The entire reason I got into real estate was because at 18 years old I used a $6,000 tax return to put towards buying my first property. By the time I was 21, I managed to turn that one property into six.

Investing in the Toronto condo market is a great way to build wealth for yourself and save for a comfy retirement. Owning an investment property means you’ll be earning extra income, so let’s dive into the exciting world of investment property taxes and what you need to know.

When it comes to buying an investment property you’ll pay certain taxes upfront such as Land Transfer Tax and HST, the latter of which you may be eligible for an HST rebate. Once you’ve made the purchase, there are some great tax benefits to owning and operating an income-earning and equity-earning real estate asset. Let’s talk investment property tax deductions.

WHAT CAN YOU DEDUCT ON A RENTAL PROPERTY?

When you own an investment property, because you’re earning extra income through the rent roll of your tenants, as with any business, you are able to deduct any expenses used to earn that income.

Investment Property Tax Deductions include (but are not limited to):

- Advertising costs and/or Realtor fees affiliated with obtaining a tenant

- Property taxes

- Interest on your mortgage

- Maintenance fees (both condo fees and general maintenance costs)

- Professional fees such as lawyers and accountants

- Utilities

- Property management wages, if you decide to go that route

- Insurance premiums

See the CRA’s full list of investment property tax deductions

These deductions can only be those related to your rental property. For instance, if you buy a home in which you plan to occupy part of the property and rent out a separate unit in the home, you are only able to deduct the expenses, or the relative percentage of expenses, related to the rental property.

CONSIDER YOUR INVESTMENT PROPERTY TAX RATE

It’s important to be cognizant of the amount of extra income you’ll earn through owning a rental property in Toronto and what that may do to your overall income tax bracket. This is where your investment property tax deductions help to offset your rental income. However, if you have more than one investment property in your portfolio, it’s important to speak with your accountant to ensure you’re not surprised come tax season.

CAPITAL GAINS TAX AND SELLING YOUR INVESTMENT PROPERTY

When you decide it’s time to sell your Toronto investment property it’s likely you’ll have earned some great equity gains over the years.

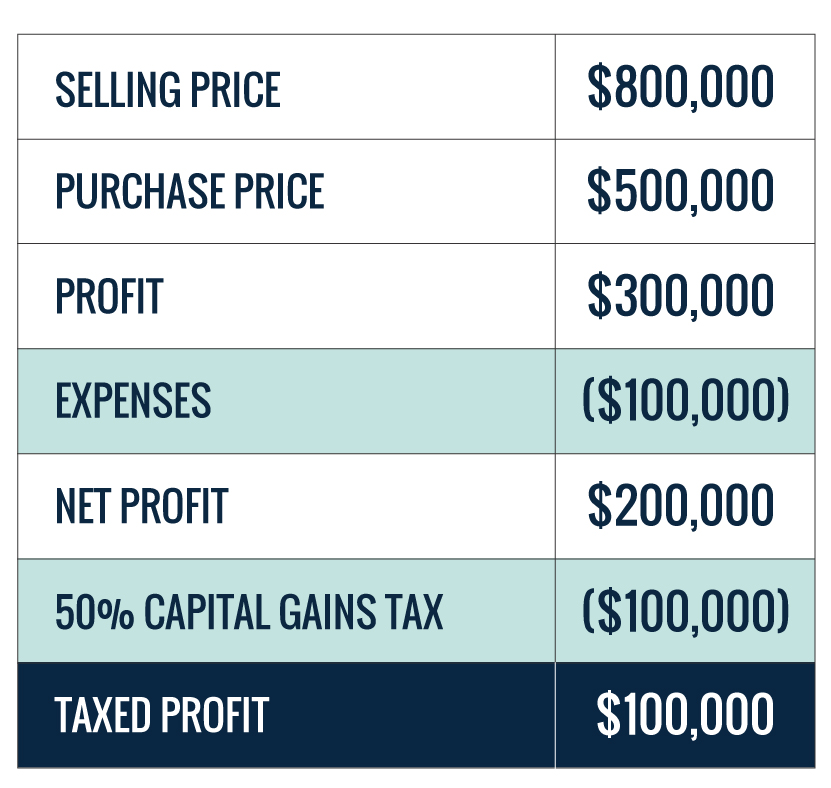

Let’s say you purchased your investment for $500,000 and are now able to sell it for $800,000. While you have profited $300,000 you are entitled to deduct any expenses used to achieve your investment that year to lower your taxable income. When selling your investment property, you will pay a 50% Capital Gains Tax on your net profit.

While your income tax bracket may not shift too much from your investment property on an annual basis, when you go to sell your investment you can expect to see a jump in your income tax rate.

With this in mind, if you and your partner are investing in a rental property together, it may be in your best interest to put the title of the investment property in the name of the individual who has a lower annual income. This way, that extra $100K you earn in income when you sell your investment property may help counteract a more significant jump in tax rate. But remember, we’re real estate agents not accountants, so we suggest getting advice from your accountant or lawyer.

If you’re ready to start building your real estate portfolio, book a call to discuss the best course of action and the best investment opportunities currently available in Toronto.

Disclaimer:

Pierre Carapetian Group Realty makes no warranty, express or implied, nor assumes any legal liability or responsibility for the accuracy, correctness, completeness or use of the information provided. Opinions are based on our own calculations and fair market value is as determined by us.