It’s the age-old debate, renting vs buying in Toronto’s under-supplied real estate market. With every passing year it seems that, for many, the dream of homeownership in Toronto slips farther and farther away.

Table of Contents

Many are posing the question, when will the Toronto real estate market crash and will rental house prices go down in 2023 in hopes of a price drop to get their foot in the door, both literally and figuratively speaking. Compared to the rest of the housing market in Canada, Toronto also has the highest rental prices in Canada.

And, after analyzing the housing market, I think 2022-2023 may finally be THE year. You now can take a close look at your finances while we attempt to settle the debate of renting vs buying in Toronto.

If there’s one thing we know for sure, the best day to buy is always yesterday. With time, house prices generally go up but the value of your money rather stagnates – if not worse!

To Rent, Or Not To Rent? That Is The Question

Is It Better To Rent Or Own In Toronto?

According to TREB’s data, the average cost of a one-bedroom rental in downtown Toronto has increased by 24% in 2022 alone. If you knew you’d be paying these record-high rents five years ago, maybe you would have pulled the trigger on saving for a down payment and moved from the world of renting to buying.

What you’re paying in rent today is comparable to what you could be paying for a mortgage on a small condo or apartment. But often the decision to buy or rent involves more than just one factor. Below are a couple of questions that you should ask yourself when deciding whether to buy or rent.

When To Rent: Ask Yourself

Do I have the money for a down payment?

Do I want to take a risk?

Do I know where I will be in 3 to 5 years?

If you answered “No”, to the questions above, it might be a better idea for you to rent instead of buy in Toronto.

One of the most important parts of buying a property in Toronto is having money for the down payment. The size of the down payment will depend on the price of the property you buy.

Buying or investing in Toronto Real Estate also always has its risks and rewards. There is the general market risk where the market will have its ups and downs that are tied to the economy, inflation or other market trends. Naturally, we know that it is necessary to take more investment risk in order to achieve higher returns, but how much is appropriate and are you able to take a risk like this in your current position?

You must also consider what your future goals are. Are you looking to move to a different country within the next year? If so, it is probably a better idea to rent rather than buy a property in Toronto. When you buy real estate in Toronto, think long-term. If you hold your property for at least six or seven years, you can make some serious equity gains. The average 10-year historical rate is a 6% increase with 2023 showing an 8.6% increase in the average sale price, according to TRREB data.

When To Buy: Ask Yourself

Can I afford to buy housing in my desired location?

Do I want to pay my own mortgage instead of someone else’s?

Do I consider real estate as more than just an investment?

If you answered “Yes” to the above questions, you should consider buying a property in Toronto rather than renting.

Investing in yourself is one of the best financial decisions you can make. Because real estate is a long-term investment, make sure you can afford a property in a location that you desire and that you choose a property that will appreciate over time, but all while still having wiggle room with your finances allowing you to still enjoy your life.

Right now you may only be able to afford a studio condo in Toronto, but years down the line that studio’s value may double, and it will give you enough equity to buy and invest in more real estate. This is the power of leverage, especially if you put down 5-10% on your first purchase.

Renting vs Buying in Toronto 2023: Financial Analysis

Financially, Does It Make More Sense To Rent Or Buy In Toronto?

One of the most challenging hurdles to overcome when it comes to buying a condo in Toronto in 2023 is having enough money for the down payment. Saving a downpayment is the biggest factor in your home renting vs buying in Toronto equation.

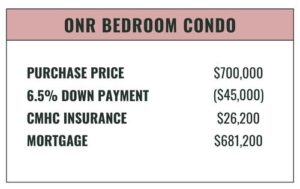

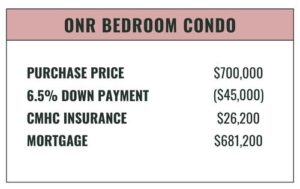

Let’s say you find a one-bedroom condo for sale with a $700,000 price tag. The minimum down payment you can make on that condo is 6.43% or $45,000.

