On 23rd June 2022, Canada’s federal government assented to the Prohibition on the Purchase of Residential Property by Non-Canadians Act – also known as ‘Canada’s Foreign Buyer Ban Law’ – with the objective of cutting costs to make housing more affordable for Canadians.

Table of Contents

Now, this law really plans to shuffle (dissuade) foreign investment in Canadian real estate. If by any chance you follow Canada real estate news, you have probably come across at least one interpretation of the impact of this new law on foreign investment in Canada’s real estate market. In this blog post, we’d like to share ours – updated with all the other information that you need to know to about buying property in Canada by non-residents and buying property in Canada as an ex-pat.

Canadian real estate is a lucrative investment market. While markets like Toronto and Vancouver have been thriving and far exceeding housing prices in other areas of the country, from a global perspective these two cities are still more affordable than cities like New York or London. Recognizing the value in our real estate market, we’ve had some Canadian non-residents interested in investing in Canadian real estate while abroad.

Our Perspective On The Impact Of Canada’s Foreign Buyer Ban

I’ll start off this section with my perspective on the impact of this act before getting into the particulars that it entails. While both government parties believe in this proposal, here’s my take on why its impact might not be as large as anticipated.

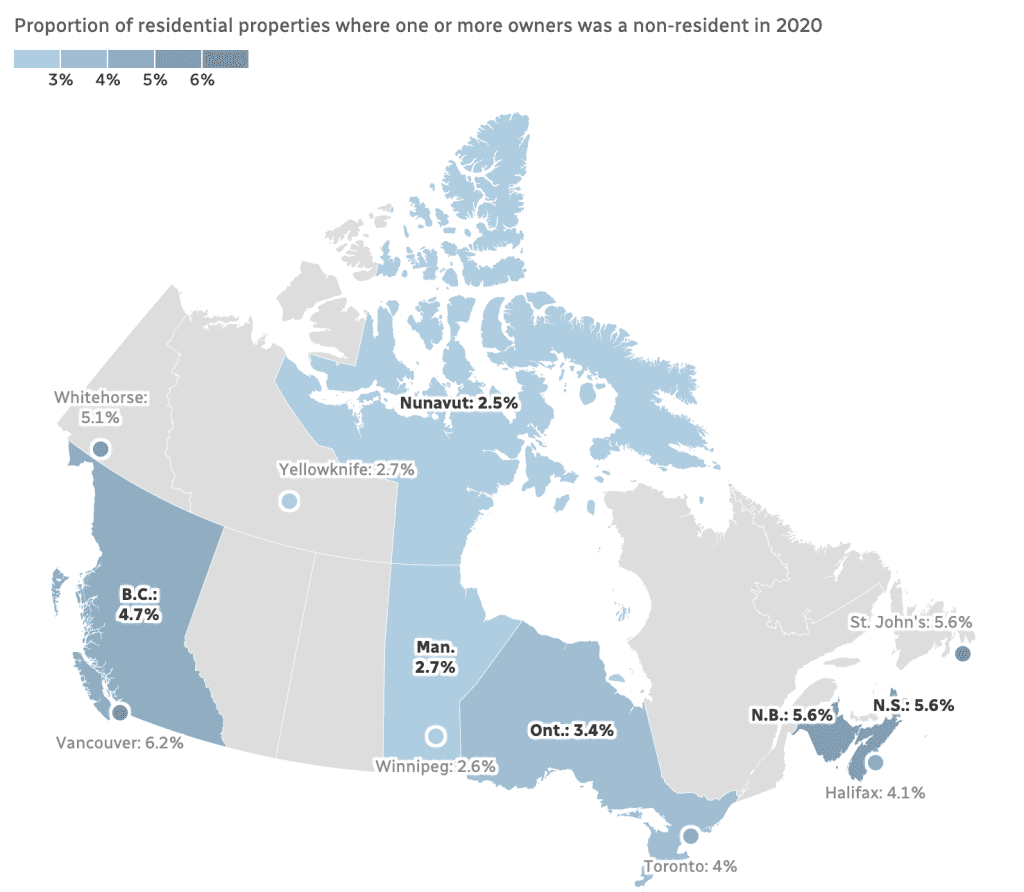

Over years we [read the news] have been ‘blaming’ foreign buyers but that’s not the problem here and I believe that the new regulations aren’t going to make much of a difference. There’s not much data on this but according to the Canadian Housing Statistics 2020 Program – between 2%-6% of the properties surveyed had at least one foreign non-resident occupant. If you’re Canadian, does that number concern you?

