If you’ve been thinking about making the jump into homeownership, before you start looking for properties on the market, you must have an idea of what you can afford. If you’re going to approach a lender to secure a home loan or mortgage loan of any kind, this blog is perfect for you.

Table of Contents

Right off the bat, let me tell you that it’s going to be hard to get a property for under $400K – $500K in Toronto. In fact, I don’t think you should be looking at the housing market. If that’s your budget, focus on the condo market. The truth is that $500,000 may get you a four-bedroom house and half an acre of land in the Atlantic provinces but here in Toronto you’re likely limited to the condo market — and studio condos at that.

On the other hand, if your budget is around 600K – $1M and upwards and you set your expectations realistically the ball is in your court. Figure out your ‘must-haves’. Work with your real estate agent and you should be able to get what you’re after. Just remember: Toronto’s real estate market is highly competitive and you can often find yourself in a bidding war. With a good real estate agent, this shouldn’t be a hassle!

In this blog, I take you through the process of securing a mortgage loan from a lender. I help you calculate roughly how much income is needed to pass the stress test and obtain a mortgage loan for any amount between $400K – $900K. If you need any help buying your dream home, you can book a call with me or somebody from my team and we’d be happy to help you!

Your Road To Mortgage Approval

How Do Mortgage Lenders Determine How Much Mortgage You Can Afford?

Unless you have cash at hand, the first step in your journey to becoming a homeowner would be to secure a mortgage pre-approval. This is where your mortgage lender will look at where you stand financially to give you an idea of how much mortgage you qualify for and at what interest rate.

Mortgage lenders look at your income, your monthly expenses, your total, and monthly debt payments, how much you have available for your down payment, as well as any other registered and non-registered savings you have in your name. They use this to calculate your debt-to-income ratios which helps them determine how much mortgage you can afford.

However, your mortgage pre-approval will generally tell you the maximum mortgage you can qualify for but it doesn’t guarantee that you’ll get that amount.

Calculating Mortgage Affordability: Gross Debt Service Ratio

One of the first things your mortgage lender will do is calculate your gross debt service ratio or GDS. This is done by evaluating your total monthly housing expenses against your monthly income. Your housing costs include:

Monthly mortgage payment

Property taxes ( 2023 rate is 0. 0.506079%)

Heating expenses

Half of your condo fees (if applicable)

When you add up your monthly housing expenses they should not exceed 32% of your gross income.

This is how you calculate your GDS Ratio:

Gross Debt Service Ratio = Total monthly housing expenses ( monthly mortgage payment + property tax + utility expenses, etc.) / Gross Annual Income

Maximum Gross Debt Service < 0.32 x Gross Annual Income

If you’re wondering what the monthly payment on a 500k mortgage is, you can use our Mortgage calculator to find out.

Use our Mortgage Calculator to determine what your monthly mortgage payments could be

Calculating Your Total Debt Service Ratio

The next step is to account for any debts you have. This includes things like:

student loans

lines of credit

car payments

credit card payments

child or spousal support payments

Whatever your total debt amount is, the amount should not exceed 40% of your gross income.

This is how you calculate your Debt Service Ratio:

TDS Ratio = GDS Ratio Cost per month + Credit Card/line of credit payments + Car payments per month + Other debt payments per month maximum

Total Debt Service Ratio < 40% of gross monthly income

How Much Mortgage Can You Really Afford?

What Is The Stress Test? How Does It Work?

If you’re confused, hang on. We’re almost there. The reason I broke down the Gross Debt Ratio & Total Debt Ratio is that these metrics are used to determine whether or not you pass the Stress Test in Canada.

To get a mortgage in Canada you have to pass the Stress Test. It’s been around 5 years or so since the government launched it as part of its new mortgage qualification guidelines. I have an entire blog on this topic. If you aren’t aware of it, I strongly recommend that you go through this blog first. It will really help you understand the rest of the blog – HOW CANADA’S MORTGAGE STRESS TEST IS AFFECTING HOMEBUYERS AND HOMEOWNERS.

