Let’s face it. Buying your first home is kind of a big deal. But before you start dreaming of ripping up carpets and picking out paint swatches, the first thing you need to consider is how you’re going to come up with the dreaded down payment (ie. the amount of hard cash you need to pay upfront when purchasing a house). While saving for a down payment can seem like a daunting task, there are a plethora of things you can do to make the process more manageable.

Before you start scrimping and saving for a house, you’ll need to infuse some semblance of structure into the mix that you can track. What do we mean by this? For starters, you should figure out how much you can reasonably save in a given timeframe, and then track your progress as you go.

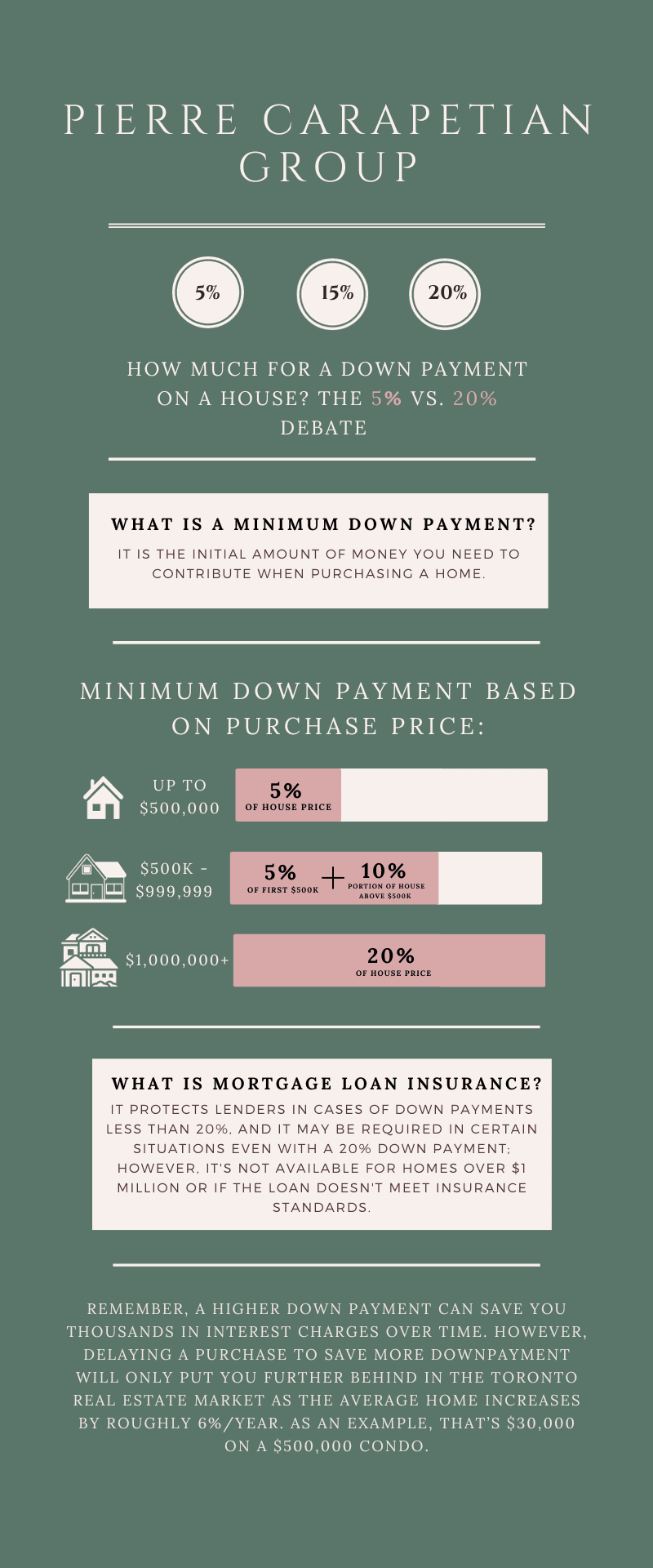

The minimum down payment in Canada depends on how much the home you want to buy costs: if the purchase price is less than $500,000 you’ll need to pay a minimum of 5%, with 10% on any remaining amount up to $1,000,000, beyond which you pay a flat 20%. So, if you’re aiming to purchase a home for around, let’s say $400,000, you will need to save at least $20,000. While you can get away with a deposit of 5%, it’s recommended that you try to put down 20% ($80,000 in this case) to avoid having to pay mortgage default insurance.

A great way to budget effectively is to give yourself a deadline and work backwards. If you need to save $50,000 for a down payment, figure out what you’ll need to save each year, each month or each week to reach that goal. Breaking it down this way helps segment your savings approach.

Related: What Is The Income Needed To Get A 400K – 900K Mortgage In Canada?

While saving for a house is a noble pursuit, it shouldn’t be your first priority if you have loads of high-interest consumer debt. But how can you remedy your debts quickly? Pay off your smallest debt first and then apply the minimum payment from that debt onto your next smallest debt, and so on and so forth until presto—you’re debt-free!

There are two reasons to clear up your outstanding debts before you start saving for a down payment: (1) you will likely not qualify for a mortgage if you have a significant amount of debt and (2) you will minimize risk if you delve into homeownership with a clean slate from the get-go.

Consider all of the things that you pay for in the run of a month and then prioritize what is most important to you (and what you might be able to let fall by the wayside). Do you need to own a car, or will public transit suffice? How about opting for a stay-cation over a vacation to bank the money you would have doled out on flights and swanky hotels? Can you possibly forego the little black box to skip out on your sky-high cable bill every month? Figure out what you’re already spending and identify areas where you might be able to cut back. These savings will add up over time, and before you know it, you’ll be signing the deed to your new digs.

Your income plays a large part in how much you can reasonably squirrel away, but the way that you choose to save money can also influence how much you take home at the end of the day. Allocating a certain percentage of your income to your down payment and setting up an automated savings plan can put your money out of sight, out of mind; removing temptation and streamlining funds.

Sending your money directly into a Tax-Free Savings Account or an RRSP means that you can accumulate gains on your down payment as it grows. First-time homebuyers in Canada can withdraw up to $35,000 from any RRSP account to put towards a down payment using the Home Buyer’s Plan (HBP) in the form of an interest-free loan that is paid back over a 15-year period. Those with tax-free savings accounts can withdraw their down payment, tax-free, once they reach their budgeted amount.

Once you get the ball rolling in the right direction, you will be surprised at how quickly your savings add up. If you put your nose to the grindstone and use some of the handy tips to start saving for a down payment, before you know it you’ll be popping a cork next to a sign reading SOLD, wondering why it took you so long to take the leap.

Get the hottest pre-construction investment opportunities right to your inbox.