Seems like a lot of money, doesn’t it? And it is.

Now compare that to what it costs to rent that one-bedroom condo which, in Toronto, is about $2,532 per month. After one year of living in that rental unit, you’ll have paid $30,384 in rent.

Congratulations, you’ve just spent more on a year’s rent than it costs for a down payment on that same condo.

It’s no wonder so many millennials are choosing to live with their parents. It’s not because they’re lazy; it’s because it’s the only way they have a chance in hell at becoming a homeowner in Toronto. According to a recent article by The Star, one third of young adults are living with their parents for this very reason: to save for a down payment.

Rent Vs Buy Calculators

Unfortunately, not everyone has the privilege of living rent-free for a year with mom and pops. If you are curious to know what you could afford based on your current rent, below are a couple of useful links:

How Much Does Home Ownership Really Cost?

Having enough saved for a down payment is one thing, but being a homeowner comes with a few extra monthly expenses.

To set the scene, let’s suppose you’ve purchased the $700,000 condo with $45,000 (6.43%) down. One thing to note here is that because you’ve put less than 20% down, you’ll need mortgage insurance which, in this case, is an additional $26,200 to your mortgage for a total mortgage payment of $681,200.

Don’t let this added mortgage insurance phase you. Honestly, paying a slight premium in mortgage insurance in order to start earning equity in the real estate market can be better than waiting to save for the full 20% down payment. We explain why in our blog “ Why 5% Down Today is Better than 20% Down Tomorrow. “

In order to calculate the monthly costs affiliated with renting vs buying, let’s say you secure a 5-year fixed rate mortgage at 4.09% over a 25-year amortization period. Your monthly mortgage payments will be $3,617. Compared to $2,532 per month in rent, that’s not bad.

Remember, the difference between renting vs. buying in Toronto 2023 is that when you rent, you’re renting space. When you buy, you’re renting money.

Related: First-Time Home Buyer Finances-Life After the Purchase

So while you’re paying just over $2,000 more to own that condo, think of it as a forced savings account paying into your home equity, unlike renting where you’re paying someone else’s equity.

Renting vs Buying Infographic: Pros and Cons

Will Toronto Condo Prices Drop In 2023?

Short answer: highly unlikely! In Toronto’s real estate market, condo prices in particular have been sky-rocketing. In fact, the condo market has seen some of the greatest gains this year at 10.5% increase year-over-year for the month of May. As of December 2022, these gains had dropped to 1.4%, but they are still up in one of our toughest years in over a decade! Conservatively and for the sake of projections we tend to use the historical average which is 6% growth per year.

The real question here is whether or not the overall cost to own a condo will decrease. While prices may have seen a small dip from their February highs, the rising cost of borrowing will negate any true Toronto condo price drop in 2023.

5-Year Projection

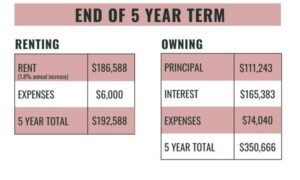

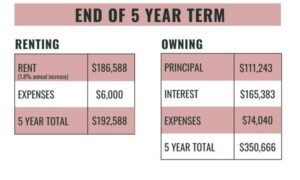

Circling back to our one-bedroom renting vs. buying Toronto scenario, let’s fast forward five years to the end of your term and see how the numbers compare:

After five years of renting, using the current guideline for an annual 1.8% rent increase, your five-year rent adds up to $157,564 along with your expenses (insurance and utilities) adding up to $4,500 for a grand total of $161,964.

After five years of owning, you’ve paid $87,263 towards your mortgage principal, $129,731 in interest, and just over $52,000 in additional expenses. Your grand total after five years of owning is $268,994.