If you don’t have the time, that’s okay. The gist of the matter is that – what you can perhaps afford and what you qualify for under the government’s Stress Test are two different things.

Under the Stress Test guidelines, homebuyers must qualify for a mortgage at a rate of 5.25% (as of June 2023) or 2% higher than the negotiated rate, whichever is larger. The point of the Stress Test is to ensure you’d still be able to afford your mortgage payments should interest rates rise.

You can use our Mortgage Affordability Calculator to take your own stress test by entering the stress test rate of 5.25%.

How Do You Know How Much Income You Need To Earn To Pass The Stress Test?

Essentially, once you find a property that you like, you calculate your Gross Debt Ratio & Total Debt Ratio based on your yearly income. If based on your current monthly expenditure and income, your Gross Debt Ratio is under 32% and your Total Debt Ratio is under 40%, you should pass the Stress Test.

If that went over your head, that’s okay. I was there too. In fact, this is pretty complicated so please bear with me as I now break down the income that you will need to earn for a 400K – 900K Mortgage.

Income Needed For A 500K Mortgage In Canada

Given what we know above, let’s see calculate how much income is needed for a 500K mortgage in Canada.

Step 1: Determine Your Downpayment

In this example, let’s suppose you are putting the minimum down payment of 5% or $25,000. Because you have less than 20% down you’ll need to pay CMHC insurance. In this case, the CMHC insurance adds an extra $19,000 to your mortgage for a total mortgage of $494,000.

Step 2: Calculate Your GDS Ratio To Ensure It’s Under 32% Of Gross Annual Income

Now let’s determine the Gross Debt Service (GDS) for a $500,000 condo using the mortgage stress test rate of 5.25% over a 25-year amortization period. Your household expenses break down like this:

Property tax $210/month ((500,000 x 0.506079%) ÷ 12)

Utilities $249/month

Half of the condo fees are $200/month

Mortgage payments of $2,944/month

TOTAL: $3,603

With your monthly household expenses amounting to $3,603, this means the required minimum income for a 500K mortgage under the Stress Test is $136,000 per year. This could also be two salaries of $68,000 per year.

$136,000 ÷ 12 = $11,333

$10,833 x 0.32 = $3626 = 31.79%

GDS Ratio: $3,602 < $3,626 GDS

Don’t forget about any debts, keeping in mind they should not exceed 40% of your monthly household income.

Step 3: Calculate Your TDS Ratio & Ensure It’s Under 40% Of Gross Monthly Income

Now add up your monthly debt obligations. This includes debts such as – student loans, lines of credit, car payments, credit card payments, child or spousal support payments, etc.

For this example, I am assuming that you’re good on your debts with your credit card line amounting to $300 / month and your other debt payments also amounting to about $500 / month.

Total Debt Service Ratio: $3602 + $500 + $300 = $4402 = 38.85 %

Gross monthly income = $11,333

TDS Ratio = 4402 < 40% of 11,333 = $4533

Expenses $2,982 < $3,013 GDS

Step 4: Start Searching For Your Dream Condo!

Assuming that your downpayment stays the same at 5% (you can cut out CHMC insurance costs by making a 20% downpayment), you could qualify for a mortgage with a maximum amount of $497,999.15, or a home with a maximum cost of $524,209.63.

There are other expenses to be mindful of when it comes to owning a home. You’ll also need to budget for closing costs and try to put some portion of your monthly income into an emergency fund.

Before I let you go, in case you’re looking to estimate how much income you need for a property – costing anywhere between 400K – 900K – I’m going to be doing the math for you below. Going forward, in all my examples I take the lowest possible downpayment and 5.25% as the existing mortgage rate over a 25-year amortization period. For my TDS calculations, I am assuming that you have a monthly debt of $500 – which is well below the average for all age groups. In case your debt is lower than this, these calculations will still hold true for you. However, if your monthly debt is higher, you may need to use a calculator to find your own TDS ratio.

Granted I am taking a 5% downpayment as my base for these calculations, I strongly recommend that you do all that you can and save as close to 20% downpayment for your dream property as possible while getting into the market as soon as possible. Your money is worth more today than it will be tomorrow.

