CANADIAN REAL ESTATE MARKET

If you’re keen on being successful with your investments in Canada’s real estate market – be it pre-construction or resale – you need to know how to talk to real estate professionals in their language. Here’s a glossary of real estate terms to help you to talk real estate:

An Agreement of Purchase and Sale is the contract between a buyer and seller for the purchase of a property.

Amenities are special features that are shared among residents of a condominium building. Common condo amenities include party rooms, pools, rooftop decks, and fitness centres.

Amortization is the set time period in which you have to pay off your mortgage.

An appraisal is the fair market value given to a particular property based on comparable sales, unique features of the property and the professional experience of the appraiser. Appraisals are typically required by the financial institution as part of the lending process when buying a home.

Appreciation is the increase in value a property earns based on market conditions and inflation.

A bridge loan, or bridge financing, is the temporary loan provided to homeowners who need funds from their home equity to make a down payment on a new property before the sale of their current home closes. Most banks and lenders will loan upwards of $200,000 for up to 120 days to help bridge the gap between closing dates. In order to be eligible for a bridge loan you will need both your Sale Agreement and your Purchase Agreement from your properties.

A buyers agent is the real estate agent representing the buyer in a real estate transaction.

When the real estate market is considered a Buyers Market, it means that there is a lot of inventory for sale. With more options to choose from, buyers have the upper hand in negotiations.

Capital Gains are the profits earned from the sale of a property or an investment where the sale price exceeds the original purchase price.

The Capitalization Rate, or Cap Rate, is the ratio of your net operating income to the property’s asset value. [ Purchase Price ÷ Net Operating Income ]

Closing, in real estate, is when the sale of a property is complete. This means all paperwork has been signed and monies have been paid.

Real estate agents will look for comparables, or comparable properties, that have recently sold in and around a particular property to determine its value based on the market at the time.

A condition within the Agreement of Purchase and Sale that must be met for the sale to proceed.

The condo board of directors is the group of people who oversee the operations of a condominium on behalf of the owners. Not to be confused with a property manager who takes care of the day-to-day operations, a condo board is responsible for any decisions regarding the condo rules, major maintenance, condo finances, and any associated by-laws.

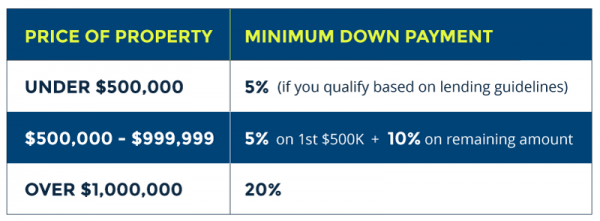

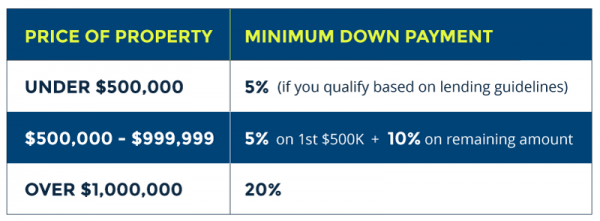

The deposit is the money given with your offer if you were in competition for a property. A typical deposit is 5% of the overall purchase price and goes towards your down payment.

Development charges are taxes imposed by the city of Toronto and passed on to purchasers of newly built property. These taxes are used to help the development of the city, such as park levies, education levies, water and sewer levies. These taxes are imposed on purchasers on the registration date and can be used as capital losses against their gains when the investor sells the property down the road.

With a fixed rate mortgage, your interest rate and monthly payments will remain the same throughout your chosen term.

Gentrification is the condition in which an area or neighbourhood becomes more developed and established. Often referred to as the Starbucks Effect in real estate as the addition of a Starbucks is an indicator that an area is gentrifying and properties will appreciate in value.

Leverage is a strategy where you use borrowed money to increase the potential return of an investment. Leveraging the equity you have in your home into additional properties is a great way to get your money to start working for you. Learn more on our leverage strategy here.

A payment structure, or deposit structure, refers to the payment schedule affiliated with a pre-construction property.

During a pre-construction property sales launch there are different phases of pricing. When an agent has platinum access they have access to the first phase of pricing and inventory and therefore can offer their clients the lowest prices before the pre-construction property moves into the next phase of pricing.

A principal residence is the property in which an individual lives in for the majority of the year.

Property taxes are monies owed to the government based on the assessed value of a property multiplied by the city tax rate for that year. You can see Toronto’s current property tax rate here.

Renovations are physical improvements made to a home that can increase its appraised value.

A return, or return on investment, is the measured success of an investment typically measured as a percentage. A real estate return is determined by the current market value of a property minus the purchase price of the property, divided by the purchase price. [ (Current Market Value – Purchase Price ) ÷ Purchase Price ]

The vacancy rate is the percentage of available rental units of an entire rental inventory.

A valuation is a estimated property value based on comparable homes that have recently sold while also taking into consideration any unique features of a property.

Year-over-year (YOY) is the measured percentage change comparing two values of the same time period in successive years.