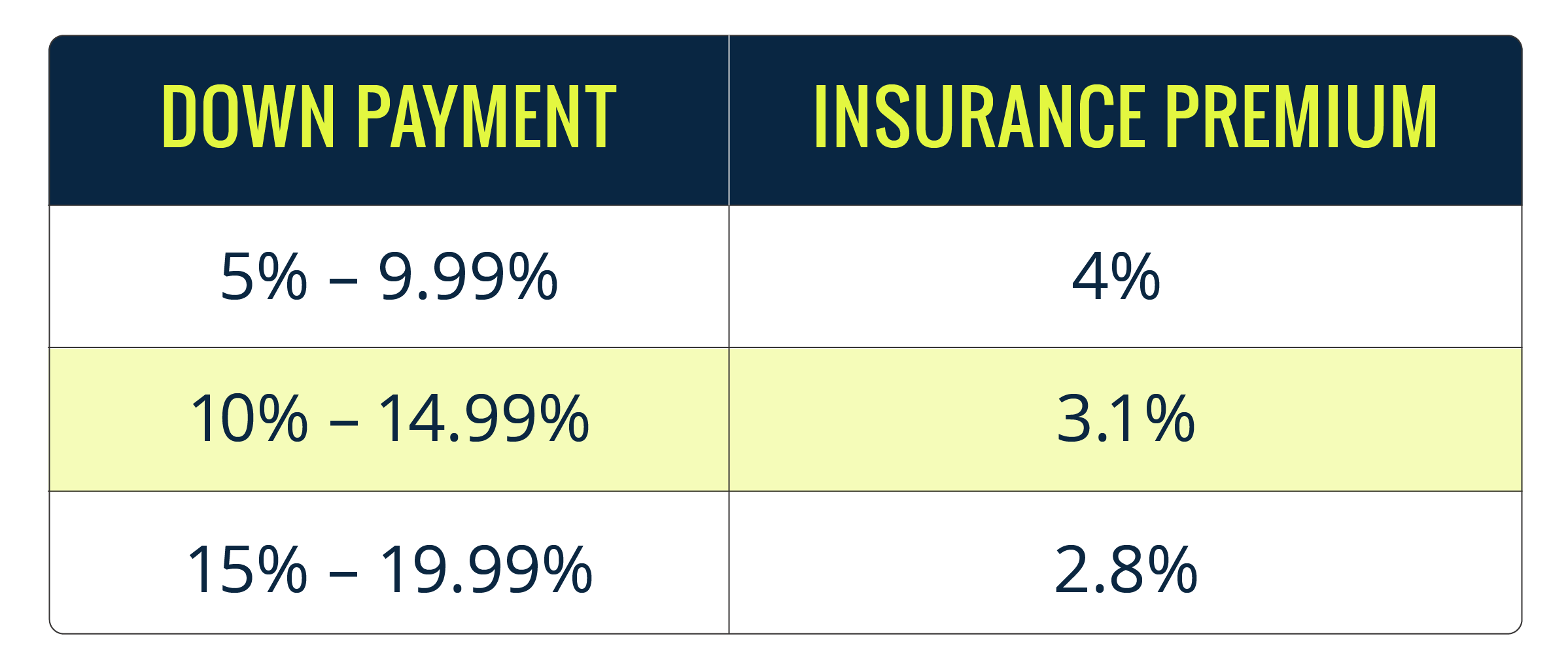

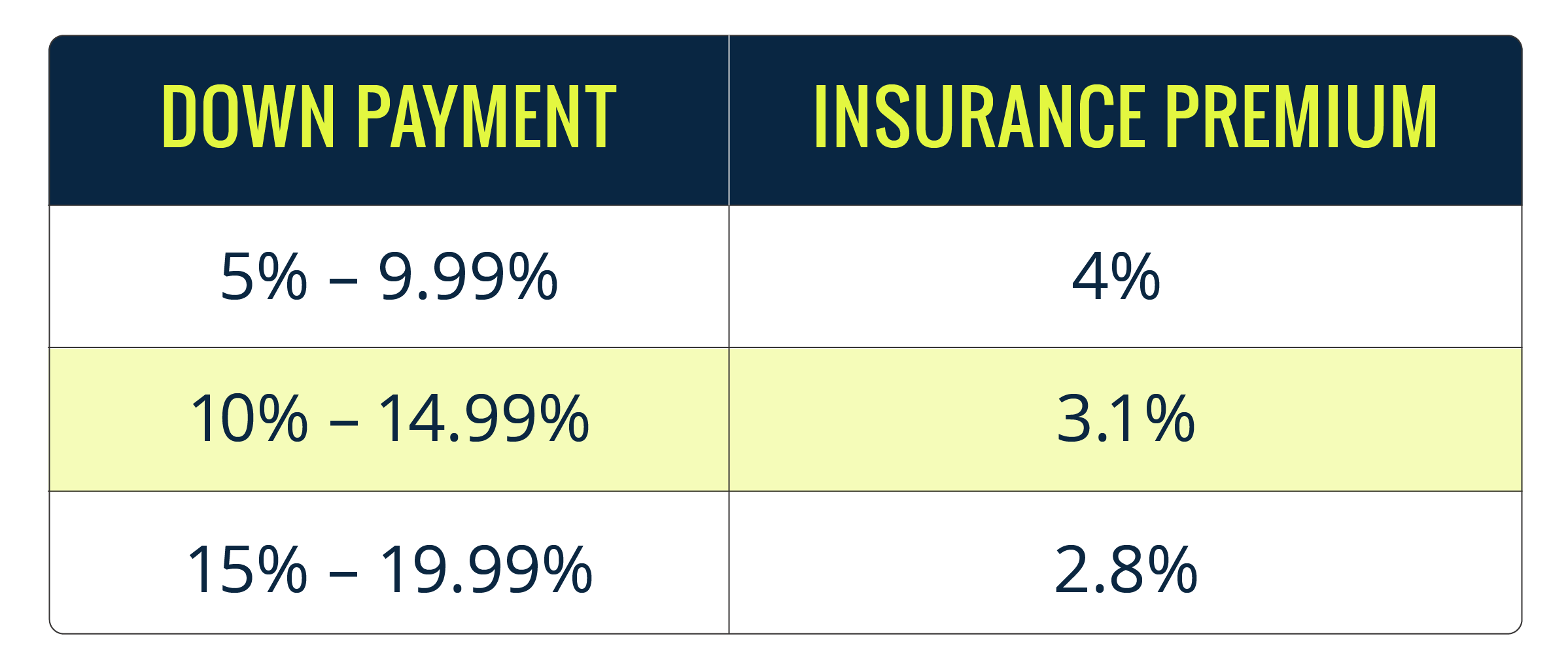

Mortgage insurance is required on all mortgages with less than 20% down. Keep in mind that the smaller your down payment, the higher your mortgage insurance will be. Below are the CHMC Premiums affiliated with different down payments.

If you can afford the higher monthly carrying expenses that will come with a smaller down payment, this does provide those unable to put 20% down on a property the chance to get into the real estate market and start building their equity. Use our Mortgage Insurance Calculator to determine how much your mortgage insurance will cost with different down payments.