Are you a prospective buyer who’s looking to cash in on their existing property and buy a new home with the proceeds of your sale? Well, personally, I think that’s a great move! But if you haven’t sold your property yet, listen up because you need to get your timing absolutely right!

Table of Contents

You could be looking to upgrade, downsize, or relocate – whatever the case may be – but you must do the math to find out how long it takes to sell a house or condo in your location. Skip this step and you could be left playing catch-up. Without the capital from your home sale – you may not have the funds to compete in a competitive real estate seller’s market!

I’m not trying to scare you away from the property market. I just want you to be prepared for the entire process – and plan accordingly. I have learned these lessons the hard way over my long career, nearly twenty years in the Toronto Real Estate Market. I am writing these blogs to educate you and home sellers like you so that you don’t end up making these common mistakes!

Average Time To Sell A House In Toronto In 2023: Expectations Vs Reality

Let’s start off by clearing the air and setting some expectations when it comes to selling your Toronto home. Some home sellers are quick to be concerned when their property doesn’t sell within a week.

But you shouldn’t be! There are a number of factors that determine how long it takes to sell a property. While it’s not uncommon for condos in Toronto to sell in one day, that’s certainly not the norm. Toronto’s real estate market is hardly your average real estate market.

What Factors Impact The Average Days On Market For Properties Listed In Toronto?

In Toronto, the average days on the market (DOM) for a property to sell is under 30. But how long your property stays listed on the market depends on a number of other factors such as:

The price bracket of your property – properties priced between $500,000 – $800,000 may sell quicker vs properties priced above $1 million vs $3 million + because the luxury condo market in Toronto is much smaller in size.

The season you’re listing your property – Spring and summer are typically the best time to sell in Toronto as things start to slow down in the colder months

Type of property – in Toronto, homes are more popular than condos which is why a home might sell quicker than a condo because of simple demand-supply economics

Location of your property – properties listed in popular, up-and-coming neighbourhoods sell quicker than those that are in not-so-desirable locations. Desirable neighbourhoods offer their residents easy access to public transport, education, recreation, etc. amongst a host of other direct and indirect benefits!

Marketing of your property – marketing your listing well plays a huge role in how quickly and how much your home or condo ultimately sells for. I’d recommend working with top real estate agents with proven track records if you’re looking to sell quickly. You can always book a call with me or somebody from my team and we’d be happy to look into your case for you!

How your property ‘shows’ vs similar homes in the local market – staged properties and houses that have been prepared to sell show better than similar homes in the local market that don’t take the extra effort to present the best versions of their property.

There are many other factors to consider when determining how long it will take to sell your house or condo. Things that will impact how long it takes to sell can range from the season you list, your neighbourhood, the market conditions, and the type of property you’re selling just to name a few. This is where a discussion with your real estate agent will help you set realistic expectations for your timeline to sell.

How Long Does It Take To Sell A House In Toronto In 2023?

