For many, buying a house is one of the most exciting milestones of their life. Be it incorporating your personal style into the interiors or just having a space to accommodate guests on a regular occasion, owning your own house offers you an opportunity to settle down, start a family (whether that be babies or dogs) and enjoy the simple things in life.

Table of Contents

But the process of buying a house in the Greater Toronto Area (GTA) is no easy feat. Toronto’s housing market is expensive. It can take years to save diligently to pay for all the costs associated with housing: closing costs, property taxes, lawyer fees etc. Once you save up or get a mortgage to help you, then what?

If you’re a first-time home buyer, you probably have many questions about the home-buying process. That’s where we step in. You’ve saved the funds. You’ve organized your Pinterest boards of home decor ideas. Now, you’re ready to begin the adventure of your lifetime – and we are happy to chaperone you through it!

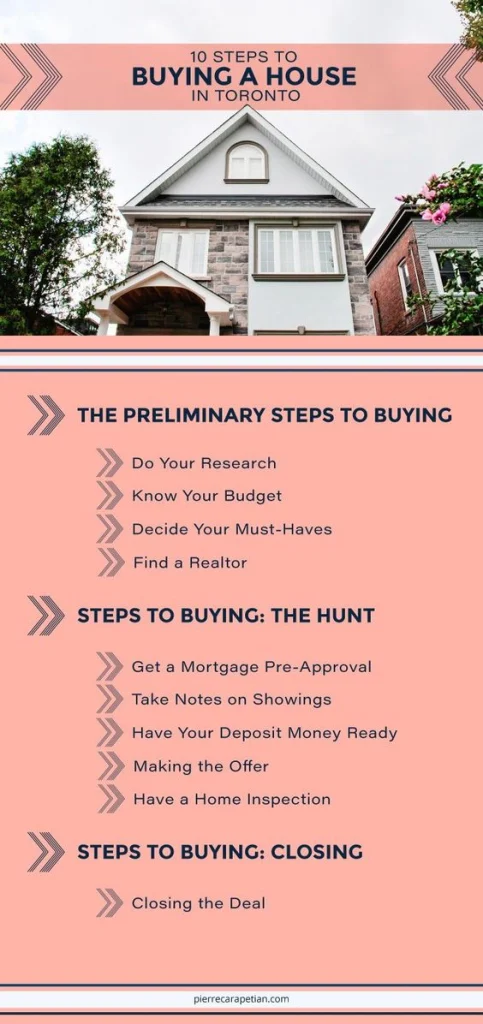

How To Buy A House In Toronto [10-Steps]

Step 1. Do Your Research

Our best piece of advice? Start doing your research on housing prices early. One thing new buyers are often surprised by is the actual cost to buy a house in Toronto as they start browsing their options and getting a feel for the market. I repeat the average price of housing in Toronto is high. It’s literally the most expensive city in Canada. Give yourself enough time to find a residential property that you like – and that’s within your budget.

Start browsing MLS listings in the neighbourhoods you’re interested in and go to open houses. Pay close attention to the home price and how long it’s on the market for. If you want a simple way to keep an eye on the cost of homes in the area, bookmark our monthly Toronto Real Estate Report.

Search MLS listings by Toronto Neighbourhood

Step 2. Know Your Budget

Having a realistic idea of your budget is one of the key steps to being successful in Toronto’s housing market. Get that spreadsheet ready and crunch those numbers. This means knowing what you have for a down payment as well as the funds for closing expenses— all of which will need to be in cash.

You can use our Mortgage Payment Calculator to help you budget for your approximate closing costs while also seeing what your monthly mortgage payments could be.

Step 3. Decide Your Must-Haves

One of the most important tips for buying a home is setting those must-haves—especially in Toronto’s HOT market. As you’re looking at listings, make note of the things you like and don’t like about each home. Craft a wish list of things you would like to have while also establishing your must-haves and the elements you can live without. As you think about your current and future lifestyle, ask yourself the following questions about the residential property:

- How many bedrooms and bathrooms do you need?

- How long do you plan to live in the home?

- Is there any possibility for future life changes?

These considerations help you narrow down the list of potential homes and keep you focused when you start searching seriously.

