(Edited April 2023 with latest Toronto real estate market prices)

I have met many individuals whose ultimate goal in life is to have a roof over their heads – one that they own, not rent. While buying a house in Toronto is getting pricey all that means is that you may have to look at the condo market instead.

You can consult your own team of real estate professionals or you can book a call with me or somebody from my team for more information but at the end of the day – you’re the one who has to make a decision and before that, you need to have the funds available to make the best decision in your interest.

Table of Contents

If you’ve been searching for properties in Toronto – you know how much a condo costs but perhaps, what you’re really looking for is guidance and perspective. As a condo owner and a real estate agent who’s been in this industry for 17+ years, I can confidently say that I can fill in the gaps that you were unable to fill during your own independent research.

I hope that by the end of this blog post, you learn something new and are able to take something away that helps you make a smart and informed purchase decision!

Unveiling The Costs Of Buying A Condo In Toronto In 2023

How Much Does A Condo Cost In Toronto In 2023?

According to TRREB’s latest market watch report released in March 2023, the average cost of condominium apartments in the Greater Toronto Area (GTA) is $703,566 – down 13% from last year!

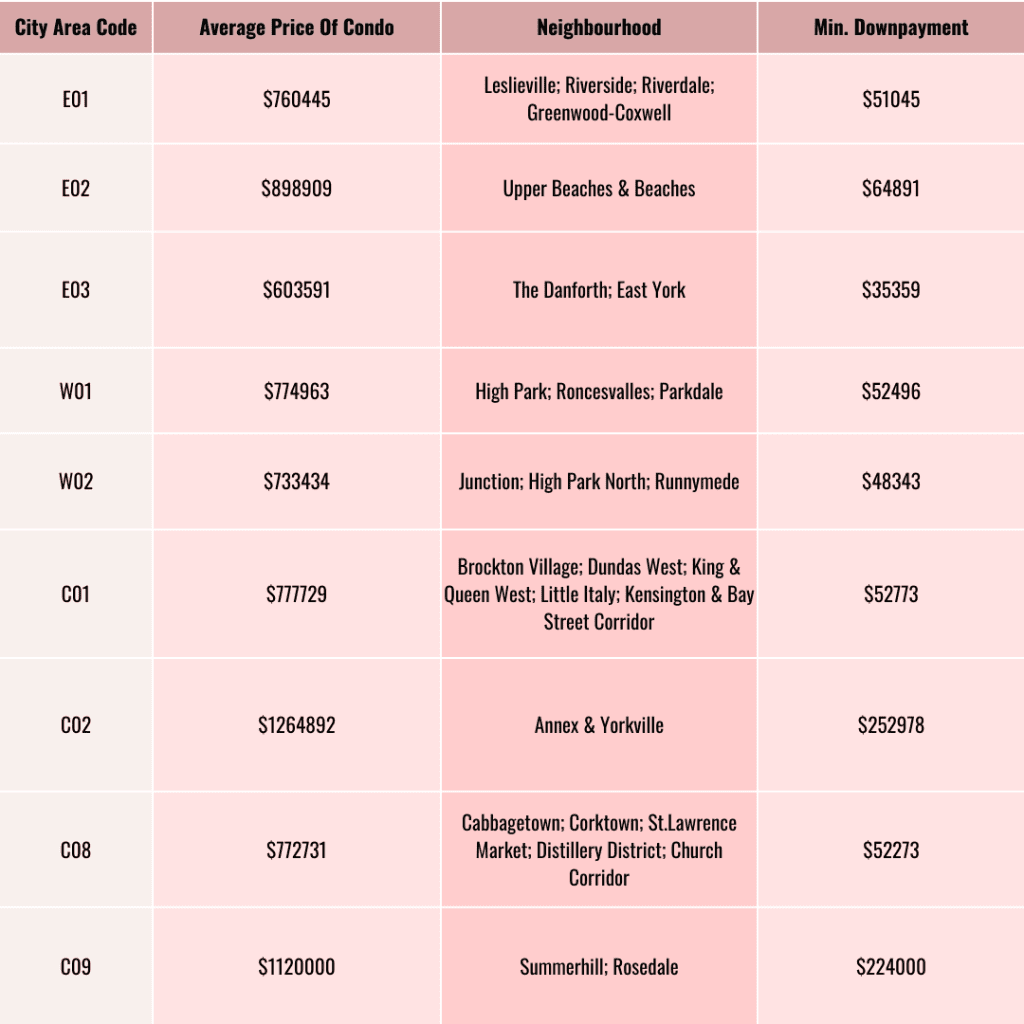

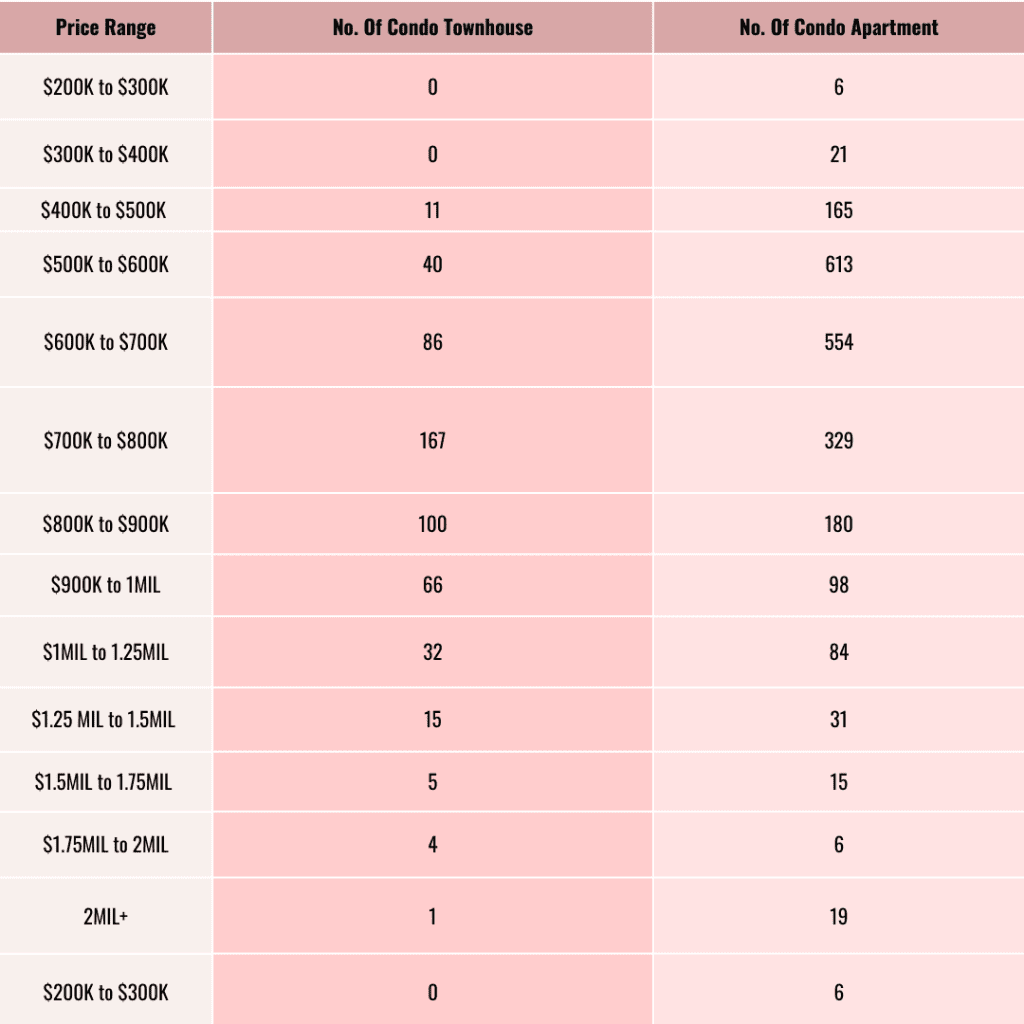

But I bet that this statistic doesn’t help you make a decision! So I created these two tables that I thought might help. It’s the same data but presented differently – by neighbourhood and condo apartment type. I used our mortgage calculator to calculate the minimum down payment that you’ll need to make.