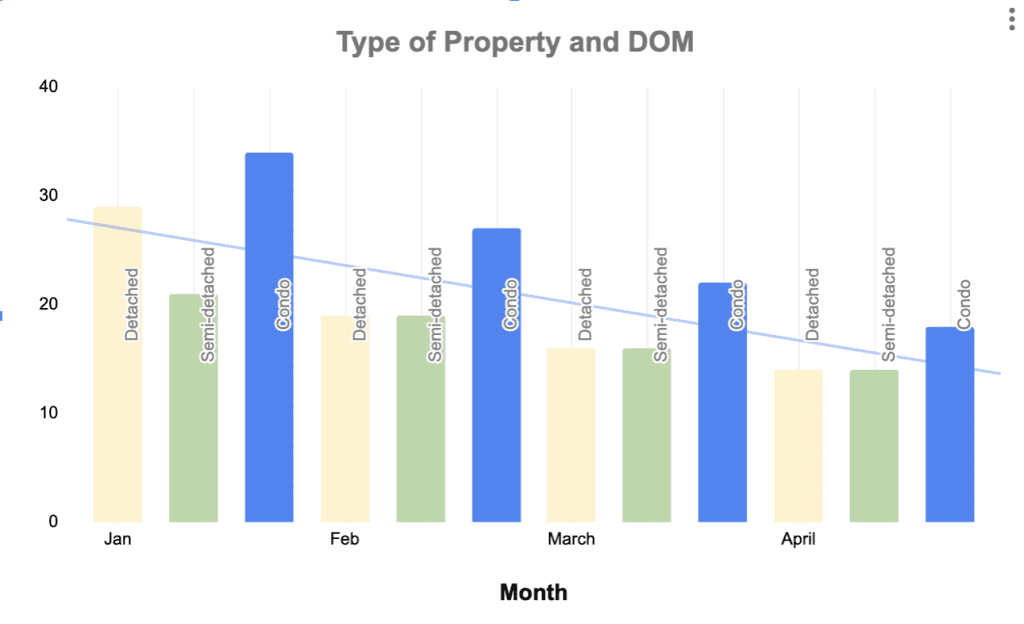

Looking at TRREB’s latest market watch, it took 14 days on average to sell detached homes and semi-detached homes in Toronto in April 2023 – with the average for the rest of 2023 being 19.5 days for detached homes and 17.5 days for semi-detached homes.

How Long Does It Take To Sell A Condo In Toronto In 2023?

The same TRREB market watch report shows that it took 18 days on average to sell a condo apartment in Toronto in April 2023 – with 2023’s overall average being 25 days.

When Is The Best Time To Sell Your Property In Toronto?

If you’re looking to sell fast, listing your house or condo for sale during the spring and fall markets means your property will likely sell more quickly than if you were to list in winter or summer.

It never hurts having the best real estate agent Toronto has to offer on your team as that guarantees you sound advice throughout the selling process and not just when it comes to budgeting an appropriate amount of time to sell your current home!

Related: Yes, Spring Is The Best Time To Sell A House In Toronto! But Why?

Selling A Property In Toronto: Timeline

What Are The Different Stages Involved In Selling A House Or Condo In Toronto?

There are three stages involved in the selling process – each with its own timeline.

PRELIMINARY – one week to one month

ON THE MARKET – 30 to 90 days

CLOSING – 60 to 90 days

PRELIMINARY | One Week to One month

The preliminary phase can range from one week to one month. This phase is all about preparing your property to go to market. Generally speaking, preparing for a home sale will likely take longer than a condo sale.

First, as the home seller, you’ll need to arrange a Preliminary Home Inspection which costs about $500. This will highlight any major issues with your house which may need to be fixed ahead of going to market or should be factored into while calculating the market value of your property. For condos, the equivalent is getting a Status Certificate which costs just over $100.

Working with a Realtor who has a full-service team can help expedite this process which can otherwise run long.

Similarly, it’s in your best interest to look for opportunities to boost your home’s value by making minor repairs and touch-ups where needed and ensuring things are in good working order. Trust me, small handyman work has a bigger influence on the asking price than what you initially spend! Curious what mini renovations might look like? Check out our team’s before and afters!

The preliminary phase also involves staging your property and having it professionally photographed in order to make it look its best when you list and market your property to a potential buyer. Depending on how extensive the repairs are or elaborate the staging, this phase can range from one week to a month.

Related: How To Prepare Your Home For Sale In Toronto In Under 30 Days [+FAQs’]

ON THE MARKET | 30 to 90 days

How long should a house sit on the market? There is no cut-and-dry answer to this, but it’s important to set expectations to protect you during the process. Once your property is live on MLS, be prepared to allow anywhere from 30 to even 90 days for it to sell.

Even when selling a downtown Toronto condo, it’s always best to over-budget your time to sell. We sold a unit at Musee Condos in one day even with the knowledge that there was interest in a similar unit that had sold the week before. Regardless, we still advised our client to allow for 60 days to sell. Even in peak sellers’ markets, it’s always good to be extra cautious with timelines.

We always err on the side of caution in order to protect our clients from selling and buying their next home. If you’re shopping for your next Toronto home, it’s best to budget around 60 days to sell followed by 60 days to close for a total of 120 days.

CLOSING | 60 to 90 days

Budget for 60 to 90 days of closing when you’re setting your timeline. Finding a new home can be tough, and in this hot Toronto market you might loose out a few times. If you budget the bare minimum you might find yourself couch surfing or staying at mom and dad’s during the interim.

How Long Does It Take To Get Money After Selling A House In Ontario?