Sure, you’ve spent roughly $100K more to own that same condo, but let’s not forget about that sweet, sweet equity. Let’s say your condo’s value increases 6% per year, your property’s market value over that five-year term would resemble something like this:

- Purchase Price: $700,000

- Year 1: $742,000

- Year 2: $786,520

- Year 3: $833,711

- Year 4: $883,733

- Year 5: $936,758

That’s $236,757 you’ve earned in equity just by living there! So while renting you’ll have paid your landlord $146,286 towards their equity, as an owner you’ll be ahead by $236,757 in equity plus the $87,263 towards your mortgage principal.

We should also note that while we’ve accounted for rent increases if your rental isn’t under rent control your increase could be at the discretion of your landlord which during this hot rental market could have you realizing significant increases beyond just 1.8% In 2022 alone, average rents increased a shocking 24%.

The Result: Profit, Tax-Free Profit

Even though after the five-year term your mortgage balance is $593,937, the equity you’ve earned over five years means, if you were to sell that condo, you’d still make a profit based on your property value.

Let’s say you decide you want to upgrade your living situation and at the end of your five-year term you decide to sell your condo at its current market value of $936,758. After paying your mortgage balance, closing expenses and legal fees, you’re still walking away with $313,122.

Not to mention that because this was your principal residence, all profits earned are 100% tax free!

Renting Vs Owning In Retirement: Example

The renting vs. buying in Toronto conversation isn’t just for first-time buyers. If you’re a retiree looking to downsize you may be asking yourself should I sell my house and rent when I retire? We thought it would be worthwhile crunching the numbers for those considering renting in retirement vs. owning.

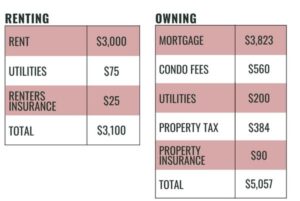

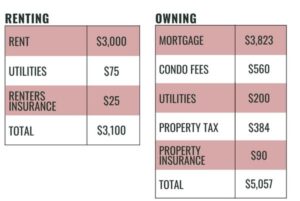

If you’re downsizing, you’re likely not buying a one-bedroom $700,000 condo, so for this example, we’ll use a two-bedroom condo with a price tag of $900,000. Below we’ll compare the cost of owning this condo with a 20% down payment and mortgage rate of 4.09% with renting a two-bedroom condo based on the City of Toronto’s average two-bedroom rental rate of $3,000.

Are you surprised to see the difference in monthly expenses is $2000? The key benefit that comes with owning is that you’re building equity alongside those monthly payments, rather than just paying your landlord. If you’re able to build equity in retirement , you’ll have more to live off in your golden years. Let’s have a look at the five-year outlook of renting vs owning that two-bedroom condo.

After the first five years, you’ll have paid about $150k more to own in retirement versus choosing to rent. And the equity gains? If we use the historic average of 5% per year, your property’s market value over that five year term would resemble something like this:

- Purchase Price: $900,000

- Year 1: $954,000

- Year 2: $1,011,240

- Year 3: $1,071,914

- Year 4: $1,136,229

- Year 5: $1,204,403

The conclusion here to consider is that if you’re able to sell your current home to downsize, choosing to use the profits from the sale of your home to buy a Toronto condo has the ability to give you a great return during your retirement. In this case, you could earn $304,403 in equity in just five years.

Remember, real estate is a long-term investment and the longer you hold a property, the better the returns will be. Not to mention the ability to leverage your equity into building a real estate investment portfolio. But that’s a story for another day!

Related: Renting Vs Selling Your House In Canada: What Should You Do In 2023

Rent Vs Buy In Toronto: Conclusion

Ultimately the decision of renting vs. buying in Toronto is yours to make. However in conclusion we’d like to state that getting into the Toronto Real Estate market is one of the best financial decisions you can make, especially if you are working with a trusted professional that can commit to finding the perfect property for your needs. To work with a trustworthy real estate expert, book a call !

We hope that this analysis of renting vs buying has been eye-opening and will help you answer the big, “should I rent or buy” question for yourself and your own finances. For those of you who are ready to make an action plan to buy your first home in Toronto, we encourage you to book a call with us to discuss your unique situation and we’ll help you make the move from renting to buying.

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.