Buying a house in Toronto is likely your largest purchase. This statement reigns true for anyone purchasing a home but it is especially true for those looking at the cost of buying a house in Toronto – the most expensive city in Canada. Though the percentage of people who spend more than 30% of their income on housing has fallen since 2016 – it’s still at 20.9%.

Table of Contents

Well, the rate of housing affordability has fallen but the cost of buying a house in Toronto hasn’t. Housing is considered more affordable today because people are earning a lot more today.

My personal rule is bigger the expense, the bigger the need to get educated prior to purchase. You can guess what that entails for a house. In fact, you don’t need to guess as I am writing this blog post to help you make an educated decision. I strive to ensure that my clients have all the resources at their fingertips enabling you to always make the best decision. I know that calculating numbers is a big turn-off which is why I have done them for you! (you’re welcome)

All the data on home prices is sourced from TREEB’s 2022 quarterly community reports. Pricing data reflective for the following types of houses: detached homes, semi-detached homes, townhouses (condos as well), and condo apartments.

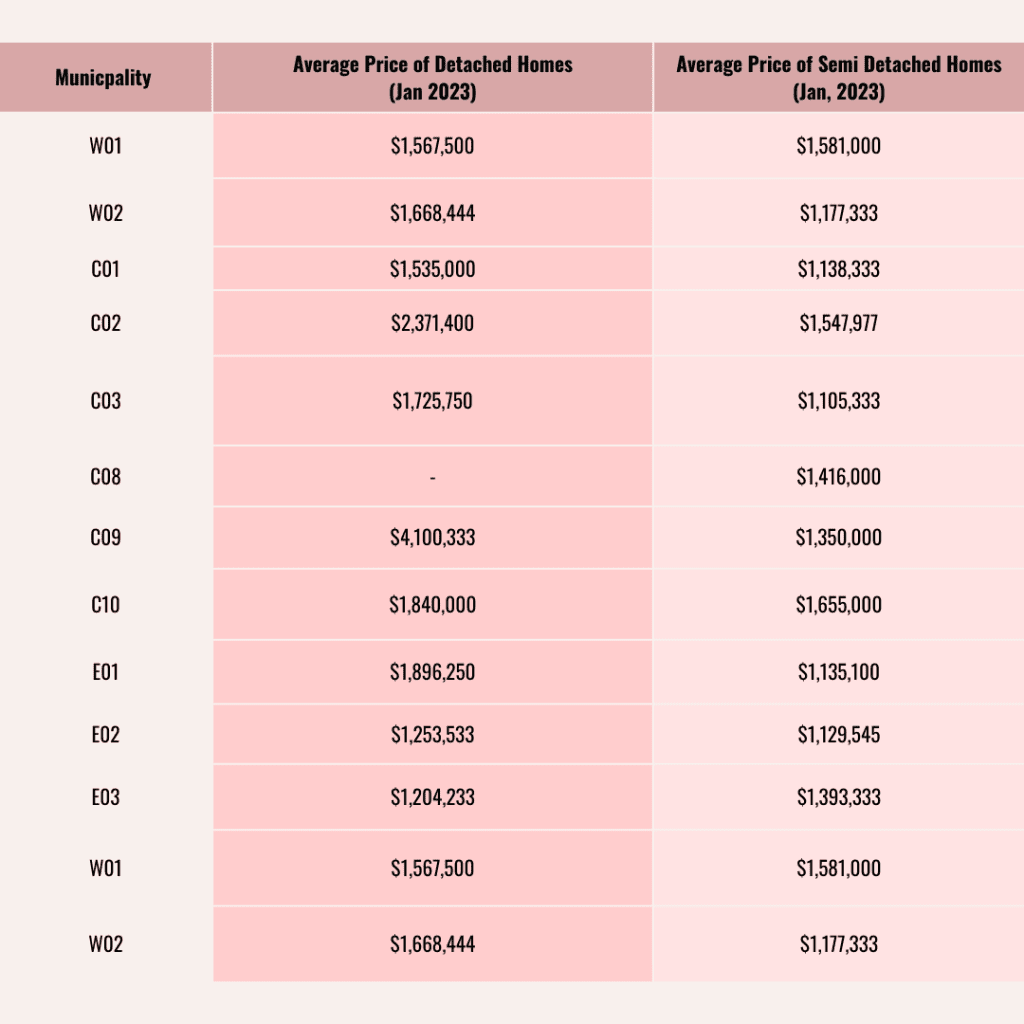

Spoiler Alert: At first glance, you might find that the cost of buying a house in Toronto’s east end continues to be the more affordable option – especially for semi-detached homes. This is a great thing to keep in mind if you want to purchase a home in the east end as things are gentrifying eastbound and that’s having a positive impact on home values.