Once you’re done settling up all the closing costs – you should receive all the money day-of your home sale or within a couple of days at best. This depends on the timing and your lawyer so be sure to question your realtor and lawyer to get this information well in advance! You don’t want any last-minute surprises when the stakes are so high.

Related: 22 Questions To Ask A Realtor In Toronto [Buying Or Selling]

Few Tips To Help You Sell Your Home Fast In Toronto

If you want to sell your home quickly and for top dollar the most important aspect of the listing is getting your pricing strategy right. That’s where the expertise of a real estate agent really helps as they are on top of local market trends and can quickly identify what’s the right price for your property depending on the prevailing market conditions.

Once you have your pricing set right – your next objective should be to ensure that your property ‘shows’ better than all the other properties listed in your neighbourhood at that point in time. You want to minimize any objections a buyer might have against your property and you need to give prospective home buyers reasons to choose your property over others and preparing your home for sale is one way to do that. There’s a lot that you can do to make your property stand out. Below is the bare-bones treatment that you must ensure your property gets before listing it on the market:

Your property must be absolutely spotless. Take the help of local cleaning services if you feel that you can’t do the task justice yourself and consider staying at a friend or family member’s home if you don’t think it doable to keep in spotless throughout showings.

Give your old walls a makeover with a fresh coat of paint. Use your own judgment to decide which walls need a makeover and which can do without one. Don’t be stingy with your efforts but also consider a magic eraser can go a long way at removing scuffs on walls that you may not need a full paint job.

Get your home staged. If setting up home decor is your cup of tea, go for it – do it yourself. You can save some money in the process too! However, if you’re not good at it or feel out of your depth once you start the process, don’t hesitate to use the services of a professional home stager. Also, many real estate brokerages – like ourselves – offer complementary home staging services for their clients. This is a great option for anybody who doesn’t have the bandwidth to take on the task of home staging. It saves you valuable time and money! One thing worth noting is that your taste might to be that of the masses. The goal of staging is to appeal to as many potential buyers as possible.

Related: How To Sell Your Home For Profit In Toronto – Fast!

What Happens After You Sell Your Property

How Soon Can I Buy My Next Property?

Use the above guidelines to set your expectations when creating your initial timeline to sell. Then, sit down with your realtor to create a full strategy that will outline pricing, timing, and their opinion on how long they think it will take to sell versus how much time you should be prepared to budget for.

Having a contingency plan helps ensure you haven’t offered on a property that you can’t follow through on because you haven’t yet sold your current home. To shed some light on the “worst case scenario” let’s say you offer on a home worth $1,000,000, so a $50,000 deposit.

If your property doesn’t close in time, and you haven’t considered a bridge loan, you not only lose that deposit, but you risk being sued for the difference in price should the seller earn less than what you had originally offered when taking that property back to market. Another way to protect yourself against these risks is to ask your lender ahead of listing if they provide Bridge Financing.

Related: How Soon Can You Sell Your House After Buying It [3-5 Years]

What Is Bridge Financing?

In our blog Six Things Sellers Wish They Knew we discuss how you can get the funds needed for your down payment when your closing dates don’t align. Most banks and lenders will loan upwards of $200,000 for up to 120 days to help bridge the gap between closing dates. In order to be eligible for a bridge loan you will need both your Sale Agreement and your Purchase Agreement from both of your properties.

The loan will have a higher interest rate than your standard mortgage, usually Prime + 2% or 3% but remember it’s a short-term loan. Additionally, your lenders will likely slap an administrative fee between $200-$500 onto the loan. The most important thing to do before you start looking for new properties is to ensure your mortgage lender allows bridged financing and budget accordingly.

Final Words

Whether you’re looking to list your home in Toronto or you’re looking to buy your next home in Toronto, our team can help you achieve your goals! Book a free call with us today and help us, help you! When you list with the Pierre Carapetian Group, you get the highest level of service. We are here to alleviate stress and give you peace of mind knowing that all of the details are taken care of. You can always learn more about selling with us here.

Pierre Carapetian

Pierre Carapetian is the Broker Of Record for Pierre Carapetian Group Realty with over 12 years of experience in the real estate market. As a proud Torontonian and real estate broker, he prides himself on knowing this city inside out. He started investing at the age of 18 and has facilitated over half a billion dollars in real estate transactions.