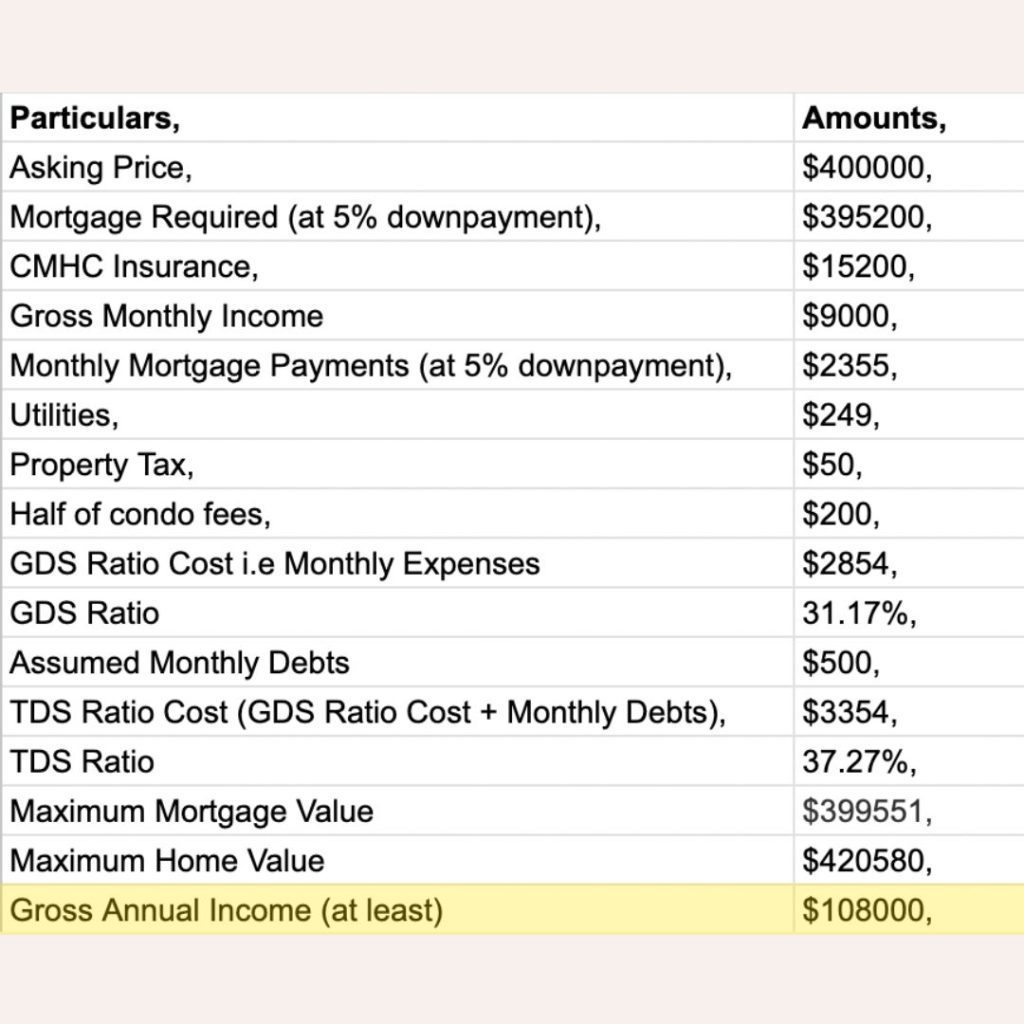

Income Needed For A 400K Mortgage In Canada

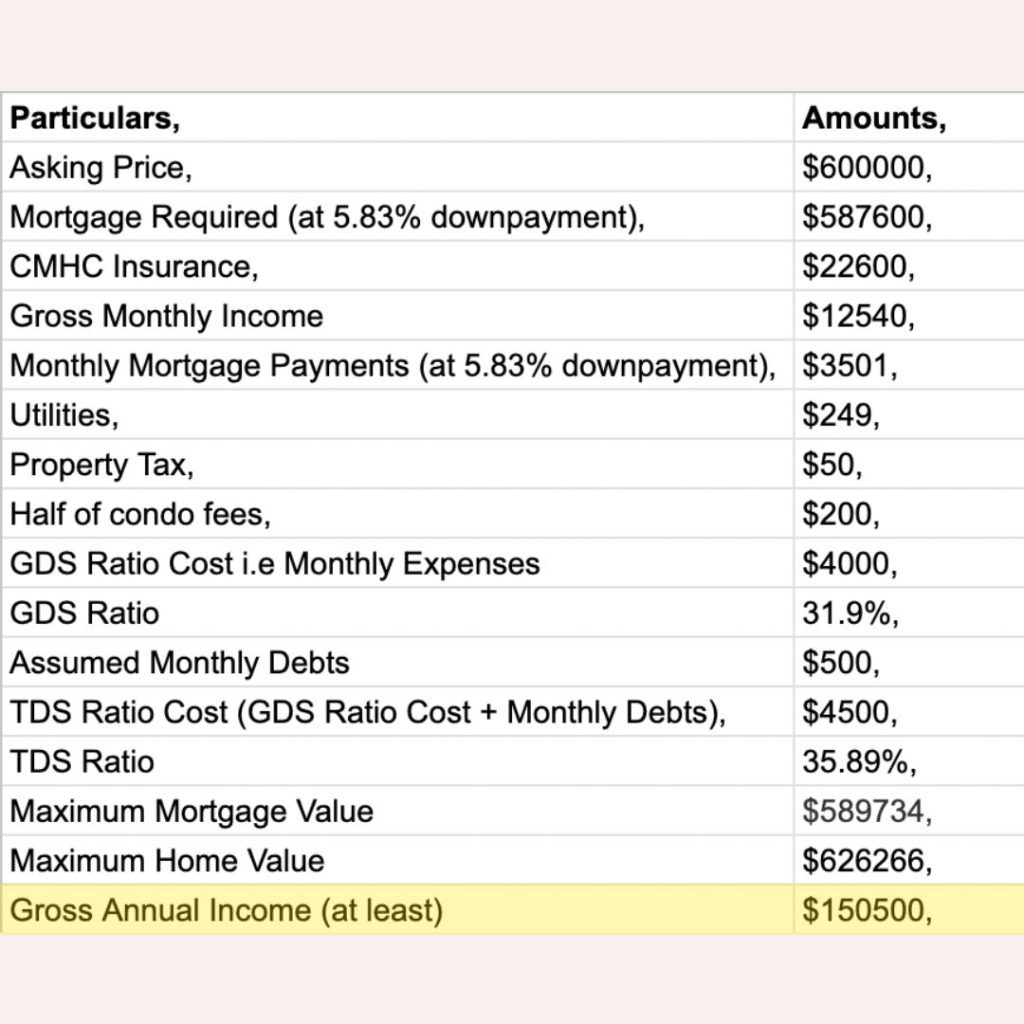

Income Needed For A 600K Mortgage In Canada