Understanding The Costs Of Buying A House In Toronto

How Much Does A House Cost In Toronto In 2023?

As of March 2023, a house in Toronto would cost you somewhere between $934,834 – $1,439,735 depending on the type of the property. Townhouses are cheaper falling on the lower end of the price range while the higher end is reserved for detached houses. Compared to last year, the market is down nearly 20% though all the signs out there are signaling that the market is rebounding to reach 2021-2022 peaks again!

What Are Your Costs When Buying A House In Toronto?

Whether you’re looking at the cost of buying a house along the Danforth for $1,070,920 or buying a house in the Annex for $3,228,857 there are more costs to consider when budgeting for your purchase.

- Down payment: First off, you’ll need a 20% down payment ready to go and you’ll need to be able to qualify under today’s new lending guidelines, aka the Stress Test. In a nutshell, the Stress Test means you’ll need to qualify at a mortgage rate of approximately 6% (as of Jan 2023) or 2% higher than your negotiated rate (whichever is higher)

Note: The Prohibition on the Purchase of Residential Property by Non-Canadians Act or ‘Foreign Ban Law’ in effect from 1st, January 2023 raises challenges for foreign investment in Canadian real estate – preventing mortgage lenders from giving out mortgages to non-residents and other foreigners as defined by the government.

- Land Transfer Tax: When buying a house you need to pay Land Transfer Tax (LTT) and unfortunately when buying a house in Toronto you get dinged twice with a Provincial LTT and a Municipal LTT. If you are a first-time homebuyer you may be eligible for a significant rebate on your Land Transfer Tax. Visit our First-Time Home Buyer Rebates page for more details on this.

- Legal Expenses: Lawyer fees will vary but they’ll typically cost you about $2,000. Additionally, you will have to pay upwards of $400 for Title Registration and this can often be tied into your lawyer fees. Don’t forget, this is the biggest transaction you’ll make and you’ll need a real estate lawyer to help make it possible.

- Home Inspection: When buying a house, it’s always a good idea to have a home inspection done to avoid any surprises post-sale. These can cost anywhere between $400 to $700.If you’re planning on renovating or improving the property be sure to put cash aside for your renovation budget. Read “Reno Versus Ready” for more on this topic.

- Your ‘Oh Sh*t Fund’: Beyond these figures, you’ll also want to set up an Oh Sh*t Fund. The purpose of the Oh Sh*t Fund is to ensure you have money put aside for any repairs and maintenance that will inevitably arise. This fund can also be used in an emergency if you lose your job or want to make home improvements in the future. We suggest putting aside 1-3% of your home’s value each year. Read more on the importance of an Oh Sh*t Fund here.

- Miscellaneous Costs: Don’t discount the budget you’ll need to travel to and from Toronto. If you’re not a resident of the city or province, the time you might take off work away from your other investments, your temporary accommodation costs, luggage storage and transportation costs, etc. – can all add up as a significant expense. This holds especially true if you’re viewing multiple properties over a couple of months!

Related: Learn How To Buy a House in Toronto with our Buyer’s Guide

What Are The Closing Costs When Buying A House In Toronto?

Resale properties have two main closing costs: lawyer fees and land transfer tax. Once you’re done with all the formalities and finally have the key in your possession, you’re expected to settle these two costs. Your lawyer will help. In case you don’t get one, ask your lawyer for a Statement of Adjustments outlining all the closing costs.

Average Cost of Houses In Toronto [Neighbourhood Breakdown]

Types Of Properties

3 Bed | 2 Bath | Detached | Semi-Detached

As you can see, the cost to own the average 3 bed, 2 bath semi-detached home in Toronto can vary greatly from neighbourhood to neighbourhood. You should now have a clearer understanding of what the actual costs of buying a house in Toronto are based on the neighbourhood(s) you’d prefer. Now you can start to adjust your expectations based on your financial situation and start saving accordingly.

The dream is achievable you just need to set up the right steps to get you there. If you’re serious about buying a home in Toronto in 2020, book a call with us today to discuss your financial situation and we’ll help make your home owning goals a reality.

Buyer Resources:

Step-by-Step Guide to Saving for a Down Payment

Mortgage Calculator

Land Transfer Tax Calculator

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.