Step 4. Find a Realtor

In a city of 50,000+ real estate agents, how do you choose? Referrals from friends and family are always a great starting point, but as with most things, be sure to do your own research. A few quick tips we mention in our blog How to Choose the Best Real Estate Agent in Toronto, are:

- Look at a real estate agent’s reviews

- Check out their website to see if they do many deals

- Hire an agent who does a lot of business in your desired neighbourhood

- Look at the quality of their listings. If they use professional photography rather than an iPhone, that might say something about the way they conduct business

- Trust your gut and always go with your instinct. If you have a bad feeling about a realtor, reach out to one of the other 50,000 in Toronto.

Along the above sentiments, make sure you and your realtor vibe. Are you a numbers person, but your realtor is more of a feelings person? They may not be the right fit. When it comes to our boutique brokerage, we’ve ensured that our team is diverse. When it comes to your home search I can help you make decisions with facts, not emotions. Are you a Toronto home buyer who wants a more emotional, family-first agent with patience sent from god? Rebecca might just be the perfect fit.

Once you’ve found the right real estate agent, they’ll be able to set up a prospect match which will send you new MLS Listings hitting the market that matches your search criteria.

Step 5. Get a Mortgage Pre-Approval

The first thing your real estate agent is going to have you do is to get a mortgage pre-approval. A mortgage pre-approval will let you know how much mortgage lenders are willing to give you to spend on a home. You may even consider doing this ahead of finding your realtor so that you can get the ball rolling right away. If you’re buying a house in Toronto, this is going to give you a realistic idea of what you can actually afford.

A mortgage pre-approval clarifies your monthly mortgage carrying costs to ensure there are no surprises. A potential lender will require you to show your income, and credit score, and to disclose your debts. Once approved, you will receive a letter that includes an interest rate guarantee that is typically valid for 90 or 120 days.

Step 6. Take Notes on Showings

One thing to know – especially for the first-time home buyer – is that when your realtor takes you on showings, you’re likely going to see a lot of houses back-to-back. It can be a lot to remember so it’s never a bad idea to take some notes while on the showings.

Take note of the things you liked and didn’t like so you can review them later with a clear mind. After a day spent seeing 10 maybe even 20 different houses, you’ll be grateful you did.

Step 7. Have Your Deposit Money Ready to Go

In Toronto’s hot real estate market, access to your deposit money is essential. This is our No. 1 tip for buying a home in Toronto. Having your deposit funds ready means that when the right property comes along, you don’t have to scramble at the last minute, potentially missing out on the one.

Having your deposit ready with your offer tells the seller that you mean business. A deposit of 5% of the purchase price is the norm in our marketplace. Should your offer be accepted, the deposit money is required within 24 hours, unless otherwise indicated.

Step 8. Making the Offer

When you find a house that you are just smitten with and decide to make an offer, don’t be too discouraged if you don’t get the first home you offer on. Toronto’s real estate market is very competitive and it’s not unusual for homes to get multiple offers. Be prepared to lose before you win.

Your real estate agent will be able to help you to make a strong offer by gauging the competition, and the fair market value, and finding the right course of action to go in strong. This is where the best real estate agent Toronto has to offer is essential.

Related: Offer Conditions and Clauses

Step 9. Have a Home Inspection

When buying a house in Toronto, having a home inspection is always a good idea, especially on older homes. Sometimes your offer may be conditional on a home inspection. Depending on whether it is a seller’s market or a buyer’s market, you may choose to forgo this condition to strengthen your offer. Think carefully about this one, as home inspections have the potential to unveil lots of unexpected expenses down the line. Ask your Realtor for their professional opinion.

Step 10. Closing The Deal

Once your offer has been accepted, CONGRATS, you’re a new homeowner! Be prepared to sign a ton of paperwork. This is when you’ll be working closely with your mortgage broker and real estate lawyer.

This is also when you pay your closing expenses. This will include your Land Transfer Tax and legal fees. If you’re a first-time home buyer, be sure to see which First-Time Buyer Rebates you may be eligible for that can save you money.

If you’re looking to buy a house in Toronto, book a call with us. Our full-service team is here to help you with every step of the home-buying process. We have a network of professionals — from mortgage brokers to lawyers — and value-add services to help make moving a breeze!