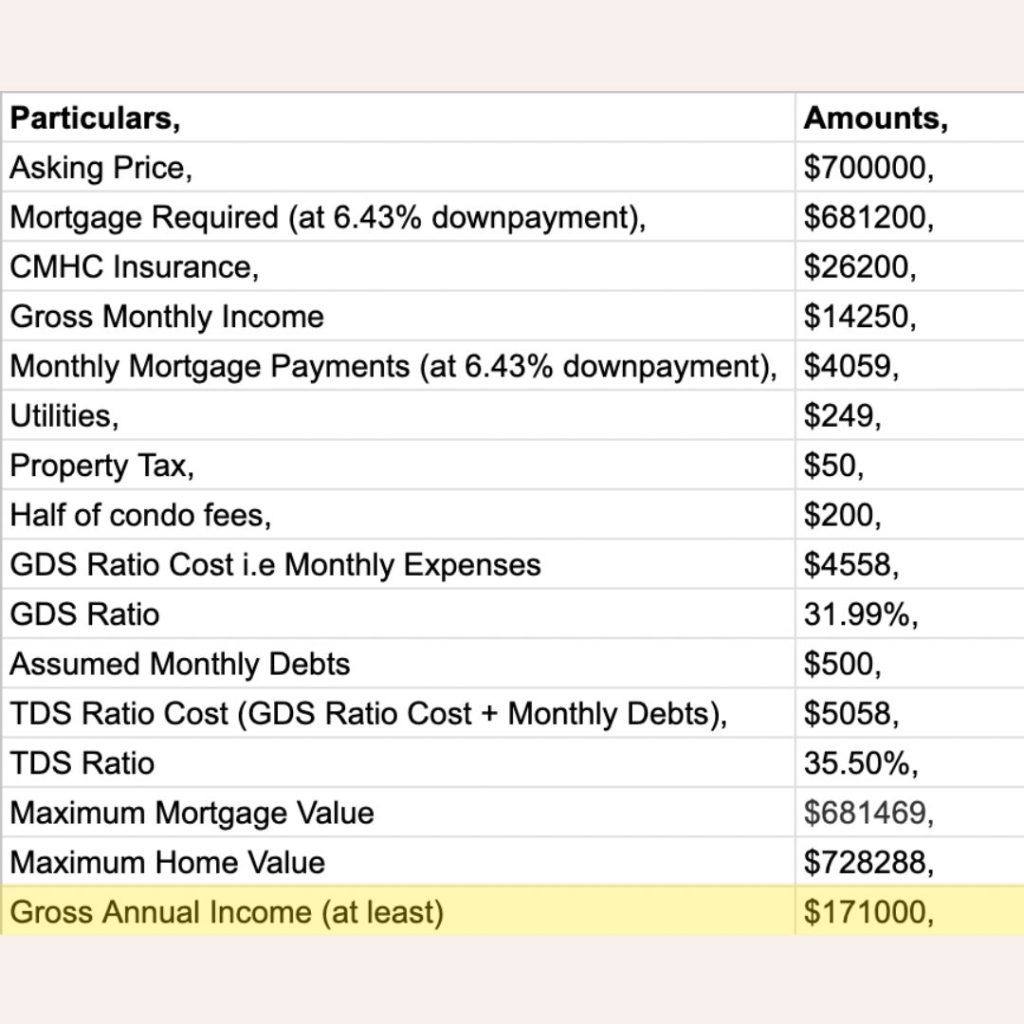

Income Needed For A 700K Mortgage In Canada

With your monthly household expenses amounting to $4,558, this means the required minimum income for a 700K mortgage under the Stress Test is $171,000 per year. This could also be two salaries of $85,500 per year.