Source: CBC News, Statistics Canada

It’s my opinion that the housing market in Canada is unaffordable due to other factors – with supply being the main issue. The government has realized that there’s a serious demand-supply issue in the housing market. Population in Canada has grown at 6.3% in the last 5 years – double the growth rate of any other G7 nation. To meet this rise in demand, Canada needs more houses. While the government has acknowledged this need, it’s important to remember that they aren’t the ones actually building.

It’s private builders incentivized by profit (how capitalism works, really) who do the actual building. In Toronto, developmental charges are expected to go up by 46% over the next two years. Then, there’s the cost to build. Ultimately, it’s the homebuyer who bears these increased expenses as builders are forced to push forward the costs making housing unaffordable for first-time Canadian home buyers. It’s all a cycle or as I like to call it – the ‘Condo Price Per Square Foot Cycle’ – a major reason why the average price per square foot for a condo in Toronto has exceeded $1400.

Related: Here’s a YouTube short with more information on who is building condos in Toronto .

Did Canada Ban Foreigners From Buying Real Estate?

According to the Prohibition on the Purchase of Residential Property by Non-Canadians Act, effective 1st January 2023, all non-Canadian individuals (not citizens or permanent residents) and corporations are banned from purchasing residential property in Canada till 1st January 2025 (next two years).

Why Has Canada Initiated A Foreign Buyer’s Ban?

The goal is to make residential real estate in Canada affordable again. Or at, least that’s the plan. According to Prime Minister Justin Trudeau’s party website, “The desirability of Canadian homes is attracting profiteers, wealthy corporations, and foreign investors. Homes are for people, not investors.”

Despite its noble intentions, Canada’s Real Estate Association (CREA) believes that the anticipated regulations may be counter-productive. In his plea before the Senate Committee, CREA CEO Michael Bourque makes his opinions crystal clear – labeling the act a ‘xenophobic legislation’ that’s equivalent to ‘scoring an own goal’ in Canada’s battle for talent acquisition.

Who Is Exempted From Canada’s Foreign Buyer’s Ban?

To start with, let’s get one thing straight: if you’re looking to rent a property as a foreigner, you’re good. This new act does not apply to you and there’s no ban on renting properties in Canada as a foreigner. Other ‘non-Canadians’ exempted from this ban are:

- Temporary residents studying at designated earning institutions (additional terms).

- Work permit holders or, if they are authorized to work in Canada under regulations laid down by Immigration and Refugee Protection Regulations (additional terms).

- Anyone who acquires a property as a result of unplanned circumstances like death, divorce, or gift.

- Any transfers that took place before the act came into effect i.e 1st January 2023.

- If your spouse or common-law partner is a Canadian Citizen.

- Members of indigenous communities who are registered members under the Indian Act.

- Refugees that have been granted protected status under subsection 99(3) of the Immigration and Refugee Protection Act.

- Foreign nationals (generally diplomats) issued an acceptance by the Chief of Protocol for the Department of Foreign Affairs, Trade, and Development.

What Types Of Property Can Foreigners Still Buy In Canada?

You can think about buying fourplexes, commercial real estate, or recreational property like vacation homes and cottages. All properties apart from those defined as ‘residential properties’ are still on the table for foreign investors looking for opportunities in Canada’s real estate. Additionally, a residential property that’s not located within the confines of a census agglomeration or a census metropolitan area is also open for foreign investment. To find out if a property lies within a census metropolitan area here’s a helpful resource.