By Neighbourhood:

By Condo Property Type

Related: Your A-Z Guide On Owning A Townhouse In Toronto

How Much Does A Condo Cost Per Month In Toronto?

Some of the monthly expenses that condo owners are liable to make include: monthly mortgage payments, condo fees, property tax, and insurance. For a condominium that’s valued at approximately $650,000 – the monthly carrying costs could amount to $3000.

Monthly mortgage payment

Condo fee ($0.55 per square foot – $0.80 per square foot)

Property Tax (2023 rate of 1.280528%)

Property Insurance ($50)

If you’re still confused or keen to learn more about this, I have an entire blog on the topic ‘How Much Does A Condo Cost Per Month In Toronto’ that covers it in great detail!

What Are Some Hidden Expenses When Buying A Condo In Toronto?

Beyond the down payment and condo closing costs you need to buy a condo in Toronto, it’s important to outline the “hidden” expenses that come with buying a condo. Keep these extra costs in mind when it comes to your budget.

- Movers (~ $1000)

- Locksmith ($50-$100)

- Utility Set Up Fees (costs will vary)

- Elevator Bookings – this is a refundable deposit ($250-$500)

- Cleaning Services ($150-$300)

- Furniture for your new space (costs will vary)

- Repairs and improvements (small or large, these costs will vary)

What Are The Best Neighbourhoods To Buy A Condo?

If you’re wondering what the best area to buy a condo in Toronto is, it depends on many different variables but looking at the different price points across the city is a good place to start.

You can easily tell that the Annex and Rosedale neighbourhoods are probably not the best place to buy your first new condo — unless you’re rolling in the dough. Remember, these are the average condo prices as of March 2023. As you continue to track the Toronto condo market in 2023, keep your eye on our monthly real estate market reports for updated TREB prices and a more accurate indication of neighbourhood sale prices.

The takeaway here: if you can be flexible in the neighbourhood, you may save some serious cash. As the average condo price in Toronto continues to rise, the demand for condos for sale in Toronto under $550K increases. It may be worth keeping your eye on condos for sale in High Park, Roncesvalles, and along the Danforth where prices are low.

We’ve seen condo prices in neighbourhoods like Leslieville and Riverside see tremendous price growth over the last few years due to gentrification and affordability (+50% since 2014!*), so if you’re wondering if you should buy a condo in Toronto, look to neighbourhoods that are up-and-coming. Your realtor is the best person to ask for advice on this.

How Do Deposits Work When Buying Resale Condos In Toronto?

When it comes to buying condos for sale in Toronto the typical deposit is 5% of the overall purchase price and it goes towards your down payment. If you’re buying a $500K condo, your deposit needed would be $25K and is usually made 24 hours after an accepted offer or with your offer if you were in competition for the property (bidding war).

How Much Down Payment For A Resale Condo In Toronto?

The minimum down payment you can make depends on the purchase price of the condo. When purchasing condos for sale in Toronto any down payment of less than 20% will require you to pay CMHC mortgage insurance.

Let’s Look At The Downpayment For a $500,000 Condo

Don’t let this added mortgage insurance phase you. Depending on the individual, paying a slight premium in mortgage insurance in order to start earning equity in the real estate market can almost certainly be better than waiting to save for the full 20% down payment. We explain why in our blog “ Why 5% Down Today is Better than 20% Down Tomorrow. “

As a quick example of what your different monthly mortgage costs would be with different down payments when buying condos for sale in Toronto. This is based on a 5-year fixed rate of 3.39% over 25-year amortization. If you put this example into the mortgage calculator you can see that paying $100K down only saves you $464 per month. Ask yourself, is it easier to save an extra $464 per month or another $75K for a down payment?

How To Calculate Your Mortgage Payments

As you search condos for sale in Toronto, use our easy-to-use mortgage calculator to see the full breakdown of costs affiliated with the different MLS listings you see. By simply entering the condo price this tool will tell you:

The minimum down payment required

How much mortgage insurance, if any, is required

Your total mortgage

Your monthly mortgage payments

How much land transfer tax is due

How Much Should I Budget For Condo Closing Costs?

The amount you will owe in closing expenses will vary depending on the purchase price of the condo apartment. It’s important to account for these condo closing costs expenses when you’re budgeting to buy a condo in Toronto.

