Welcome to our in-depth guide on navigating the Toronto’s Vacant Home Tax (VHT) declaration process for Toronto property owners.

With the significant changes coming into effect in 2024, including the tax rate increase to 3%, understanding the nuances of this declaration has never been more critical. Whether you’re a homeowner, investor, pre-construction condo owner, or hold a property not yet assessed for taxes, this guide is tailored to demystify the process and ensure you’re well-prepared. Importantly, the deadline for the VHT declaration is February 29, 2024, making it essential to familiarize yourself with the requirements and exemptions to ensure compliance and avoid unnecessary taxation.

Join us as we navigate through the essentials of the VHT, offering you clarity and confidence in meeting your obligations as a property owner in Toronto.

Table of Contents

What is the Vacant Home Tax?

The Vacant Home Tax (VHT) is a municipal initiative aimed at encouraging the occupancy of homes and contributing to the housing supply in Toronto. It targets homes that remain vacant for most of the year by imposing a tax on their owners. This measure is part of Toronto’s broader strategy to address housing affordability and availability.

How much is the Vacant Home Tax?

Starting in 2024, the Toronto’s Vacant Home Tax will see a significant increase from its initial rate of 1% to 3%. This hike reflects the city’s intensified effort to discourage property vacancies and mobilize these assets into the housing market.

Who must make the Vacant Home Tax Declaration?

All property owners in Toronto are required to declare the occupancy status of their properties annually, with few exceptions. Please declare to avoid the property being deemed vacant and subsequently taxed.

List of Exemptions

- Pre-Construction buildings still under construction and not yet ready for occupancy are exempt.

- Properties Awaiting Tax Assessment: New properties that have taken occupancy but have not been assessed for property taxes yet.

- In the event of the death of the property’s principal owner;

- If the property is undergoing repairs or renovations and occupation and normal use of the property is prevented, all necessary permits have been issued for the repairs and renovations, and the City’s Chief Building Official is of the opinion that the repairs or renovations are being actively carried out without unnecessary delay;

- If the principal owner of the property is in hospital or long-term or supportive care;

- In the event of a legal ownership transfer, excluding name changes, the addition of a second owner, and the removal of a second owner;

- If the property was vacant for employment purposes;

- In the event of a court order in that prohibits occupancy.

Note: While exempt, in some cases you may need submit additional documentation or an appeal application. Visit the Vacant Home Tax Government website here for all the details.

For Home Owners

For individuals who occupy their property as their primary residence, declaring this status is crucial to avoid the Vacant Home Tax. This declaration serves as a confirmation that the property is not vacant and is actively used as the owner’s main place of living. The City of Toronto requires this declaration to ensure that homes which are lived in are not unjustly taxed under the VHT. Homeowners must annually affirm their occupancy status to remain exempt.

For Investors

Investors with multiple properties play a pivotal role in the housing market. To comply with the VHT, investors are required to declare each property that is rented out and provide proof of tenancy. This could include lease agreements or other documentation that verifies the property is occupied by tenants. The declaration is essential in ensuring that investment properties contributing to the rental market are not subject to the vacant home tax, acknowledging their active role in housing.

For Pre-Construction Condo Owners

Owners of condos that are currently under construction and have not yet been occupied are exempt from the Vacant Home Tax declaration. This exemption recognizes the transitional status of these properties, acknowledging that they cannot be occupied until construction is completed. Pre-construction condo owners need to be aware of this exemption to avoid unnecessary concern over the VHT until their properties are completed and ready for occupancy.

For Properties That Have Not Had Taxes Assessed

Properties, such as new pre-construction condos that have been occupied but have not yet been assessed for property taxes, are also exempt from the VHT declaration. This exemption is in place because these properties do not yet have a tax assessment, which is a prerequisite for the VHT declaration. Owners of such properties should monitor their status and be prepared to declare once they receive their tax assessment.

How to Submit the Vacant Home Tax Declaration

To submit the Vacant Home Tax Declaration, property owners should visit the official City of Toronto website at Toronto.ca. The online submission process is designed to be user-friendly, allowing property owners to comply with the VHT requirements easily. The website provides detailed instructions and support for those needing assistance with their declaration, ensuring a smooth and efficient process.

What Information is Required to Submit the Vacant Home Tax Declaration?

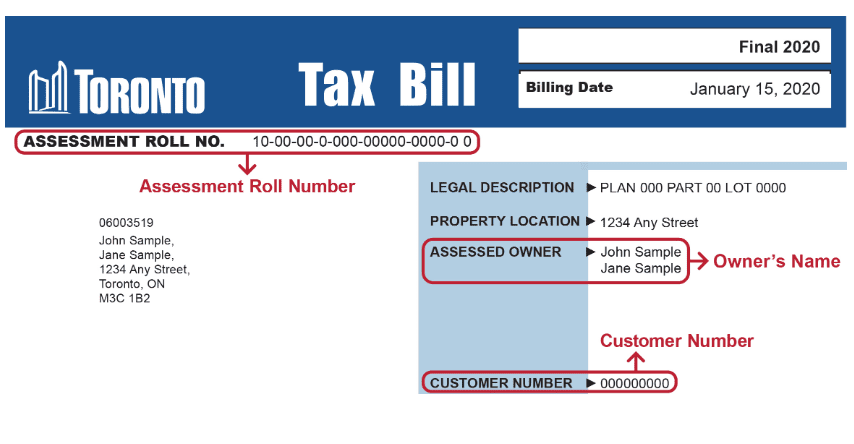

When preparing to submit your VHT declaration, ensure you have the following details accessible from your Toronto Property Tax Bill:

- Assessment Roll Number: This is a unique identifier for your property, crucial for the declaration process as it confirms the property in question.

- Customer Number: Assigned specifically to you as the property owner, this number is necessary for the identification and processing of your declaration.

- Owner’s Name(s): The legal name or names of the property’s owner(s) as registered with the city. This information must match the official records to validate the declaration.

Gathering this information beforehand will streamline the submission process, making it easier to comply with the Vacant Home Tax requirements in Toronto. If you have any questions or require further assistance with your Vacant Home Tax declaration, please don’t hesitate to reach out to us. Our team is here to provide you with the support and guidance you need to navigate this process smoothly. Contact us via email, phone, or through our website’s contact form, and let us help you ensure compliance with Toronto’s Vacant Home Tax regulations.

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.