Let’s say you’ve been living in a Toronto rental property for many years. You love the place you’re in and you are locked into a great rental rate, much lower than what the average rent in Toronto is these days. Over the last several years you’ve managed to save a significant chunk of change; enough for a down payment. When it comes to buying real estate vs investing in a rental property of your own — is one more advantageous than the other?

RENTING AND INVESTING VS BUYING A HOUSE

In order to properly outline the scenario at hand, let’s cover some key points that vary when you’re buying real estate for investment versus buying with the intention of living there.

Buying a Property to Live in

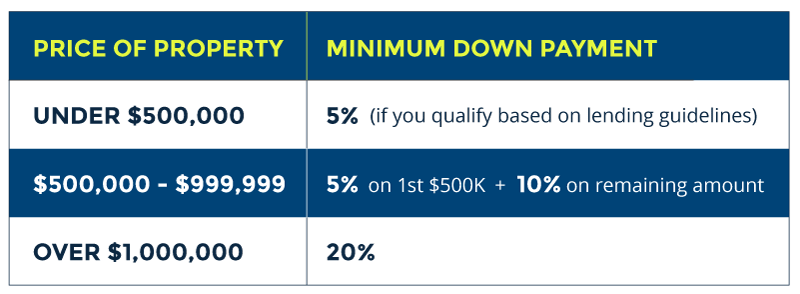

When you are buying a house or resale condo that you plan to occupy yourself, your downpayment can be less than 20%, as long as the price tag is under $1,000,000. If it’s over the million dollar mark, you will need the full 20% downpayment.

As a first-time buyer, you may be eligible for several of Canada’s first-time buyer rebates. These include a Land Transfer Tax rebate and a first-time home buyer tax credit.

Buying Real Estate as Investment

When you’re buying real estate as an investor, you are obligated to pay the full 20% down payment. However, when investing in pre-construction condos, your 20% down payment is typically segmented into four 5% deposits over a three to four year build time.

For instance, right now River & Fifth Condos has a 5% per year limited time deposit structure. These types of deposit structures can be easier to digest for some buyers and investors.

As an investor, you forgo your first-time buyer rebates but, if you invest in a pre-construction property, you are eligible for the HST Rebate at closing, to a maximum of $24,000, provided you have a one year lease in place.

Download our Comprehensive Guide to Investing in Pre-Construction Toronto Condos

INVESTING IN REAL ESTATE: BEING A RENTER AND A LANDLORD

It seems counterintuitive, doesn’t it? Why would you pay rent when you own a property? While some people are buying real estate investment properties outside of Toronto and continuing to rent here, the rental income you can earn in Toronto is far more lucrative.

The key element to success here, should you have enough for a downpayment, is to be able to rent out your investment at a higher cost than you are currently paying in rent. This allows you to break even on living expenses, giving you the cash flow of the difference in rent.

Allow me to demonstrate.

Let’s say you’re locked into a below market rental rate of $1,800 per month, along with your utilities you pay a total of $1875.

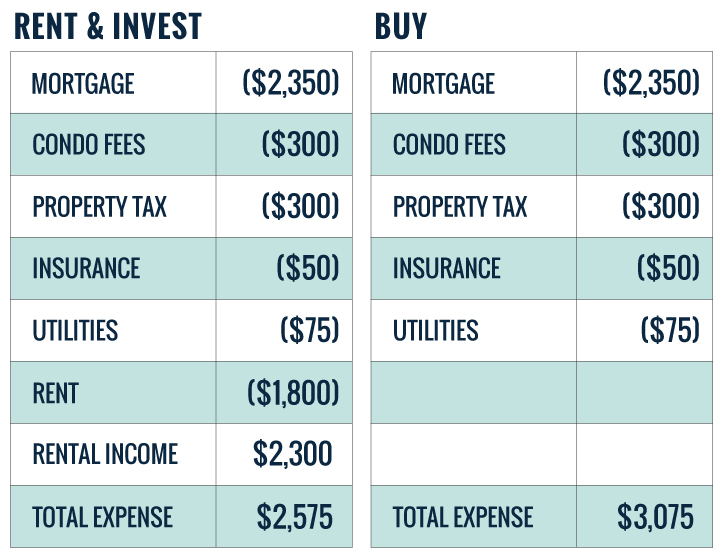

You buy an investment property for $600,000, for which you can charge $2,300 per month in rent. The point I’m trying to illustrate in the chart below is that your monthly carrying expenses are the same whether you own that condo as your principal residence or own it as an investor. But if you know that you can charge more in rent than you currently pay in rent, you’ll gain the difference and have a cash-flow positive investment property.

Also, if your investment has never served as a rental property before, you’re exempt from rent control. You can read more on rent control guidelines here.

To sum up, renting and investing vs buying a house or condo on its own has advantages. The key is to be able to charge your tenants more rent than you’re currently paying.

Now let’s talk equity. Investing in the Toronto condo market, as in the example above, allows you to generate significant equity gains each year.

Historically, Toronto condo prices grow an average of 5% per year. However, Toronto’s condo market has been out-performing that for many years. In June and July of this year alone we’ve seen prices go up 5.1% and 7.7% y-o-y respectively.

The other advantage here is, should you decide you no longer want to be a renter, you can move into your investment property. Just be sure you respect the current lease terms you have with your tenant.

INVESTING IN REAL ESTATE BY BUYING YOUR FIRST HOME

Perhaps renting and investing isn’t ideal for you. The alternative to renting and investing is to buy your first home. If you decide to buy instead of invest, you aren’t obligated to put the full 20% down payment (except with pre-construction). However if you have it, it will help lower your monthly mortgage payments and you won’t have to pay mortgage default insurance.

By owning your own home, you are able to build up the equity in your property and when the time is right, use our leveraging strategy to reinvest those funds into a second property that can be used as an investment.

We generally recommend evaluating your property’s market value after five or six years of owning it. By then you’ll likely have earned great equity gains in the market and will have paid down a portion of your mortgage.

For a full look on how to build your real estate portfolio, you’ll want to read Turn Your Property into a High-Grossing Real Estate Portfolio.

The biggest advantage to owning your own home is that when you decide it’s time to sell, because it is your principal residence, all of the profits earned are completely tax-free.

We’ve helped several of our clients make smart real estate decisions. We understand that everyone’s starting point will be different. Book a call with us to discuss your financial situation and help clarify your real estate goals.