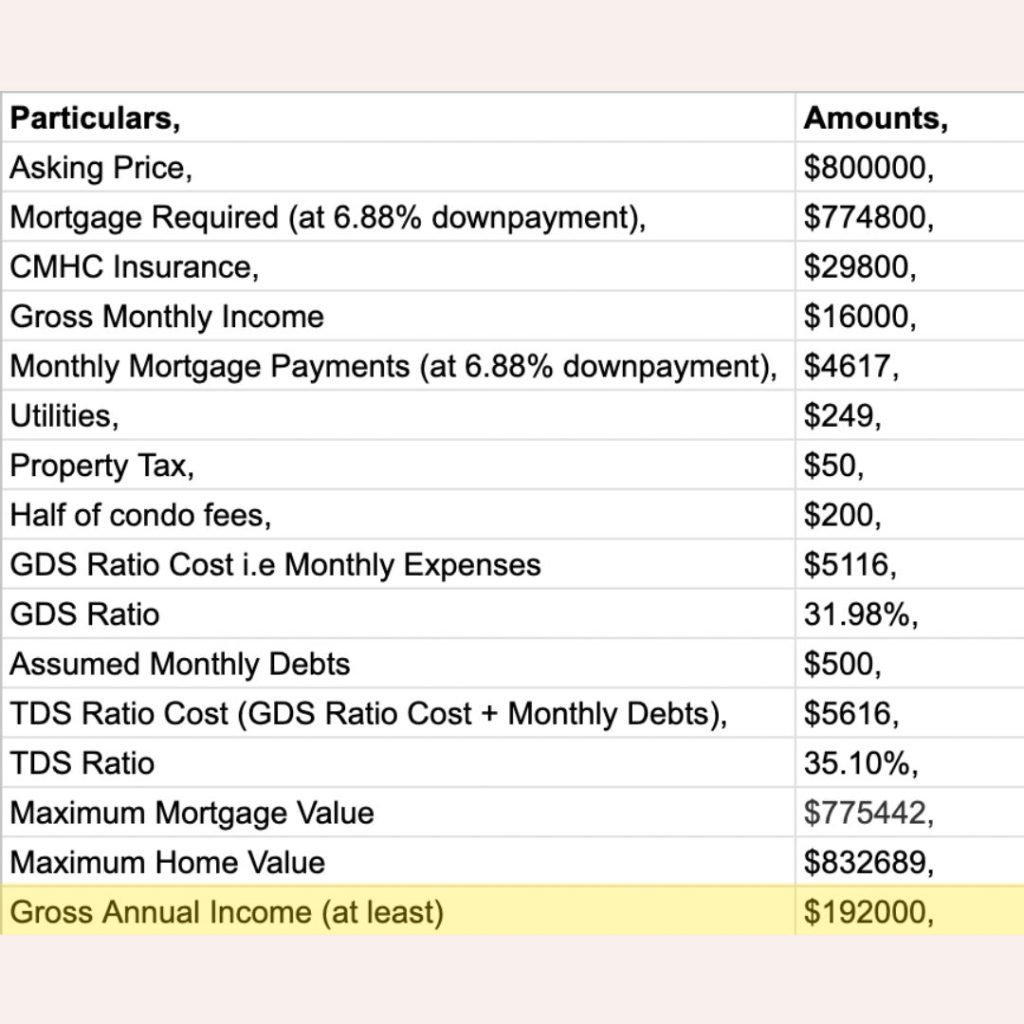

Income Needed For A 800K Mortgage In Canada

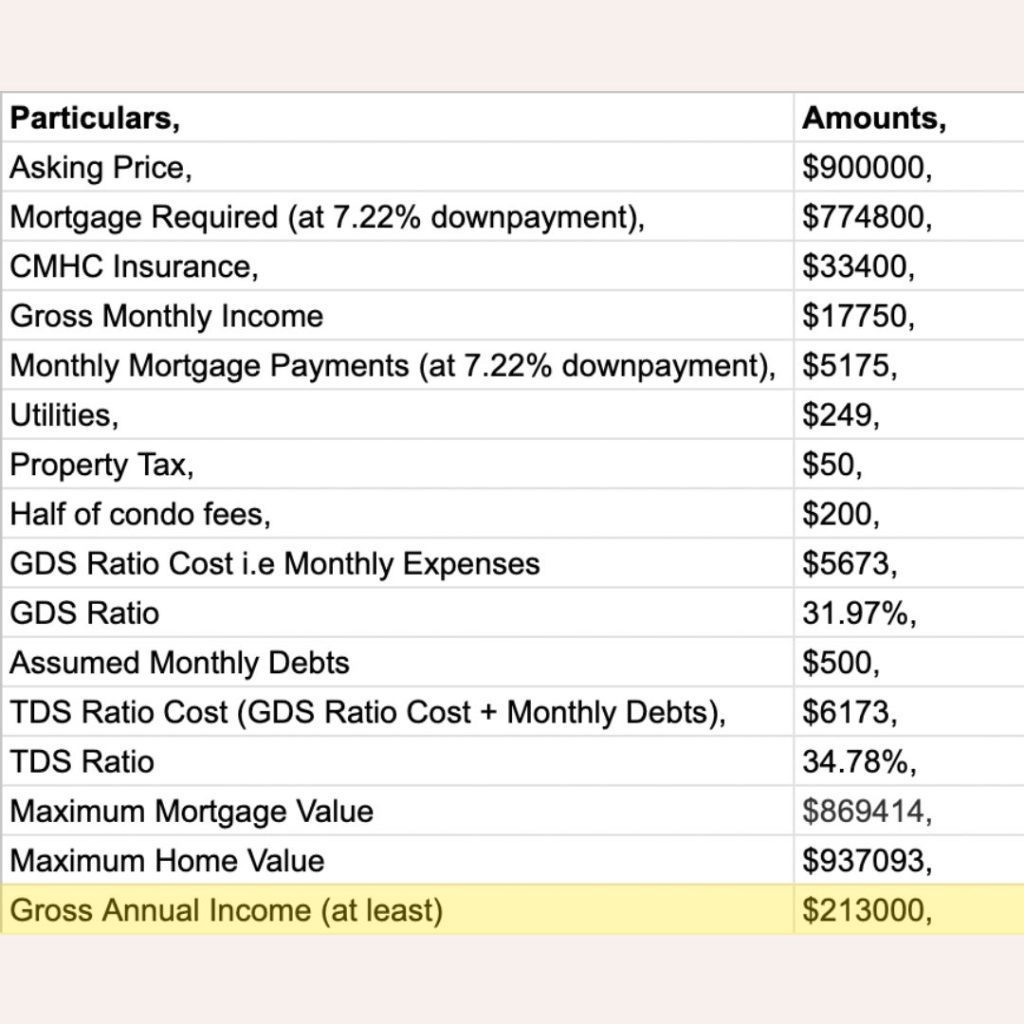

Income Needed For A 900K Mortgage In Canada

With your monthly household expenses amounting to $5,673, this means the required minimum income for a 900K mortgage under the Stress Test is $213,000 per year. This could also be two salaries of $1,06,500 per year.

How Can You Afford A Higher Mortgage At Your Current Income Levels?

If you are able to increase your down payment to 20% you won’t have to pay mortgage default insurance (CMHC insurance) and your monthly payments will decrease allowing you to afford more. There are other ways to increase your down payment that we discuss in our Step-by-Step Guide to Saving for a Down Payment.

Ways you can increase your down payment:

Using the Home Buyers Plan, which allows first-time home buyers to loan themselves funds from their RRSPs

Using funds from your Tax-Free Savings Account

Getting a gifted down payment from the bank of Mom & Dad

Final Words

Be sure to use our Mortgage Affordability Calculator along with the Gross Debt and Total Debt Service equations from above to help you with your budget. When you’re ready, book a call with us to discuss your unique financial situation so we can take you one step closer to homeownership!

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.

FREQUENTLY ASKED QUESTIONS

Lenders use Gross Debt Service (GDS) and Total Debt Service (TDS) ratios to calculate mortgage affordability. For a $500K mortgage, these ratios must be carefully managed to ensure the total housing costs and other debt payments do not exceed 39% and 44% of your income, respectivelyTo qualify for a $500K mortgage in Canada, an annual income of around $136,000 is generally needed to meet the requirements of the mortgage stress test, assuming minimal other debts. This amount can also be the combined income of two salaries of $68,000 each

Lenders use Gross Debt Service (GDS) and Total Debt Service (TDS) ratios to calculate mortgage affordability. For a $500K mortgage, these ratios must be carefully managed to ensure the total housing costs and other debt payments do not exceed 39% and 44% of your income, respectively.

Debt-to-income ratios are critical as they help lenders assess the proportion of your income that goes towards debt payments, ensuring you can comfortably manage the financial commitment of a mortgage without overextending yourself.

The stress test ensures that you can afford mortgage payments at a higher interest rate than the actual rate, safeguarding against potential rate increases and financial hardship. This means proving you can handle payments at the contracted rate plus 2%, or the Bank of Canada’s five-year benchmark rate.

Yes, using an affordability calculator can give you a rough estimate of the mortgage amount you might qualify for based on your income, debts, and the prevailing mortgage rates

Other factors affecting mortgage applications include your credit score, down payment size, existing debts, and financial history. These elements determine the risk profile and the terms of the mortgage offered by lenders.

Lower income applicants can improve their chances of mortgage approval by saving for a larger down payment, reducing existing debts, and maintaining a good credit score to reduce their perceived risk to lenders. Contact us if you need more guidance.