If the term ‘interim occupancy’ feels foreign to you – that’s okay, you’re not alone. Odds are that you’re a first-time homebuyer in Canada. The learning curve for first-time homebuyers in a super-competitive real estate market like Canada is steep. But I’m here to flatten that curve for you!

Table of Contents

Buying a pre-construction unit in Canada is very different from purchasing a resale property. You’re only going to go through interim occupancy if you’re purchasing a pre-construction unit in Canada.

In the simplest of terms – interim occupancy is the last leg before property ownership gets transferred to you and you can proudly call yourself a condo owner! You can live in your property during interim occupancy but again – you’re not the owner of it just yet. Here’s where things can get confusing and it’s important to understand the difference between interim occupancy and final closing.

The rest of this guide focuses on simplifying the concept of the interim occupancy period and comparing it with the final closing period.

Simplifying The Interim Occupancy Period In Canada

What Is Interim Occupancy?

Interim occupancy is the period of time between the day you get your keys (interim occupancy date) and the final closing, the day property ownership gets transferred to your name (final closing date).

Interim occupancy period = Time period between interim occupancy date & final closing date.

How Does Interim Occupancy Work?

Your lawyer will receive a document known as the “Interim Statement of Adjustments” when your interim occupancy date has been confirmed with the developer or vendor. When your lawyer receives this document, you are able to move into your building even though construction may not be complete on all of the units in the building.

The lower floors will receive interim occupancy first as the builder works their way up to complete construction on each suite and common spaces in the building. The majority of the time, there are hundreds of buyers, so this occupancy period takes time and coordination to be done properly. It is important to note that during the interim occupancy phase, you do not own the unit yet. Ownership will be transferred to you when the condo has been registered with the municipality and this can only be done when all construction on the building is complete.

How Long Can Interim Occupancy Last?

On average, interim occupancy in Canada last between 3-6 months. However, the actual duration/timeframe of your interim occupancy period varies from one condo development to the next, meaning that your interim occupancy period could last anywhere from a few weeks to a few years.

Typically, if you are on the lower floors of a building, you will qualify for an earlier occupancy date, therefore you may have a longer interim occupancy period. If you’re worried about the registration & completion time – look for units in buildings developed by some of the best condo developers in the city.

RELATED: WHY IT IS A GREAT TIME TO INVEST IN BUYING AN ASSIGNMENT CONDO IN TORONTO

Can I Rent My Unit During The Interim Occupancy Period?

In order to rent your unit during the interim occupancy period you need to get permission from the builder in writing because technically, the builder is the owner of your unit until the final closing date. Permission to rent can be included in your Agreement of Purchase and Sale and it is better to clarify your intentions to the builder long before construction has begun to avoid legal complications.

If you get the go-ahead and plan on leasing your unit during interim occupancy, it is important to note that you can’t apply for the HST rebate as a principal resident but must do so as an investor. Refer to this article to understand more about the difference between HST rebate in Ontario for end users, vs. HST rebate in Ontario for Investors.

Do You Pay Mortgage During Interim Occupancy?

No, since you’re not technically the owner of the condominium during the interim occupancy period – you do not need to pay any mortgage. Instead, you’re liable to pay a monthly fee to your condo developer that’s commonly referred to as the interim occupancy fee. Your mortgage payments will officially start the day property ownership gets transferred to your name. i.e. the final closing date.

Understanding Interim Occupancy Fees

During your interim occupancy period, you will have to pay the developer an interim occupancy fee. You will not have to pay a mortgage fee during your interim occupancy period since you do not legally own the property yet. Your interim occupancy fee is typically lower than what your mortgage would cost per month because you’re not paying the principal portion of the payment.

How To Calculate Interim Occupancy Fees In Canada?

According to the Condo Act of 1998, the monthly interim occupancy fee is calculated based on three things:

-

interest (calculated on a monthly basis) on the unpaid balance of the purchase price at the prescribed interest rate

-

estimated monthly municipal taxes for the unit (purchase price of the condo multiplied by 1% – 1.5% divided by 12 to arrive at the monthly charge)

-

projected common expense fees for the unit.

Whether you move in on your interim occupancy date or not, you will still have to pay these fees until the final closing. Developers aren’t making a profit through these interim occupancy fees – which incentivizes them to make sure that interim occupancy is as short as possible!

The Condominium Authority of Ontario also states that “Once the interim occupancy period ends and ownership of the unit is transferred, you may be owed money if your builder collected more money for property tax than the actual property tax amount. Alternatively, you may owe your builder money if they collected less property tax than the actual amount that was charged by the municipality.”

RELATED: WHY NOT TO SELL YOUR PRE-CONSTRUCTION CONDO AT OCCUPANCY

Interim Occupancy vs Final Closing: Key Differences

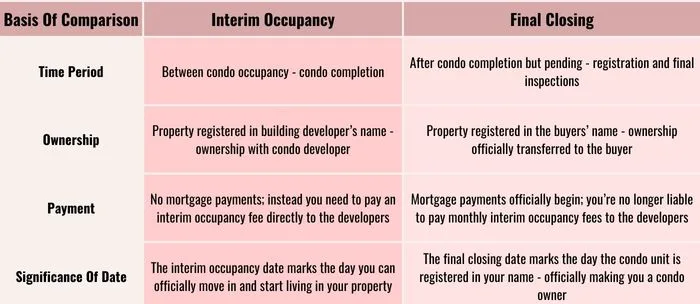

There are a couple of key differences between interim occupancy and final closing, however, the biggest difference to beware of is the change in payment structure and its impact on your finances.

During interim occupancy, you pay an occupancy fee directly to the developer as you have not yet taken possession of the property but are allowed to occupy it. The final closing date is typically the same for all units, regardless of the floor level, once the construction is completed and registered with the Land Registry office. At the final closing, interim occupancy fees cease, and your mortgage payments come into effect, including the principal. It’s important to note that during interim occupancy, you are not paying off your mortgage principal as it is a temporary stage.

What Is The Difference Between Interim Occupancy and Final Closing?

Tarion Warranties

Your one, two- and seven-year warranties begin as soon as you are granted occupancy of your unit meaning the start date of your interim occupancy. If there are any issues with your unit, it is your responsibility to submit the appropriate warranty form to Tarion. In the disclosure document that is attached to your purchase agreement, you will find common element boundaries and responsibilities for repair and maintenance. Tarion has a 30-day period that you can fill out your first warranty.

Final Words

I know. Buying a pre-construction condo in Toronto is definitely not straightforward. Whether you’re a first-time homebuyer or an experienced real estate investor – you could benefit from some help. If you are in the market looking for some help – book a call with me or somebody from my team and let us show you the way!

I have made a living investing in Toronto’s real estate market for the last 15 years. I love investing in pre-construction condos and if you read my blog regularly – you’re probably already aware of my bias! For some proof or validation, you can always go through my clients’ returns before ultimately booking a call for yourself!

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.