Along with your down payment on that $500,000 condo apartment, your condo closing costs need to be paid for in cash and these include: Land Transfer Tax, Title Insurance, Legal Fees, Property Tax Adjustment

Land Transfer Tax

Land Transfer Tax (LTT) is charged to anyone buying real estate. In Toronto, you pay both a municipal LTT and a provincial LTT. The total amount owed will depend on the purchase price of the property.

As an example, when buying a condo in Toronto that costs $500K, you’ll pay a total of $12,950 in Land Transfer Tax ($6,475 both provincially and municipally) is owed. However, if you are a first-time buyer, you may be eligible for a Land Transfer Tax Rebate. On a $500K condo, that would save you $8,475! More on first-time buyer rebates later.

Title Insurance & Legal Fees

These typically get lumped together at closing. The cost to have the title of the property changed from the seller’s name to yours can range from $250-$500. Most real estate lawyers will include this fee in their fees. It’s wise to budget $1,500 to $2,000 in legal fees.

Property Tax Adjustment

In some cases, the seller has already paid for property taxes beyond the property’s closing date. If so, the buyer will need to reimburse the seller the difference.

Read: Understanding Closing Costs Before You Purchase that Property

How Much Does It Cost To Buy A Pre-Construction Condo In Toronto?

The deposit structure on a pre-construction condo will vary depending on the builder and the project, but it is usually 15% over the first year and 5% on occupancy which is three to four years later.

For a $500,000 pre-construction condo your typical deposit structure will resemble this:

$5,000 on signing

Balance of 5% in 30 days ($20,000)

5% in 90 days ($25,000)

5% in 270 days ($25,000)

5% on occupancy in 3-4 years ($25,000)

How Much Do Pre-Construction Condo Closing Costs Amount To?

Both the Land Transfer Tax and your legal expenses outlined above are the same when you buy a pre-construction condo. However, there are a few additional expenses to budget for when buying a pre-construction condo. Luckily, you have a three to four-year build time to save the funds.

Development Charges & Tarion Home Warranty

Both the Tarion Home Warranty and Development Charges are specific to newly built properties and are due at closing. Development charges are taxes imposed by the city of Toronto and passed on to purchasers of newly built property and are used to help the development of the city, such as park levies, education levies, and water and sewer levies.

On a $500K pre-construction condo you can expect to pay about $1,100 for The Tarion Home Warranty and anywhere from $8K to $10K in development charges.

HST

Purchasers who plan on living in their pre-construction condo will have the HST portion of their purchase tied into their mortgage and will not have to have to worry about this at closing.

Purchasers who are using their pre-construction condos as investments will need to pay HST upfront to a maximum of $24,000, but are eligible for a full rebate provided they have a one-year lease in place.

Read more on this in FAQs When Buying a Pre-Construction Condo.

Finally, Is It Worth Buying A Condo In Toronto?

Yes, yes, and another yes. Don’t fall prey to the media headlines – they never give you the full picture! I have been in this business for 17+ years and my belief is this – when it comes to real estate – the best day to invest is always yesterday! Investing in real estate is not like investing in stocks. With real estate, you can use leverage to make 10x your initial investment.

Coming back to the point. Historically, on average Toronto condos have been appreciating at 4%-5% / year (barring the last few years). And that’s because of the super-competitive housing market, changes made to the fair housing plan, extremely high vacancy rates, stringent lending guidelines, growing population and popularity of the city, and a lot more.

If you need more convincing, check out our blog on ‘Toronto Condo Market: Why Now’s [Actually] A Great Time To Invest’.

Are You A First-Time Buyer?

The government of Canada grants first-time buyer rebates to help alleviate the harrowing costs involved with buying your first home. These include a $750 First Time Buyer Tax Credit and a full or partial Land Transfer Tax Rebate. Click here to find out if you’re eligible for the First Time Buyer Rebates and how to get them.

Not only are you now equipped with the full list of costs you need to be aware of when you buy a condo in Toronto, but you also have the tools and tips to decide: should I buy a condo in Toronto? Start searching condos for sale under $500K here or book a call with us to discuss your financial situation and get started on a custom action plan for you!

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.