Examples of ‘residential properties’ – that you cannot invest in – include:

- Small dwelling or detached homes with 3 or lesser units

- Semi-detached homes, rowhouse units, residential condos, or any other real and immovable property that is being purchased with the intention of being owned

- Other prescribed real and immovable properties

Related: What Is A Multiplex Home – Is It a Good Investment In Toronto?

What Is The Penalty For Investors That Violate The Ban?

Anybody – irrespective of whether you’re a Canadian or Non-Canadian – if you’re found guilty of violating this law or helping another Non-Canadian violate this law, you’re liable to pay a maximum fine of $10,000 USD. Additionally, a court has the power to overlook the sale of the property purchased – dictating the manner of sale along with the other selling conditions. According to me, the fine is too little to make any difference to real investors.

Financial Prospects For Foreign Investment In Canada Real Estate

Do Foreigners Have To Pay Property Taxes In Canada?

If you’re considered a foreign, non-resident individual or corporate, then yes – you do have to property the Non-Resident Speculation Tax (NRST) or Foreign Buyers Tax.

Who is deemed a non-resident varies depending on if you ask the bank or the government. One test that’s often used is the ‘183 days rule’. To a Canadian bank, an ex-pat or any Canadian citizen living abroad for more than half of the year (or 183 days) is considered a non-resident and the same financing rules apply to them as they would to a foreigner buying property in Canada.

What Is The Tax On Foreign Nationals Buying Real Estate In Canada?

As of October 2022, the Foreign Buyers Tax is only applicable to those foreign buyers who are buying in Ontario and in British Colombia. In Ontario, the Foreign Buyers Tax is 25% of the home’s purchase price and in certain regions, in B.C. it is now 20%. With that being said, certain investments are exempt from NRST. Before you make a decision, it would make sense to consult and double-check your strategy with a lawyer.

To the government, however, you are not considered a non-resident for tax purposes and so as a Canadian citizen, even non-resident, you are 100% exempt from the Foreign Buyers Tax.

Related: Moving to Canada: What International Buyers Need to Know

What Financing Options Do Non-Residents Have To Invest In Canadian Real Estate?

When investing in real estate you need a minimum 20% down payment. As we mentioned above, however, when you’re getting a non-resident mortgage in Canada a Canadian bank will see you as a non-resident foreign buyer and require you to put down at least 35% in order to obtain a mortgage with them.

Keep in mind, as a non-resident investing in Canadian real estate while abroad, avoiding a mandatory 35% down payment means you may want to look beyond the big five banks to secure a mortgage.

Can you get a non-resident mortgage in Canada without needing 35% down? The answer is yes, but you will likely need to turn to private mortgage lenders or trust companies. This is where finding the right mortgage broker, one who has experience arranging non-resident mortgages on behalf of expects buying property in Canada, is key.

Note: It’s important to note, that regardless of who you obtain your non-resident mortgage from, you should ensure that you have your down payment funds in a Canadian bank account for at least 30 days ahead of finalizing your mortgage. Non-bank lenders may be more lenient on this, so it’s always good to clarify ahead of time.

What Are The Different Types Of Closing Costs Involved?

When investing in a resale property, you only have two closing costs to account for: Land Transfer Tax (LTT) and legal expenses.

When it comes to investing in pre-construction you have a few extra closing expenses to account for beyond the LTT and legal fees, but they aren’t due until the building registers with the city in three to four years.

Pre-construction closing costs include Development Charges and miscellaneous fees that are specific to newly built properties. You will also need to pay HST at closing to a maximum of $24,000 but may be eligible for a full HST rebate provided you have a one-year lease in place. Ensure you discuss your eligibility for this HST rebate with your real estate lawyer as a Canadian living abroad.

Dream Team, Assemble!

If you’re in the market to invest in Canadian real estate while living abroad, the next time you’re in Canada, put aside some time to meet with a few people to help arrange everything accordingly. The team you’ll need includes:

• a mortgage broker who specializes in arranging Canada non-resident mortgage

• a real estate lawyer to help ensure all of your non-resident tax questions are answered

• top real estate agent who has a network of professionals to offer you expertise in investing in Canadian real estate.

Book a call with us today to get started!

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.