Related: Yes, You Can Buy A House While Separated In Ontario

Bonus – How You Can Save 20% on Furniture For Your New Home

Whether buying your first home or a move-up home it’s very likely that you’ve maxed out your spending possibly forcing you to tighten your pockets for the first year. One value-add that we offer our clients is the ability to purchase furniture for their new home at a discount. We have trade discounts at many popular Toronto realtors from West Elm to EQ3 and Crate & Barrel. That additional 15-20% on your new furniture can really add up!

What Else Do You Need To Know Before Buying A House In Toronto

Spring is almost upon us. Now is as good a time as any to start thinking about your goals for 2023 — right? For those who have been dreaming of the day they become homeowners in Toronto – now’s the time. You now know how to buy a house in Toronto and now I’m about to share some other tips that will help you make your dream a reality!

When’s The Best Time To Buy A House In Toronto?

Spring season is the busiest time of the year in Toronto’s real estate market. Everybody wants to capitalize on the sun and take advantage of the long, warm days to complete their move before winter. However, if you’re on a budget – winter is definitely the best time to buy a house in Toronto! There are typically fewer homes listed for sale as many sellers wait until the spring market to take advantage of the inevitable price surge. But if you’re trying to be mindful of costs, mark your calendars for December-March.

Related: The Cost to Buy a Semi-Detached Home in Toronto by Neighbourhood

Will House Prices In Toronto Drop In 2023?

The President of the Toronto Regional Real Estate Board, Kevin Crigger, believes that “price stability found towards the end of 2022 will carry through to 2023”. Alternately, ReMax’s Toronto Housing Market Outlook 2023 predicts that house prices in Toronto are expected to drop by nearly 11% for 2023.

How To Budget For A New House In Toronto?

If your goal in 2023 is to buy a new house – make it your top priority. Houses are expensive in Toronto and you will need to plan to save some money in advance. Consider working your way backward toward determining how much money you really need.

For example, let’s say you need an extra $50,000 for closing costs in order to buy a house next year. By working backward, you can figure out how much money you’ll need to save each month, each week, or each day. Breaking it down this way helps segment your savings approach.

Depending on your timeline to buy — let’s use 12 months as an example — you will need to save:

$4,167 per month | $912 per week | $137 per day

By breaking it down this way, you can determine which goal is easier to set in order to save what you need when your closing costs are due.

What Should First-Time Home Buyers Be Aware Of?

Most first-time homebuyers that I have interacted with, first look at the condo market and then the housing market. A couple of years ago this made sense as condos were significantly cheaper. Today, however, condo prices are rising and according to me, it makes more financial sense to spend a bit extra and buy in the semi-detached market.

Irrespective of whether you end up buying a house or a condo – there are two things that you should be aware of as first-time homebuyers.

The Stress Test

Under the Stress Test guidelines, homebuyers must qualify for a mortgage at a rate of 5.19% or 2% higher than the negotiated rate, whichever is larger. So the first thing you should do is get a mortgage pre-approval to get a better sense of what your budget will allow.

First-Time Home Buyer Rebates and Incentives

One of the benefits of being a first-time home buyer in Canada is the grants in place to help alleviate some of the costs of buying a home. These include:

If you’re a first-time home buyer who’s craving guidance, download our First-Time Homebuyers Guide to tame your curiosity!

Alternatives To Buying A House In Toronto

You went through the blog. Took notes on all the 10 steps and yet – there’s a problem. High home prices have made housing unaffordable for a lot of Canadians. As of 2021, the rate of unaffordable housing in Ontario is at 24.2% (down 3% from 2016). The rate of unaffordable housing looks at Canadians spending more than 30% of their income on housing. By the numbers, housing is more affordable in Canada today than it was in 2016 but that’s not because of a fall in housing costs. Instead, the fall is attributed to people’s rise in median income earned.

Should purchasing that home not be for you, we have two blogs – renting vs buying in Toronto and cost of buying vs building in Toronto – that weigh down the pros and cons of each strategy.

Final Words

Phew, you made it to the end. I know that was a long read but I do hope that you were to take away something valuable from it. If you’re looking to create an action plan to help you buy a house in 2023, look no further. Book a call with us and let’s get started and find you a dream home that falls within your budget. I have more than 15+ years of experience in the industry and have facilitated real estate transactions worth over $500 million. Trust me when I say that a real estate professional’s opinion can take you a mile when you’re buying a property in a hyper-competitive market like Toronto. I can help you find a gem by studying the real market value of a property – not what’s listed by the seller!

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.